The market ended yet another volatile session on a negative note on June 15, dragged by technology, FMCG, power stocks and index heavyweight Reliance Industries. The losses were, however, capped by Bajaj Finance twins, auto, banking & financial services and metal stocks.

At close, the Sensex was down 152.18 points, or 0.29 percent, at 52,541.39, and the Nifty was down 39.90 points, or 0.25 percent, at 15,692.20. The broader space outperformed frontliners. The Nifty midcap 100 and smallcap 100 indices gained 0.35 percent and 0.6 percent.

India VIX remained above the crucial 20 mark at 22.15, indicating the trend still favours bears.

Stocks that were in action included Strides Pharma Science and Indraprastha Gas, which were among top gainers in the futures & options segment, rising 5 percent to Rs 326 and 4 percent to Rs 355.35, respectively. Affle India jumped 5.2 percent to Rs 1,019.7.

The three stocks also formed a bullish candlestick on the daily charts.

Here's what Jigar S Patel of Anand Rathi Shares & Stock Brokers recommends investors do with these stocks when the market resumes trading today:

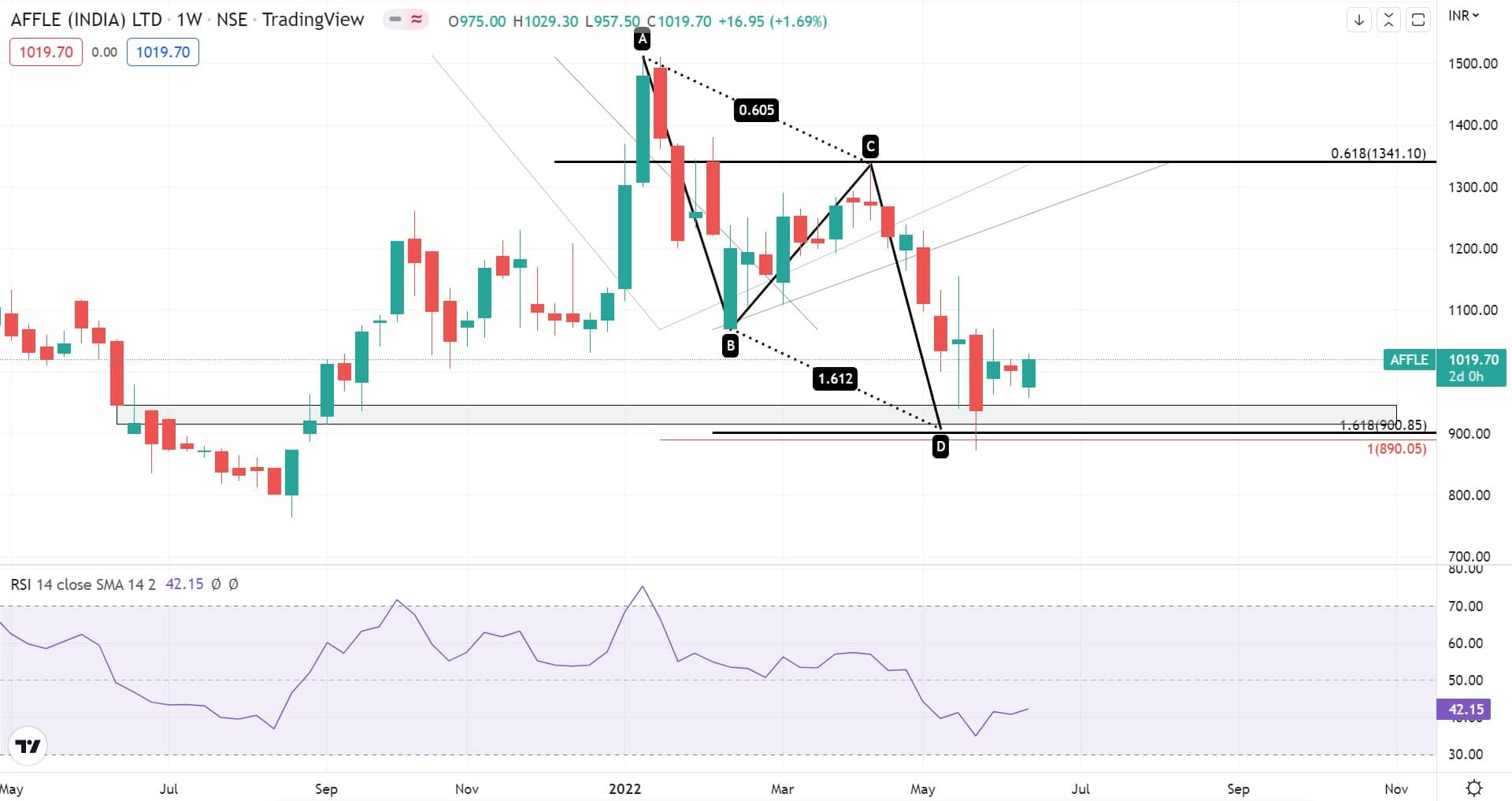

On the weekly chart, the counter has completed the N-wave formation near its crucial support zone of Rs 950 and rebounded nicely.

Affle also formed a bullish AB=CD pattern on the weekly chart along with the relative strength index (RSI) making an impulsive structure near 30 levels, which is looking lucrative.

So, at current levels, one should buy in small tranches and buy another at Rs 990. An upside is seen till Rs 1,200, with good support at Rs 940-950.

Stride Pharma has corrected almost 65 percent in the last couple of years. At present, it has formed a bullish alternate BAT pattern on the weekly chart along with weekly RSI making a bullish divergence near its potential reversal of Rs 280-300, making it perfect for long-term investment.

One can buy this immediately since these are historical levels. The upside is seen till Rs 500-550, with good support at Rs 260-270.

IGL has a classic setup where crucial support of Rs 340 has been tested multiple times. On three hours chart, it has formed Bullish BAT pattern with a potential reversal zone of 340-350. RSI on three hours chart has displayed an impulsive structure, which hints at positive momentum.

One can buy the stock at current levels, with upside potential till Rs 385 with support seen at Rs 340.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.