In calendar year 2022, Unified Payments Interface (UPI) processed over 74 billion transactions worth Rs 125.94 trillion, while in 2021, the platform processed over 38 billion transactions worth Rs 71.54 trillion. That’s a growth of 90 percent in volume terms, and 76 percent in value, showed data from the National Payments Corporation of India (NPCI).

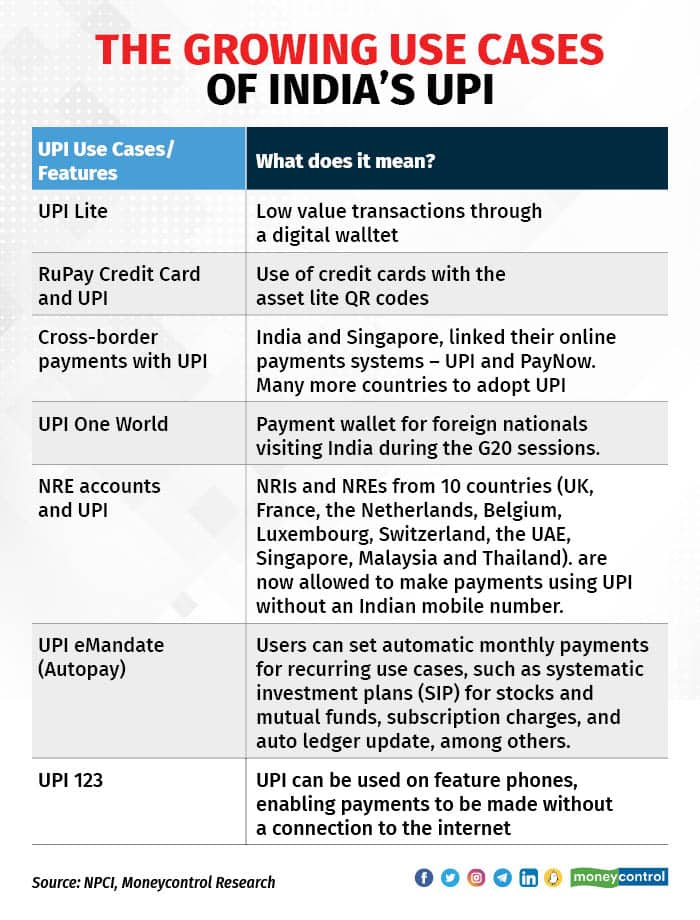

India’s homegrown UPI is leapfrogging to create multiple use cases and there’s been a lot of buzz around its diversification in the last few weeks. Just a week ago, India kicked off its first cross-border real-time payment systems connectivity with UPI. Here’s an explainer of how UPI’s use cases have diversified and evolved in recent times:

UPI Lite

At the beginning of 2022, the Reserve Bank of India (RBI) launched the concept of UPI Lite with the aim of making easier the digital payments experience for users.

The feature allows users to initiate low-value transactions directly from a digital wallet without entering their UPI PIN. In 2023, Paytm was the firm payments firm to incorporate this feature option on its platform.

Enabled by the NPCI, the Lite option will help users carry out multiple small-value UPI transactions instantly and enhance their digital payments experience.

“The data available with NPCI shows that more than 50 percent of UPI transactions are below Rs 200. And for this, UPI Lite will be a great option, as it will be extremely fast compared to what we use now, and the chances of failure at the banks’ end are very low,” said an independent consultant on digital public infrastructure to Moneycontrol.

Users can add a maximum of Rs 2,000 to the UPI Lite wallet. The UPI Lite option helps users make payments even in an offline mode, but only if the wallet has money in it.

RuPay credit card on UPI

In order to boost credit card acceptance across merchants and businesses, NPCI in the first week of February announced the integration of RuPay credit cards with UPI. The two are linked to provide a seamless, digitally-enabled credit card lifecycle experience for customers.

“Customers will benefit from the ease and the increased opportunity to use their credit cards. Merchants will benefit from the increase in consumption by being part of the credit ecosystem with acceptance of credit cards using the asset lite QR codes,” said a statement released by NPCI.

“To enable this, customers should check the credit card accounts from the issuer bank based on thier registered mobile number and link it to the UPI ID on BHIM app or any UPI app” the statement added.

Post-linking the card, the customer will be able to make payments to merchants by scanning the UPI QR code on the card. Payment authentication will be done using the UPI PIN.

Banks that are presently live with this feature include HDFC Bank, Indian Bank, Punjab National Bank, and Union Bank of India.

Cross-border payments with UPI

For NPCI, cross-border payments are a part of its long-term vision. Banks and payment companies in several countries and regions have partnered with the international arm of NPCI to accept UPI payments. These include the UK, France, the Netherlands, Belgium, Luxembourg, Switzerland, the UAE, Singapore, Malaysia and Thailand.

