The benchmark saw a nearly 1 percent correction on August 8, after a day of sharp intraday recovery. Bears maintained their dominance over the market breadth, with about 1,808 shares declining compared to 877 rising shares on the NSE. The market may attempt a bounce back after six weeks of consistent losses, but sustainability will be the key to watch. Below are some short-term trading ideas to consider:

Rajesh Palviya, Senior Vice President Research (Head Technical Derivatives) at Axis Securities

Sanghvi Movers | CMP: Rs 307.7

Sanghvi Movers registered 17.5% gains last week. With this strong buying momentum, the stock has experienced a trend reversal, as it has decisively broken out past a one-and-a-half-year "down-sloping trendline resistance" at Rs 292 on a weekly closing basis. Huge volumes on this breakout signify increased participation.

The stock is well placed above its 20-, 50-, 100-, and 200-day SMAs, which reconfirms a bullish trend. These averages are also inching up along with the price rise, further reinforcing bullish sentiment. The daily, weekly, and monthly strength indicator RSI indicates rising strength. The daily "Bollinger Bands" buy signal signifies increased momentum. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 350, Rs 385

Stop-Loss: Rs 280

Kajaria Ceramics | CMP: Rs 1,308.5

Kajaria Ceramics, with the past couple of sessions' up-move, has decisively surpassed the "multiple resistance" zone of Rs 1,267 on a closing basis, indicating a strong comeback by bulls. Over the past couple of months, rising volumes have signified increased participation. The stock is well placed above its 20-, 50-, 100-, and 200-day SMAs, reaffirming a bullish trend. These averages are also inching up along with the price rise, reinforcing bullish sentiment.

The daily, weekly, and monthly strength indicator RSI indicates rising strength. The daily "Bollinger Bands" buy signal signifies increased momentum. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 1,420, Rs 1,500

Stop-Loss: Rs 1,267

TVS Motor Company | CMP: Rs 2,968.9

TVS Motor Company, with last week's price action, has confirmed a "Cup and Handle" formation breakout at Rs 2,965 on a closing basis. The past couple of weeks' rising volumes show increased participation. The stock is well placed above its 20-, 50-, 100-, and 200-day SMAs, reaffirming a bullish trend. These averages are also inching up along with the price rise, reinforcing bullish sentiment. The daily "Bollinger Bands" buy signal signifies increased momentum. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 3,100, Rs 3,250

Stop-Loss: Rs 2,880

Rajesh Bhosale, Technical Analyst at Angel One

Tech Mahindra | CMP: Rs 1,480.4

From the April swing low near Rs 1,180 to the June peak around Rs 1,700, Tech Mahindra saw a strong rally, followed by a month-long price correction. This week, after testing the 50% retracement level of that advance, prices staged a solid rebound, forming a bullish engulfing pattern on the weekly chart. The formation of this pattern at a key support zone signals a potential resumption of the uptrend.

Notably, this support aligns with the 89-WEMA, further reinforcing the bullish outlook. On the momentum side, the RSI Smoothened has generated a fresh buy signal from the oversold territory, lending additional confirmation to the positive view.

Strategy: Buy

Target: Rs 1,600

Stop-Loss: Rs 1,420

Indian Bank | CMP: Rs 650.85

Despite weakness in the broader banking space over the past couple of months, Indian Bank has stood out with notable relative strength, consistently holding above its multi-month bullish breakout zone. This week, while the overall market came under pressure, the stock gained over 4%, breaking out of consolidation and confirming a Flag pattern on the weekly chart — a classic continuation signal in an uptrend.

On the momentum front, monthly and weekly RSI readings remain firmly above 80, underscoring strong bullish sentiment, while a pullback in the daily RSI toward 40 offers an attractive buy-on-dips opportunity.

