The benchmark indices extended their northward journey for the third straight session, rising 1 percent on June 6, after the RBI surprised the street with its move. Market breadth favoured the bulls, as about 1,459 shares advanced compared to 1,132 declining shares on the NSE. The momentum is expected to sustain in the upcoming session, though some profit booking at higher levels cannot be ruled out. Below are some short-term trading ideas to consider:

Rajesh Palviya, Senior Vice President Research (Head Technical Derivatives) at Axis Securities

Persistent Systems | CMP: Rs 5,676.5

On the daily chart, Persistent Systems has experienced a trend reversal, forming a series of higher tops and bottoms. Additionally, it has surpassed the past three weeks’ down-sloping trendline resistance at Rs 5,630, indicating a positive bias. The stock is currently sustaining above its 20-, 50-, 100-, and 200-day SMAs, reaffirming bullish sentiment. Both the daily and weekly strength indicators (RSI) show rising strength. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 6,000, Rs 6,200

Stop-Loss: Rs 5,550

NMDC | CMP: Rs 72.5

On the weekly chart, NMDC has surpassed its past one-year down-sloping trendline resistance on a closing basis. The stock is trading well above its 20-, 50-, 100-, and 200-day SMAs, all of which are inching upward in line with rising prices—further confirming bullish sentiment. The weekly Bollinger Bands buy signal indicates increased momentum, while both the daily and weekly RSI remain in positive terrain. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 80, Rs 85

Stop-Loss: Rs 70

Glenmark Pharma | CMP: Rs 1,590.2

Glenmark Pharma has decisively broken out above the 6–8 weeks’ down-sloping trendline resistance at Rs 1,500 on the weekly chart, confirming a trend reversal. Over the past couple of weeks, strong rising volumes have signified increased participation. Both the daily and weekly Bollinger Bands buy signals confirm momentum. The stock is currently sustaining above its 20-, 50-, 100-, and 200-day SMAs, further supporting bullish sentiment. The daily and weekly RSI indicate rising strength. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 1,670, Rs 1,790

Stop-Loss: Rs 1,540

Osho Krishan, Chief Manager - Technical & Derivative Research at Angel One

Eternal | CMP: Rs 261.85

Eternal has shown impressive growth, surging nearly 10 percent in the past trading week. This surge was accompanied by key technical developments, starting with a consolidation breakout surpassing the 200-day SMA, suggesting renewed market interest and a possible trend reversal. Additionally, the MACD line has shown a positive crossover near the zero line, adding a bullish undertone. These indicators suggest that Eternal may be entering a period of sustained growth. Hence, we recommend buying Eternal on dips in the Rs 250–245 range.

Strategy: Buy

Target: Rs 270, Rs 275

Stop-Loss: Rs 232

Jindal Stainless | CMP: Rs 694.70

Jindal Stainless has posted a strong move following a consolidation phase and is now positioned above all significant EMAs, including the 200-day SMA. The recent buying interest has been supported by increased volumes and positive developments. Furthermore, a sloping trendline breakout on the daily chart enhances the bullish outlook. The stock has also moved above a crucial neckline zone, now expected to act as a support level. Hence, we recommend buying Jindal Stainless on dips in the Rs 690–680 range.

Strategy: Buy

Target: Rs 750, Rs 760

Stop-Loss: Rs 640

Trent | CMP: Rs 5,777

Trent has experienced a gradual resurgence over recent trading weeks, culminating in a strong weekly close. The counter is now trading above all its short-term EMAs on the daily time frame after a prolonged period, indicating inherent strength. It has also witnessed a breakout from its consolidation phase, backed by a positive 14-day RSI crossover, further strengthening its bullish stance. Hence, we recommend buying Trent around Rs 5,750.