Many others have shown interest in adopting India’s UPI and integrating it with their payment solutions.

In a first-of-its-kind collaboration with another country, India and Singapore, on Tuesday, linked their respective online payments systems ― UPI of India and PayNow of Singapore ― for seamless cross-border transactions between the two countries.

One of the main challenges of sending remittances or cross-border payments is the high cost involved. Even the cheapest available provider charges 8.6 percent of the transfer amount (including all fees and exchange rates) as part of the total cost of an INR-SGD transfer.

"There are costs involved, such as currency exchange costs, intermediary charges, and regulatory costs. The cost of sending money across international borders remained high, at around 6.4 percent of the transaction amount on average in the first quarter of 2021," wrote Naveen Jaiswal, Partner IBM Global Consulting Solutions Leader for Industries in a LinkedIn post.

UPI One World for G20 guests

RBI’s Deputy Governor Rabi Sankar, along with Nandan Nilekani, co-founder of Infosys and NPCI’s MD & CEO Dilip Asbe launched ‘UPI One World’ for foreign nationals visiting India during the G20 sessions.

Transcorp is the entity permitted by the RBI and NPCI to issue UPI One World to foreign nationals. It is the only entity with both Foreign Exchange (AD2) and Payments (PPI) licenses required to exchange currency, and thereafter issue UPI One World wallets.

Transcorp UPI One World wallets will initially be offered via the Transcorp-Cheq app to all G20 nationals and non-resident Indians (NRIs).

A simple KYC-based process, followed by mobile registration, will allow users to load money via international currency/cards and pay at any QR code in India using the ‘@trans’ handle which operates on the interoperable UPI 2.0 rails.

NRE accounts and UPI

NRIs from at least 10 countries are no allowed to make payments using UPI without an Indian mobile number. These countries are Singapore, Australia, Canada, Hong Kong, Oman, Qatar, USA, Saudi Arabia, UAE and the United Kingdom.

"To begin with, we shall be enabling transactions from mobile numbers having the country code of (10 nations)... and shall extend this to other country codes in the near future.,” said NPCI while launching the same.

UPI eMandate (Autopay)

NPCI launched the UPI AutoPay on 22 July 2020 for recurring payments using the UPI trail. This feature was introduced for the convenience of users.

Users can set automatic monthly payments for recurring use cases, such as systematic investment plans (SIP) for stocks and mutual funds, subscription charges, and auto ledger update, among others.

The autopay allows users to make recurring transactions of up to Rs 15,000 automatically through UPI apps, and up to Rs 1 lakh via authorisation on the due date.

Industry sources say that while this feature was introduced some time ago, it’s gaining prominence now. “We see a much younger generation using the feature for bill payments and SIP investments. This feature is hassle-free and secure,” said the co-founder of a payment solutions start-up.

To further enhance the feature for merchants, NPCI said that the mandate cannot be cancelled/revoked by the borrower (for lending), and auto-debits can be done for up to Rs 15,000 without a PIN.

UPI 123 for feature phones

In February 2022, NPCI and RBI jointly launched UPI 123Pay, wherein UPI can be used on feature phones, enabling payments to be made without a connection to the internet. The aim is to help people in rural areas who cannot afford a smartphone to participate in UPI transactions.

Here, users can access their bank accounts and perform routine transactions, such as receiving and transferring funds, paying for regular purchases, and bill payments, etc., by giving a missed call to the number displayed at the merchant outlet. The customer will receive an incoming call to authenticate the transaction by entering the UPI PIN.

During the launch, RBI Governor ShaktiKanta Das, said, "This current decade will witness a transformative shift in the digital payments ecosystem in the country.”

Expectations from the upcoming UPI 3.0

While there are multiple use cases evolving from the UPI, there are more expectations from the UPI version 3.0.

“Interoperability of RBI’s central bank digital currency (CBDC) and UPI will be very interesting. It is expected to be linked even for the pilot version of CBDC,” said the independent consultant quoted above.

Experts also expect the next wave of innovation within UPI to have more to do with GST and other tax benefits to further accelerate adoption.

Apart from new features, NPCI should encourage more Third Party Apps (TPA) to integrate the native UPI payment within their apps for better experience and greater success, said Deepak Abbot, founder of Indiagold, a gold loan platform.

"The current process of approvals and audit makes it difficult for any app to take this path. Ease of integration will help in faster adoption and much more innovative use cases,” Abbot added.

While on the customer side there are proposals to introduce income tax benefits for digital payments, there are also recommendations for providing cashback incentives to merchants for the adoption of UPI QR.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.