Market mavens believe that Tata Motors’ newly launched Tiago EV has what it takes to become the best-selling electric vehicle (EV) in India.

On Wednesday, Tata Motors launched the electric version of its popular hatchback Tiago, starting at Rs 8.49 lakh (ex-showroom) with the top-end model costing Rs 11.79 lakh (ex-showroom).

With the launch of the Tiago EV, Tata Motors now has three models in its passenger EV portfolio, which includes the Nexon EV and Tigor EV.

Tata Motors commands an 88 percent share of India’s EV market and has over 40,000 EVs on the road, Shailesh Chandra, MD of Tata Motors PV (passenger vehicle) business unit, had told CNBC-TV18 in an interaction earlier this month.

The Nexon EV drove it to the leadership position in the EV market and the Tiago EV, the country’s first premium electric hatchback, should cement that.

Thursday’s 4 percent surge in the Tata Motors share price was evidence enough that the market is perhaps enthused by the prospects of the new model. However, several automobile stocks were under pressure on Friday with the Tata Motors stock trading at Rs 397.15, down 1.2 percent at the time of writing.

What has likely grabbed the market’s attention is the affordability of the Tiago EV. The company’s strategy of offering a premium EV at an affordable price is seen as a game-changing one.

Overall, the new model is a very strong package of premium features and attractive pricing, said Nomura in a research report.

The learnings from the Nexon EV on customer usage patterns and improving supply chains have helped the company price the Tiago EV more attractively, the brokerage firm said, adding that this strategy could help the automaker garner more market share.

“We expect the introductory pricing of the car to attract a larger consumer base who might have not considered EV as a viable option due to affordability,” Nomura explained. “In our view, the car has the potential to become the best-selling EV in India.”

In India, around 44,000 hatchbacks are sold per month on average, with the economy hatchback segment accounting for about 50 percent of this in the first five months of FY23. And Nomura expects the Tiago EV to sell 3,000-5,000 units per month and its overall EV sales to touch 60,000/96,000 in FY23/24.

According to Nomura, every 1 percent market share gain in passenger vehicles has the potential to add around Rs 5,000 crore to the market capitalisation of Tata Motors.

Also Read | With volatility gripping the markets and sentiments bearish, these sectors are looking attractive

Tiago EV- a shot in the arm for Tata Motors

In what is probably the case during this early stage of EV adoption, EV players are more focused currently on boosting volumes and gaining market share, rather than sales or profitability.

“Be it Tata Motors or Mahindra & Mahindra, all these players in the EV space are focusing on brand establishment rather than profitability at present,” said Mitul Shah, head of research, Reliance Securities.

Every company wants to establish itself as a strong EV brand rather than just focusing on profitability, so “the initial game would be chasing market share and that is where Tata Motors has got reasonable success in the last 2-3 years”, he added.

Also Read | With volatility gripping the markets and sentiments bearish, these sectors are looking attractive

Total cost of ownership – the cherry on the cake

Total cost of ownership (TCO) includes purchase cost, running expenses, maintenance cost and resale value.

TCO is a more accurate assessment of the economic efficiency of EVs in comparison to cars with internal combustion engines (ICEs), said Emkay Global Financial Services.

“TCO for Tiago XT Petrol stands at Rs 19.1/km, while it is slightly higher for Tiago XT EV at Rs 20.4/km, assuming monthly usage of 1,000 km,” the brokerage firm highlighted.

“In case of monthly usage of over 1,250 km, TCO will be favourable for EVs. TCO for EVs can further reduce if we consider state-level subsidies and FAME fleet subsidies,” it added.

As per Nomura, the breakeven period could be around three years with EVs’ running cost of about Rs 1 per km currently against Rs 7 per km for ICE. This means EVs are cost-efficient in the long run compared to ICE, even if their TCO is more right now.

ICICI Direct Research explained that the Tiago EV comes across as the most affordable EV offering domestically and is around Rs 3 lakh more expensive than the ICE-powered Tiago with the payback period pegged at about three to five years.

Outlook for Tata Motors’ EV business

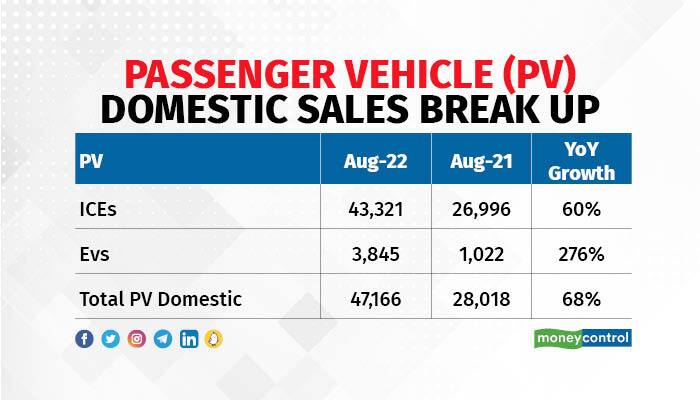

According to Jefferies, EVs now form 8 percent of Tata Motors’ passenger vehicle volumes in India.

Several market participants believe that EVs, which are increasingly a focus area for the company, are expected to contribute around 20 percent to domestic passenger vehicle sales over the next five years.

In August 2022, the carmaker sold 3,845 EVs in the passenger vehicle space in India. This is in comparison to the company selling 43,321 ICEs. As seen in the table below, the contribution of EVs has increased sequentially.

Jefferies believes that Tata Motors has the potential to gain market share as EV adoption rises while ICICI Direct Research is of the opinion that the newly launched EV model would help the automobile major retain its leadership position in the electric passenger vehicle space.

According to Nomura, the stock is trading at about 4.3 times its FY24 Enterprise Value/Earnings Before Interest Tax Depreciation Amortisation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.