Strategy: Buy

Target: Rs 710

Stop-Loss: Rs 619

Anshul Jain, Head of Research at Lakshmishree Investments

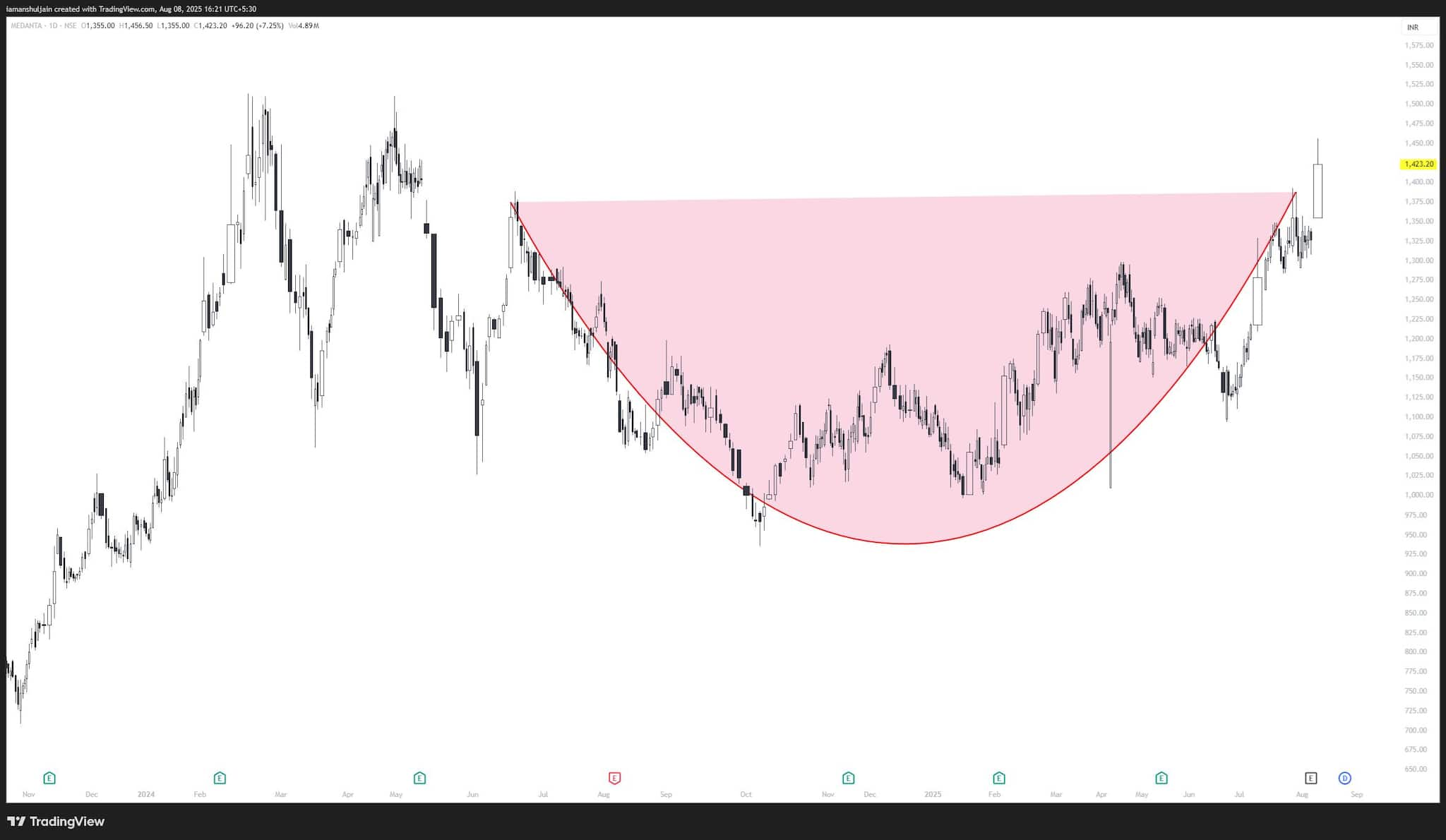

Global Health (Medanta) | CMP: Rs 1,423.2

Medanta has broken out of a 282-day-long rounding pattern with a massive volume surge — over 1,334% above the 50-day average — signaling strong institutional participation. The breakout coincides with stellar quarterly results, featuring 50% EPS growth year-on-year and sales rising over 20%. Moving averages and momentum indicators are bullishly aligned, providing additional support for further upside. This blend of powerful price action, extraordinary volumes, and strong fundamentals points to a potential sharp follow-through rally, offering an attractive setup for momentum traders aiming to capitalize on institutional buying and sustained market strength.

Strategy: Buy

Target: Rs 1,650

Stop-Loss: Rs 1,300

Pidilite Industries | CMP: Rs 3,081.3

Pidilite, after a failed breakdown of its box pattern with boundaries at Rs 2,900–3,110, has rebounded sharply to test the box high. It is now consolidating near this upper boundary, forming an inside bar — a sign of controlled price action before a possible breakout. The reversal from the box low created a bear trap, adding strength to the structure. A decisive move above Rs 3,120 will confirm the breakout and likely accelerate momentum toward the Rs 3,400 zone. The price setup, coupled with the failure of bears to hold breakdown levels, signals strong underlying buying interest and bullish continuation potential.

Strategy: Buy

Target: Rs 3,400

Stop-Loss: Rs 2,980

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.