September 30, 2022 / 16:25 IST

Rupak De, Senior Technical Analyst at LKP Securities

Nifty snapped its losing streak as the index posted a gain after seven consecutive days of correction. On the lower end, it found support at 16800 and moved up. On the daily chart, the index has formed a bullish engulfing pattern. The daily RSI is seen to be entering the bullish crossover.

Going forward, the trend may remain bullish with an upside potential of 17300/17500. On the lower end, 16950/16800 may continue to act as crucial support for the short term.

September 30, 2022 / 16:05 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

RBI in its policy meeting raised its benchmark repo rate by 50 basis points to 5.9% which was in-line with market expectation. Since May’22 RBI has raised interest rate by 190bps and expect repo rate to be raised to 6.5% in this cycle.

It expect inflation to come down close to its target of ~4% over a two-year period and projected real GDP for FY23 at 7%. Post RBI’s commentary, Nifty bounced in green and gained strength throughout the session. The rally was especially seen in banking sector stocks. This has also given some support to falling rupee which had depreciated by 7% since April’22.

With most key events now behind, market finally found some strength on Friday. After 7 consecutive fall, Nifty witnessed strong rally and closed with gains of almost 300 points. It also reclaimed the 17,000 zones, making the short term technical view positive.

Nifty can now move towards 17,500-17,700 zones with key support around 17,000 and 16850. Auto and consumption sectors would be in focus ahead of monthly sales data and high demand in the ongoing Navaratri festival. Pharma sector is seeing some value buying as market focused on defensive names in times of global uncertainty.

September 30, 2022 / 16:01 IST

Amol Athawale, Deputy Vice President - Technical Research, Kotak Securities

What lifted the market sentiment was the RBI's policy rate hike of 50 bps that came in as expected and its comment that India's economy remains on strong footing despite global headwinds. The relief rally was backed by investors' preference for growth-driving stocks from banking, automobile, realty & metal space.

However, global macro factors will continue to dictate the domestic market sentiment going ahead as any fresh spell of negative news could once again trigger the downward spiral. Technically, after a sharp selloff the Nifty took support near 16800 and bounced back sharply.

On daily charts, the index has formed a long bullish candle, and also formed a promising Hammer candlestick formation on weekly charts which is broadly positive.

For the trend following traders the 200- day SMA (Simple moving Average) and 16900 would act as a sacrosanct support zone. Above the same, the reversal wave is likely to continue till 17250. Further upside may also continue which could lift the index till 17400. On the flip side, below 16900, uptrend would be vulnerable and on further decline the index could slip till 16800-16700.

September 30, 2022 / 15:59 IST

Prashanth Tapse - Research Analyst, Senior VP (Research), Mehta Equities:

Post RBI raises repo rate by 50 bps - stepping up its fight against persistently high inflation, markets gained strong momentum as governor states economic activity are in stable mode with inflation number inline with RBI expectation and manageable range while geo political issues led to currency risk but bearable as of now.

Regarding liquidity concern he says we are in surplus to manage the situations. This fired the bulls to cover up all losses made in the last 3-4 days on index. Technically on the index we see major hurdles at 17327 mark and Nifty will be out of the woods only above 17707 mark.

September 30, 2022 / 15:50 IST

Vinod Nair, Head of Research at Geojit Financial Services.

An in-line rate hike along with the RBI’s confidence in the economy’s growth momentum aided the domestic market to alter the seven-day losing streak.

The decision to retain inflation at 6.70% with a marginal cut but a healthy GDP forecast of 7.0% indicates the resilience of the Indian economy.

Although the commentary warned about prevailing risks to the domestic economy from the global economy, the MPC refrained from sounding very hawkish. Continuation of the policy stance as 'withdrawal of accommodation' indicates more rate hikes in the future, but data-driven.

September 30, 2022 / 15:32 IST

Rupee Close:

Indian rupee closed 50 paise higher at 81.35 per dollar on Friday against previous close of 81.85.

September 30, 2022 / 15:30 IST

Market Close:

Indian benchmark indices ended sharply higher on September 30 with Nifty closing above 17,000 after Reserve Bank of India (RBI) announced repo rate hike by 50 bps.

At Close, the Sensex was up 1,016.96 points or 1.80% at 57,426.92, and the Nifty was up 276.20 points or 1.64% at 17,094.30. About 2283 shares have advanced, 1058 shares declined, and 95 shares are unchanged.