Strategy: Buy

Target: Rs 6,240, Rs 6,260

Stop-Loss: Rs 5,440

Anshul Jain, Head of Research at Lakshmishree Investments

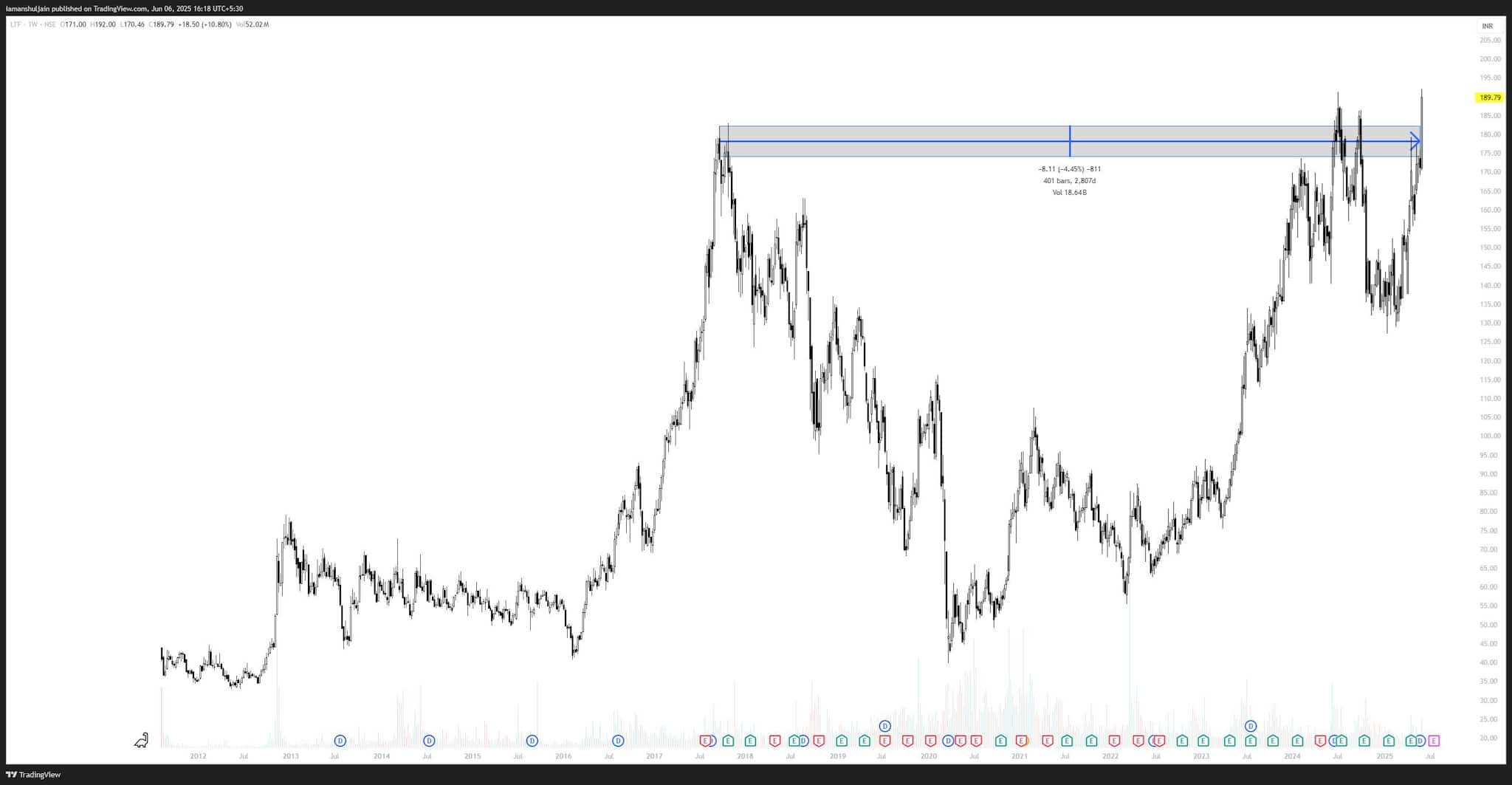

L&T Finance | CMP: Rs 189.79

L&T Finance has broken out of a massive 401-week-long cup and handle pattern on the weekly chart, supported by a robust structural setup and institutional accumulation. Although breakout volumes aren’t extremely large, they are above average, supporting the sustainability of the move. Immediate resistance lies at the swing high of Rs 189. A move above Rs 190 will likely trigger fresh momentum, pushing the stock towards Rs 240 in the coming weeks as the bullish trend unfolds.

