Defense stocks are on a warpath—surging up to 30% in just a week and more than 100% from their recent lows. But is this just a tactical rebound, or does the rally have firepower to sustain? Let's break it down.

1) Big Falls, Big BounceDefense stocks were among the worst casualties in the small- and mid-cap meltdown earlier this year. Many plunged 50–75% from their 2023 peaks, setting the stage for a sharp rebound. And rebound they did.

Mazagon Dock Shipbuilders skyrocketed 183% from its recent low, while Garden Reach Shipbuilders & Engineers jumped 126%, and Cochin Shipyard climbed 67%. Other big gainers include Paras Defence, Bharat Electronics, Bharat Dynamics, and Zen Technologies, with gains of 48–56%.

Yet, despite this surge, many stocks are still well below their previous highs. "The rise we’ve seen so far is only a relief rally, just like in many other sectors," said Amit Anwani, Prabhudas Lilladher's Capital Goods and Industrials & Defense Analyst. The lack of major institutional buying underscores this. "No significant institutional buying has been seen. The earnings story is the same as last year—just sentiment has changed," a fund manager added.

When momentum returns, traders latch onto positive narratives—and the defense sector has been flooded with them lately.

2) The Local Narrative Is StrongMarch is typically an action-packed month for defense approvals, and this year has been no different. India's Defence Acquisition Council (DAC) last week cleared proposals worth ₹54,000 crore, adding to the ₹2.2 lakh crore (trillion) worth of approvals in FY25 alone. The push for domestic procurement has been remarkable, climbing from 54% in FY19 to 75% in recent years.

One of the biggest developments? The government has cut procurement timelines from two years to six months, signalling a more aggressive approach to military modernisation. That’s a boon for Indian defense players like PTC Industries, Mazagon Dock, Hindustan Aeronautics (HAL), BEL, and Bharat Dynamics.

There are several company specific good news that reaffirms confidence in the growth of some of the companies. "The improving supply chain for Hindustan Aeronautics Limited (HAL), especially with its Nasik factory becoming operational, is a game-changer," said Anwani. "Once engine supplies stabilise, HAL can deliver aircraft on time and in larger numbers." Similarly, Bharat Electronics Limited (BEL) has benefited from a surge in defense electronics orders, while Mazagon Dock Shipbuilders (MDL) is sitting on a robust order book.

Meanwhile, expectations are that India will continue to increase spends on defence and build local capabilities considering China’s belligerence, and continued increase in military spends amid a tense geo-political climate.

