The market closed a rangebound session off the day's high because of selling pressure in last hour of trade on May 23, continuing the uptrend for the third straight day as buying was seen in metals, auto, pharma, and oil and gas stocks.

The BSE Sensex gained 18 points to 61,982, and the Nifty50 34 points to 18,348, while the Nifty Midcap 100 index gained six-tenth of a percent and Smallcap 100 index stayed flat with a positive bias.

Bank Nifty rebounded after a correction in the previous session, but failed to sustain the 44,000 mark. The index gained 69 points to 43,954.

Stocks that were in action on Tuesday included Route Mobile which rallied 4 percent to Rs 1,468.35, the highest closing level since September 13 last year, and formed bullish candlestick pattern with long upper shadow on the daily scale with strong volumes.

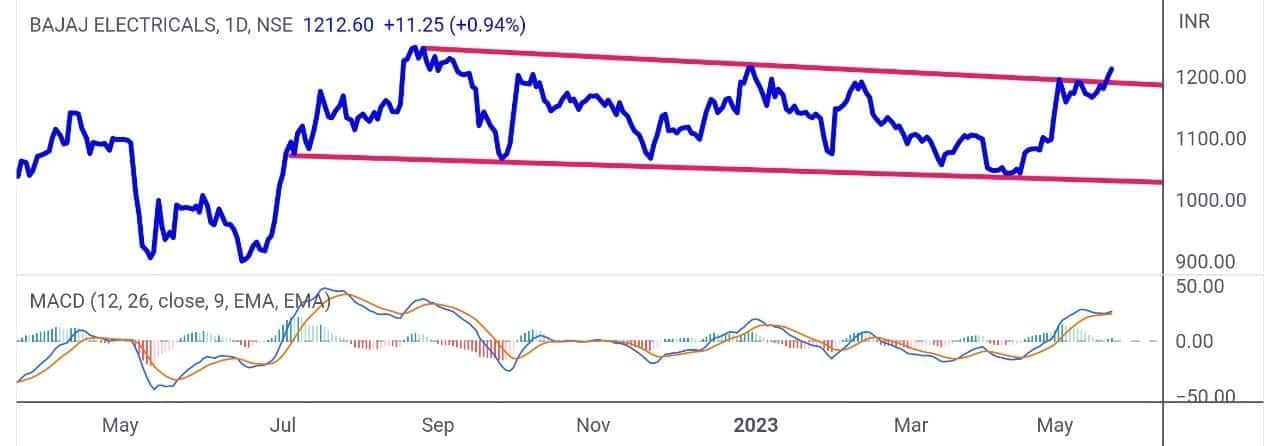

Bajaj Electricals shares gained 1 percent to Rs 1,212.60, the highest closing levels since December 30, and formed a small-bodied bullish candle with long upper shadow on the daily charts, indicating profit-booking at higher levels after hitting the highest levels on intraday basis since August last year.

Divis Laboratories continued to see healthy volumes for yet another session. It jumped 3.7 percent to Rs 3,385.8, the highest closing level since May 10 and formed a long, bullish candlestick pattern on the daily scale for second consecutive session.

Here's what Rohan Shah of Stoxbox recommends investors should do with these stocks when the market resumes trading today:The price action of Route Mobile supposedly took a breather by means of profit taking bouts after 282 percent run-up from the listing day. The price action corrected 56 percent from the all-time high and entered into a lateral trading range after losing the downside momentum.

The current sideway trend not only hints at a more significant support level, but also that the ownership of stocks are potentially transferring from weak to strong hands.

We thus reiterate going long in Route Mobile with entry in the range of Rs 1,475-1,435 with an upside move towards Rs 1,730-1,750 zone. On the flip side, Rs 1,377-1,360 to act key support area.

The stock rallied almost more than 40 percent from the June 2022 low and post that stock turned sideways, trading in the channel which contained for more than 10 months.

The stock staged a breakout from the said channel this week with strong volumes and supportive momentum. Thus going forward if breakout unfolds well on expected line, price is expected to head higher towards Rs 1,280-1,300 levels, whereas, Rs 1,190-1,170 shall provide key support zone.

The stock broke out of from descending resistance trendline in April 2023. After that stock went into consolidation mode for almost a month and now previous resistance zone acted as support for the stock.

In last two days, the stock has been trading well above the support zone with good gains. However, 200 DEMA (day exponential moving average) has been another resistance point for stock on multiple instances. If stock closes above its 200 DEMA for the day, it will open up the targets of Rs 3,700 and Rs 3,900 respectively. On the other hand, the support will come at Rs 3,300 and Rs 3,240 levels.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.