Strategy: Buy

Target: Rs 240

Stop-Loss: Rs 170

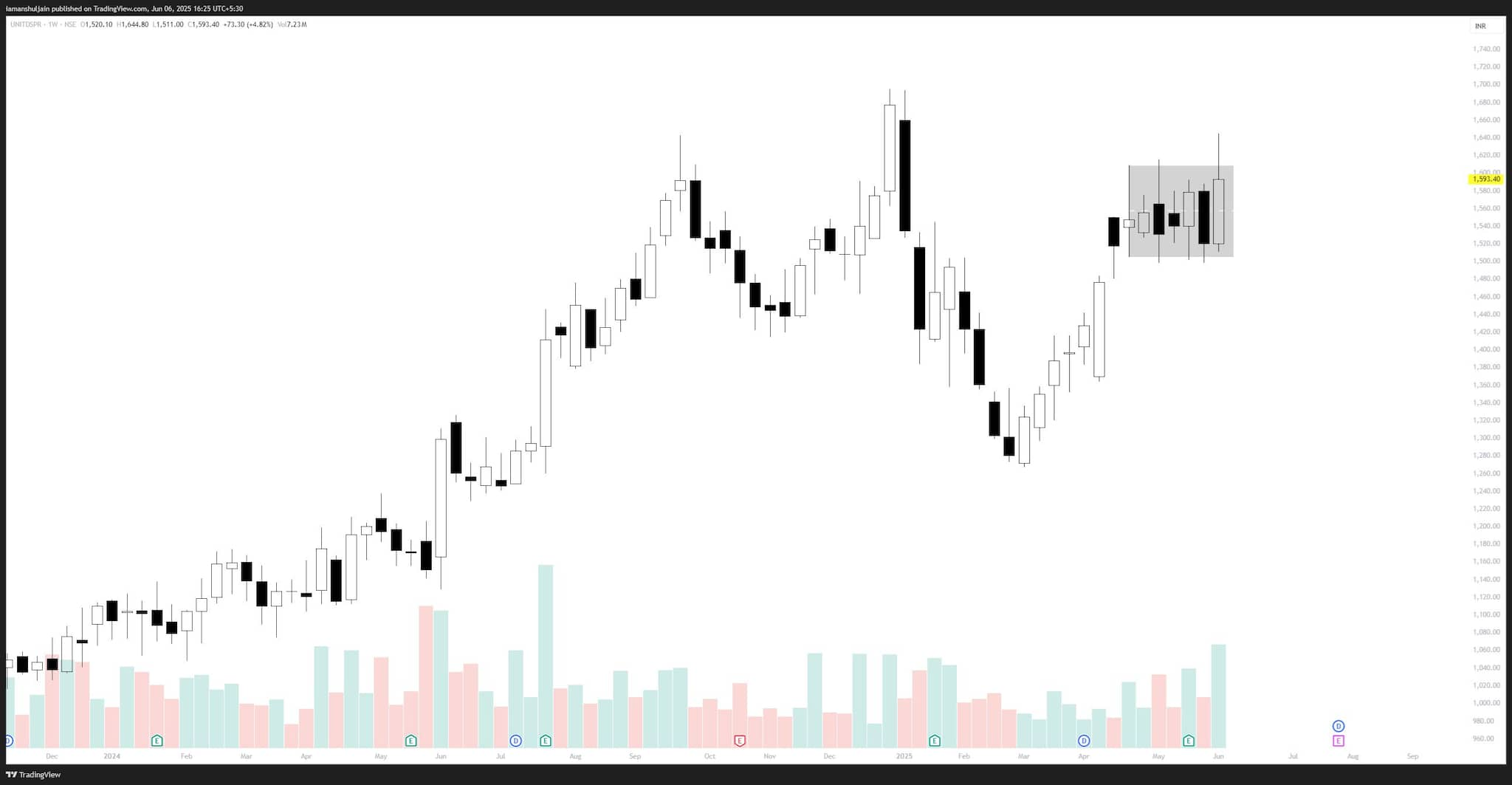

United Spirits | CMP: Rs 1,593.4

After a 26 percent rally in seven weeks, United Spirits has entered a seven-week consolidation phase, forming a bullish flag pattern on the weekly chart. A breakout above Rs 1,610 is expected to trigger fresh momentum, potentially propelling the stock towards Rs 1,800—a new all-time high. The moving average catch-up is nearly complete, making the stock ripe for a breakout. The structure remains bullish, with the flag formation acting as a launchpad for the next upmove.

Strategy: Buy

Target: Rs 1,800

Stop-Loss: Rs 1,540

Deepak Fertilisers and Petrochemicals Corporation| CMP: Rs 1,544.6

Deepak Fertilisers has broken out of its swing structure and is showing strong follow-through momentum. The stock, along with the broader sector, is attracting fresh fund flows. Among its peers, Deepak Fertilisers demonstrates the highest relative strength. The breakout is holding firm and is setting the stage for a major upward move. A minor moving average catch-up on the daily chart is awaited, after which the stock is likely to resume its bullish trajectory toward higher levels.

Strategy: Buy

Target: Rs 1,700

Stop-Loss: Rs 1,490

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.