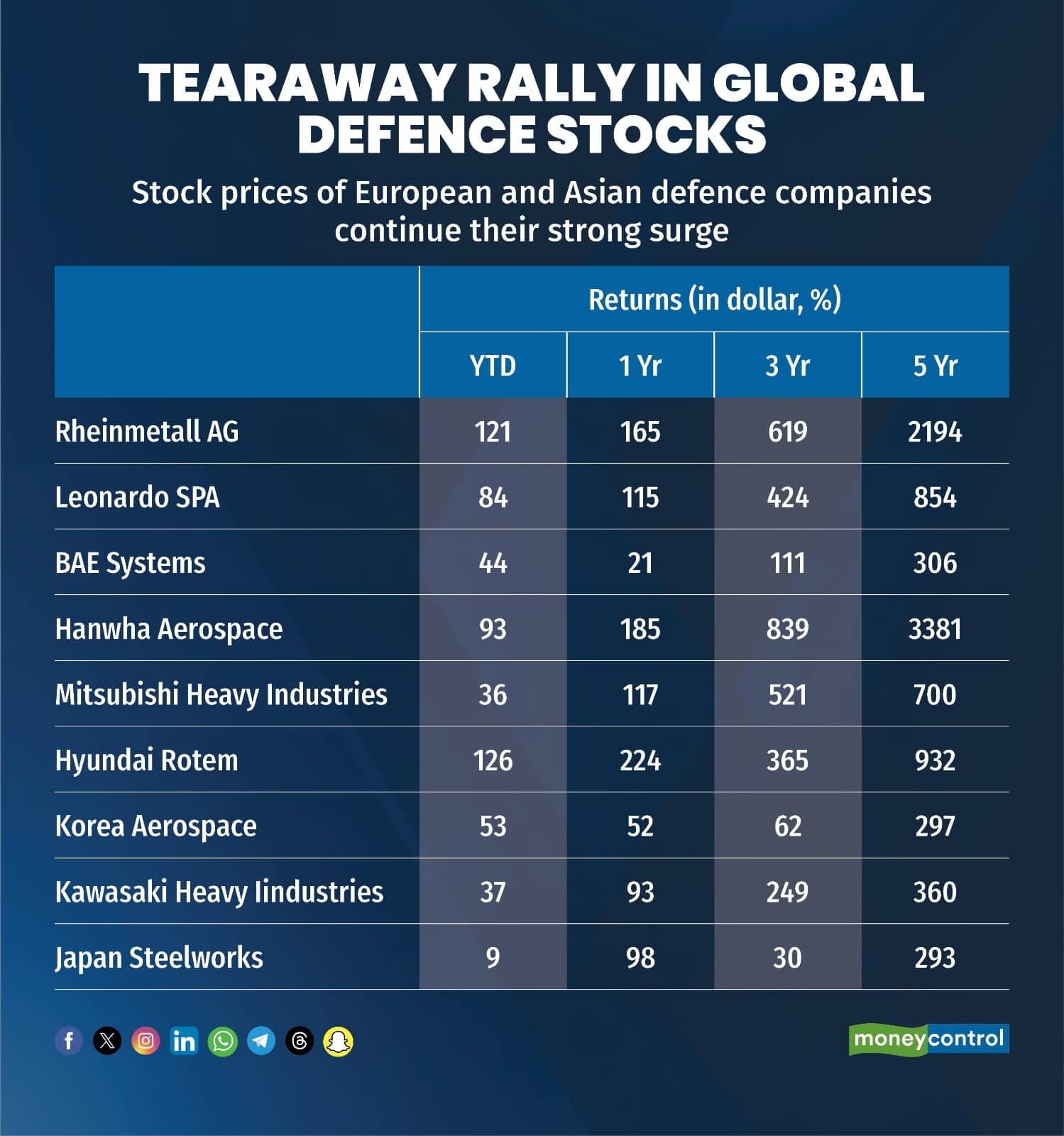

3) The Global TailwindsThe backdrop of heightened global military spending is unmissable. In 2024, global defence budgets hit $2.46 trillion, up from $2.24 trillion in 2023, with a real-terms increase of 7.4%, per the International Institute for Strategic Studies. Europe, in particular, is ramping up spending, driven by NATO pressure and geopolitical tensions.

Germany recently approved a €500 billion defence programme, while former U.S. President Donald Trump has pushed NATO allies to increase spending to 5% of GDP—or risk being left undefended. The urgency to bolster military capabilities worldwide is creating opportunities across the defence ecosystem.

This global spending spree has fuelled rallies in defence stocks across the U.S., Europe, and Asia. Companies like Lockheed Martin, BAE Systems, Rheinmetall, and Hanwha Aerospace have all seen gains, reinforcing the bullish case for defence as a theme.

The Warning ShotWhile defence remains a strong long-term play, the notion that Indian companies will directly benefit from global military spending is optimistic at best.

"I'm really doubtful about how European defence spending will benefit Indian companies," said Anwani. "India's defence sector is focused on localisation, reducing import dependency, and modernisation. Our priority is strengthening domestic production, not exports."

Within Asia, South Korean and Japanese companies have strong capabilities and are best positioned to capture Europe’s defence orders. Indian firms like Data Patterns, Astra Microwave, Centum Electronics, and Dynamatic Technologies might see some indirect benefits, but vendor relationships in defence take years to build.

"There is no immediate impact from European spending," said Harshit Kapadia, VP – Industrials, Consumer Durables, and Renewables, Elara Capital. The idea that Europe’s export opportunity is driving Indian stock prices is nothing but hyperbole. "India needs to establish vendor relationships, develop prototypes, and finalise deals – all long-drawn processes,” Kapadia said.

Meanwhile, domestic defence order momentum is driving short-term stock market rallies. “This rally is expected to continue for a few weeks as domestic spending picks up," Kapadia said.

