YES Bank plunged over 10 percent to Rs 83.70 in morning trade on July 18 and hit a fresh 5-year low as net profit of the private lender plunged 91 percent year-on-year (YoY) weighed down by a three-fold increase in provisions and weak asset quality.

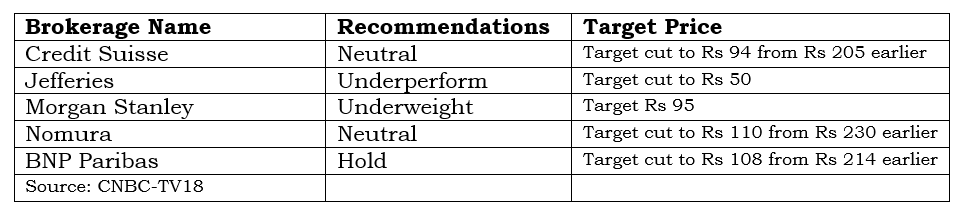

Most global brokerage firms maintained their rating on YES Bank but some of them reduced their target price by more than 50 percent after June quarter results. Jefferies maintains a target price of Rs 50 which translates into a fall of nearly 50 percent.

“Q1 earnings are far worse than what we had anticipated. Below inventory grade book increased by Rs 6,500 crore, which is not a good sign. About half of the new NPLs are outside the watch list,” said the Jefferies note.

However, the management has assured capital infusion in Q2, but optics are too unsettling. The investment rationale, henceforth, is coterminous with capital.

However, Yes Bank turned the corner sequentially in June quarter with a Rs 113.76 crore standalone profit against loss of Rs 1,506.64 crore in the previous quarter due to sharp fall in provisions.

Net interest income during the quarter grew 2.8 percent YoY to Rs 2,281 crore with muted loan growth of 10.1 percent. However, on a sequential basis, NII and loan book was down 9 percent and 2.2 percent in Q1.

The interest reversals of Rs 223 crore on account of fresh slippages during the quarter affected net interest income.

Here’s what global brokerage firms recommended on YES Bank post June quarter results:

Credit Suisse: Neutral | Target cut to Rs 94 from Rs 205

Credit Suisse maintained its neutral rating but reduced its target price to Rs 94 from Rs 205 earlier.

A drop in CASA deposits highlights pressing recapitalisation needs, it said. CET 1 or common equity tier 1 ratio is down to 8 percent, and net NPAs equates to 35 percent of this.

Earnings got some support from Rs 450 crore of treasury gains, Credit Suisse noted. It looks like CET-1 would remain low at 9 percent by March 2020. The global investment bank slashed EPS by 72 percent on larger dilution, weaker growth, and higher credit costs.

Nomura: Neutral| Target cut to Rs 110 from Rs 230 earlier

The path to recovery could be challenging for YES Bank. Going forward, capital raised in the near-term would be critical, Nomura said. The Q1 results are weak with over Rs 10,000 crore of addition to BB & below book.

The global brokerage firm slashed FY21-22 earnings by 30-50 percent, and any delay in capital raise could be negative.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.