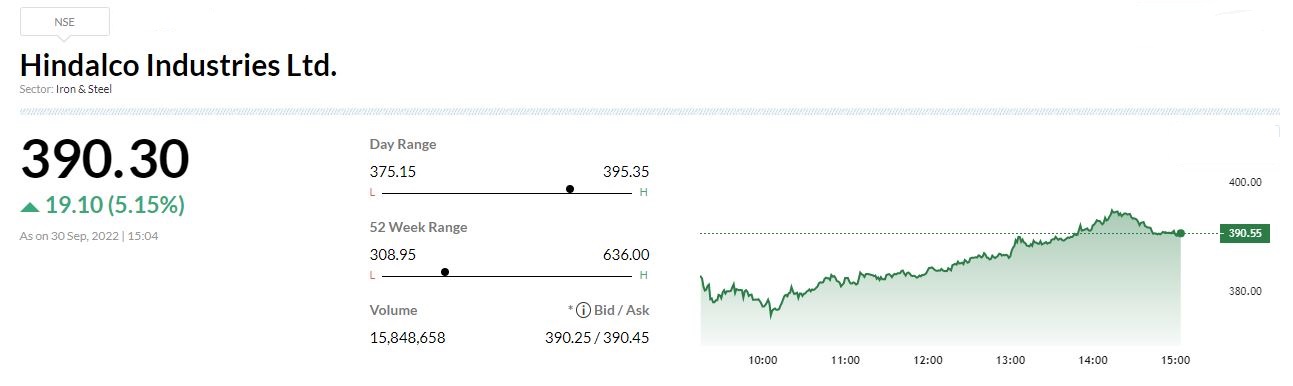

Hindalco Industries, Bharti Airtel, IndusInd Bank, Bajaj Finance and Kotak Mahindra Bank were among the top gainers on the Nifty. However, losers included Shree Cements, Asian Paints, Britannia Industries, Coal India and Dr Reddy’s Laboratories.

All the sectoral indices ended in the green with auto, power, capital goods, bank, realty and metal up 1-2 percent.

BSE Midcap and Smallcap indices added 1 percent each.

September 30, 2022 / 15:26 IST

Jefferies View On Power Grid

Research firm Jefferies has maintained buy rating on Power Grid Corporation with a target at Rs 260 per share.

The government has rejecting proposal to buy PFC’s stake in REC is positive, while EPS dampener is behind the company.

The transmission spend should pick up ahead, said Jefferies.

The beneficiary of asset monetisation & 6.6% dividend yield is added sweetener.

The reported RoE should improve to 19% from 17-18% & move higher as payout increases, reported CNBC-TV18.

September 30, 2022 / 15:19 IST

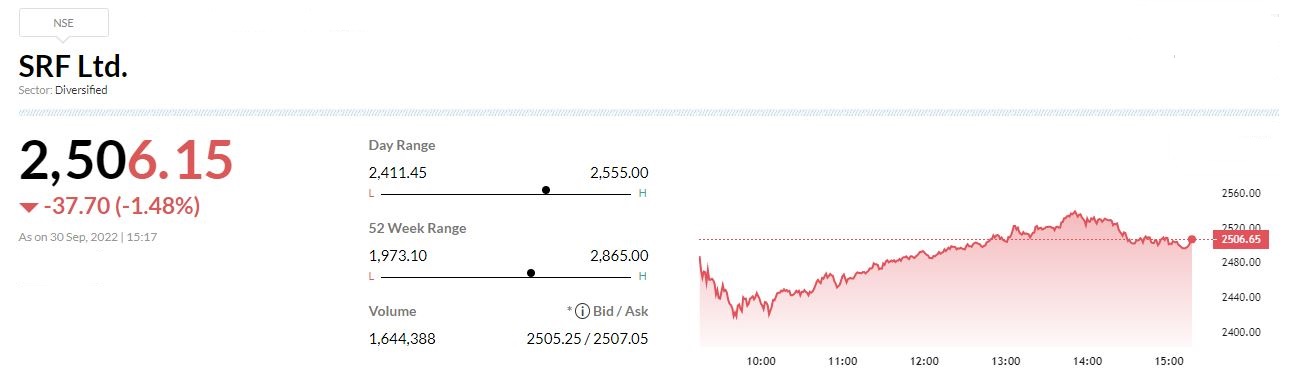

Jefferies On SRF

Broking house Jefferies has kept hold rating on SRF and raised the target price to Rs 2,290 from Rs 2,200 per share.

The channel checks indicate domestic & export refgas prices are coming off lifetime peaks. The MT growth outlook is robust on the back of its 5-year Rs 12,000 crore capex plan in chemicals.

Brkong house raises FY23 EBITDA estimate by 5% on refgas strength, reported CNBC-TV18.

September 30, 2022 / 15:14 IST

BSE Smallcap index rose 1 percent supported by the Anant Raj, Transformers And Rectifiers and RPG Life Sciences

September 30, 2022 / 15:11 IST

Mini Nair, Chief Financial Officer at Geojit Financial Services:

RBI’s rate hike was in expected lines as inflation remains elevated coupled with continued global uncertainties. This hike is also to keep in pace with what’s happening across the globe. But in contrast to many other countries, economic activities in India are stable now and most of the sectors are holding back well.

Growth in credit offtake driven by the sustained retail and improving corporate credit is a proof of that. Overall, I think the rate hike is a positive communication as the hike will help to control the inflation and to protect the currency.

September 30, 2022 / 15:05 IST

CLSA On Hindalco Industries

Brokerage firm CLSA has reiterated buy rating on Hindalco Industries with a target at Rs 525 per share.

The downstream demand concerns and lower LME lead to underperformance. The stock has corrected over Novelis’ profitability concerns and volatile aluminium prices.

Expected weakness in Q2 earnings also weighed on the stock, said CLSA.

The concerns were overdone with share price indicating aluminium price of USD 1,850/tonne.

Any uptick in metal prices or clarity on Novelis’ outlook would likely to lead to a re-rating, reported CNBC-TV18.

September 30, 2022 / 15:03 IST

ALERT | Eurozone September CPI inflation at 10% YoY and Preliminary September Core CPI at 4.8%