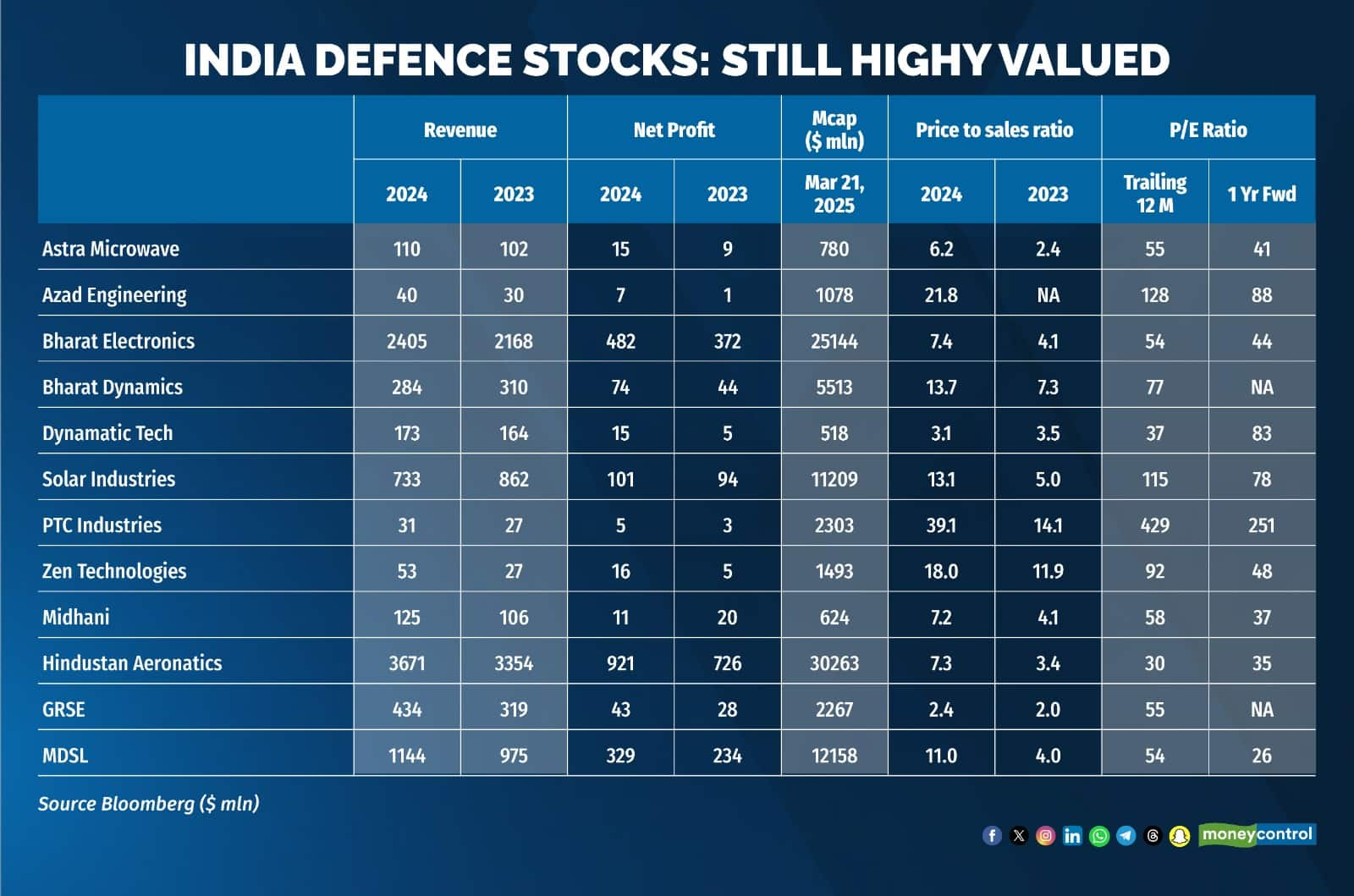

Should you buy at these levels?Right now, most defence stocks are trading at 40x FY27 earnings—not exorbitant, but the questions is whether in the current environment if it is sensible to look at earnings for two-years forward. On one-year forward basis, stocks look alarmingly expensive, especially the smaller stocks.

Besides, as in the case of most sectors, Indian stocks are also way too expensive compared to their global peers. The difference is, defence is a global industry where all boats are rising. Arguably, companies in Europe, Japan and South Korea which are witnessing fairly high growth as well are a great hunting ground for global investors. These companies should provide a reasonable anchor for valuations in India too. Some could argue that comparing valuations cross countries is meaningless – even a Google for its fantastic moat trades at significantly lower multiple than IT companies, after all.

Be that as it may, the real test will come if the market corrects again. Historically, even the strongest narratives struggle to hold up when broader sentiment turns sour. The ongoing rally is being driven by sentiment and positive news flow, but without any significant change in earnings prospects in the short to medium term.

With no major institutional buying seen yet, the smart play might be to accumulate on dips rather than chase the rally – and stick strictly only to the leaders.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.