The market has extended uptrend for yet another session and settled the volatile trade with moderate gains on April 25. Traders seem to be cautious ahead of monthly expiry of futures and options contracts on Thursday.

The BSE Sensex gained 75 points to 60,131, while the Nifty50 climbed 26 points to close at 17,769, and formed a Doji kind of pattern on the daily scale, indicating indecisiveness among bulls and bears about future market move.

Bank Nifty also ended with minor gains, up 43 points at 42,678, while the broader markets had a mixed trend with the Nifty Midcap 100 index falling 0.1 percent and Smallcap 100 index gaining half a percent.

Stocks that performed better than broader markets included RITES which surged nearly 9 percent to Rs 380 and formed robust bullish candlestick pattern on the daily scale with large volumes, trading above all key moving averages (21, 50, 100 and 200-day EMA - exponential moving average). It has decisively broken more than a month long consolidation.

Mahindra Holidays and Resorts India rose over 3 percent to Rs 310 and formed bullish candle on the daily timeframe with long upper and lower shadow indicating volatility in the stock. It has seen robust volumes with trading above all key moving averages.

JK Lakshmi Cement has not only seen a narrow range breakout, but also small downward sloping resistance trendline adjoining highs of April 5 and April 13. The stock has gained more than 3 percent, with holding above all key moving averages.

Here's what Rohan Shah of Stoxbox recommends investors should do with these stocks when the market resumes trading today:

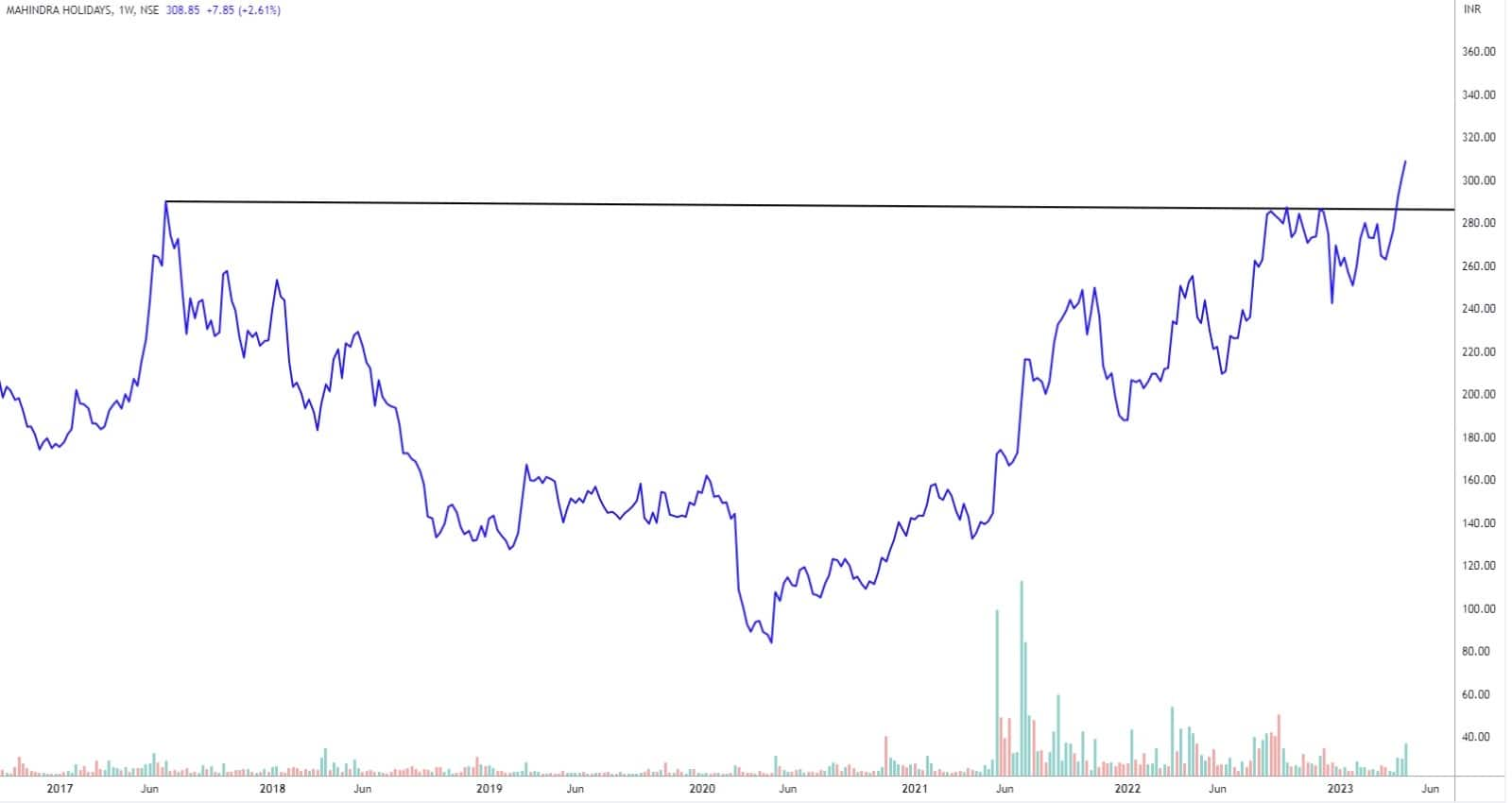

Mahindra Holidays and Resorts India

Since May 2022, the stock has been in strong trend as price has been forming series of Higher highs and Higher low. The rise in price is well supported by volumes indicates robust price structure.

On the weekly timeframe, the stock has generated a breakout from Bullish Cup & Handle price pattern denotes bullish signal for short to medium trend. As per the pattern, the price has potential to scale higher towards Rs 345-350 zone in short term, whereas on the downside, Rs 300-295 would act strong support zone for the stock.

The stock saw a sharp upmove from mid-June 2022 to October 2022, where price rallied from Rs 226 to Rs 433 levels. In this process, the price witnessed a breakout from multi-week resistance trendline with sharp rise in volumes denoted a bullish signal for medium term trend.

Post breakout, the price rallied to new highs and then saw profit booking dragging price lower towards the trendline which provided strong support which highlights robust price action. This week the price has resolute a breakout from intermediate resistance trendline and from Master Candle pattern indicates bullish bias from short term trend.

As per price action, we see price heading towards to challenge its previous life highs of Rs 430. While, on the downside, Rs 370-365 to act intermediate support zone being the breakout zone the mentioned candlestick pattern.

The stock has been in strong momentum recently, where the price rallied from Rs 646 to Rs 850 levels. Post strong rally, price witnessed minor profit booking forming a potential bullish Flag type pattern on the daily chart.

On Tuesday, the price has staged a breakout from the said pattern suggests continuation in the prior trend. Momentum indicator RSI (relative strength index) has generated bullish crossover with surpassing above 60 levels which is bullish sign and compliments bullish view in price.

The price action suggest, price has potential to trend higher towards Rs 850, followed by Rs 885 levels in the near term. On the flip side Rs 780-770 zone to provide intermediate support.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.