Benchmark Nifty 50 is trading in a narrow range with volatility being noticed around 24,500 level, and India VIX - the fear index - rising by 3 percent to 15 levels ahead of tomorrow's Union Budget announcement.

According to Avani Bhatt, Vice President of Derivative Research at JM Financial, "From here on, price moves are expected to be more rationalized and range-bound. India VIX is expected to gradually cool off to the 11-13 percent range in the August series."

Avani adds, "A lot of factors have changed on the economic, political, and sentiment fronts from the period of the interim budget to the final budget, leading to a high probability of a more accommodative and populist budget. Markets have factored in this scenario and seen a very good recovery of nearly 15% on Nifty from the panic lows of National Election Day."

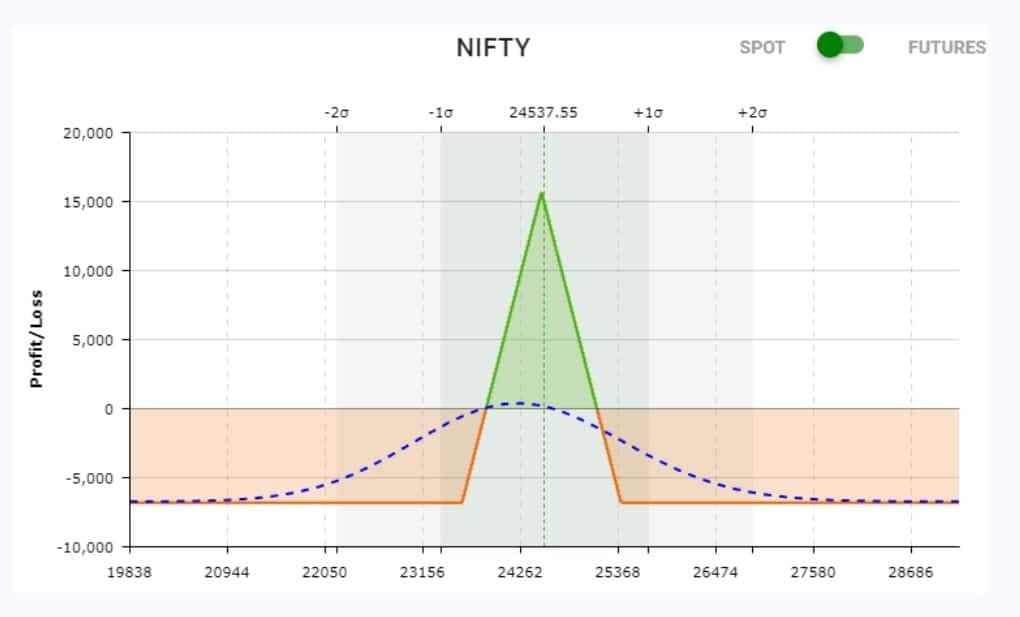

In context of this view, Bhatt recommends an Iron Fly strategy for the 29th August monthly expiry:

Strategy for 29th August expiry:

- Sell 24500 CE at Rs 530-540

- Sell 24500 PE at Rs 380-390

- (Combined premium of 910-930)

- Buy 25400 CE at Rs 150-160

- Buy 23600 PE at Rs 130-140

Net Premium Inflow: 630-650

Margin Required: Approx Rs 53,000

Target: 500 points

Stop Loss: 250 points

About Short Iron Fly: It is an advanced options strategy that involves selling an at-the-money call and put (forming a straddle) and buying an out-of-the-money call and put (forming wings). This strategy is designed to profit from low volatility and the passage of time, aiming to capture the premium received from selling the straddle while limiting potential losses with the wings. The maximum profit occurs if the underlying asset's price remains near the strike price of the sold options, while losses are capped due to the protective positions of the purchased options.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!