The market recouped its morning losses in the afternoon trade and managed to close the day on a positive note on February 4.

The 30-share BSE Sensex gained 113.31 points to close at 36,582.74 while the Nifty50 rose 18.60 points to 10,912.30 and formed bullish candle on the daily charts.

"We believe that the stage is very much set for benchmark index to go beyond recent hurdles. Last two days upmove has laid the foundation and further impetus may probably be provided by the RBI monetary policy scheduled this week," Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel Broking, told Moneycontrol.

He said as far as levels are concerned, Friday's low of 10,800 played a sheetanchor role.

He advised traders to trade with a positive bias and should follow strict stop losses below 10,800 for existing longs.

"A move beyond 10,987 would unfold next leg of the rally and in this scenario; lot of recent beaten counters would see sharp short covering moves. Do watch out for all these possibilities and should position accordingly," Chavan said.

The broader markets underperformed frontliners with the Nifty Midcap index falling 0.88 percent and Smallcap index 1.55 percent. More than two shares declined for every share rising on the NSE.

The sectoral trend was mixed as Nifty Bank and IT indices closed higher while Auto, FMCG, Metal and Pharma declined.

We have collated top 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 10,912.2 on February 4. According to Pivot charts, the key support level is placed at 10,841.63, followed by 10,771.07. If the index starts moving upward, key resistance levels to watch out are 10,955.33 and then 10,998.47.

Nifty Bank

The Nifty Bank index closed at 27,186.60 on February 4. The important Pivot level, which will act as crucial support for the index, is placed at 26,926.87, followed by 26,667.13. On the upside, key resistance levels are placed at 27,345.07, followed by 27,503.54.

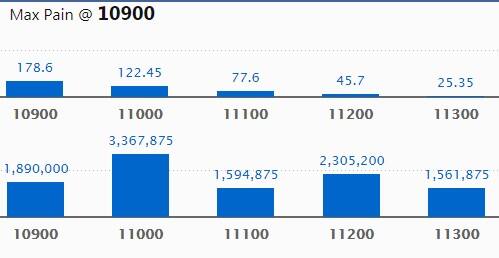

Call Options Data

Maximum Call open interest (OI) of 33.67 lakh contracts was seen at the 11,000 strike price. This will act as a crucial resistance level for the February series.

This was followed by the 11,200 strike price, which now holds 23.05 lakh contracts in open interest, and 10,900, which has accumulated 18.90 lakh contracts in open interest.

Meaningful Call writing was seen at the strike of 11,100 which added 3.04 lakh contracts, followed by 11,000 strike which added 2.11 lakh contracts and 10,900 strike which added 1.78 lakh contracts.

There was hardly any Call unwinding seen.

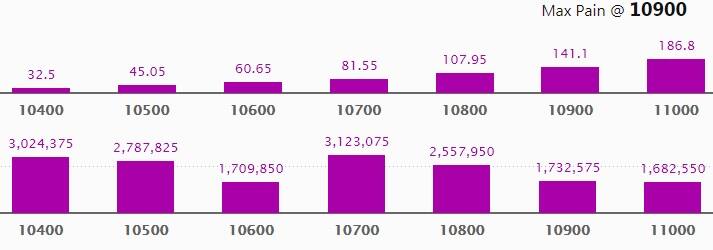

Put Options data

Put Options data

Maximum Put open interest of 31.23 lakh contracts was seen at the 10,700 strike price. This will act as a crucial support level for the February series.

This was followed by the 10,400 strike price, which now holds 30.24 lakh contracts in open interest, and the 10,500 strike price, which has now accumulated 27.87 lakh contracts in open interest.

Put writing was seen at the strike price of 10,800, which added 5.35 lakh contracts, followed by 10,900, which added 4.02 lakh contracts and 10,600, which added 1.77 lakh contracts.

There was hardly any Put unwinding seen.

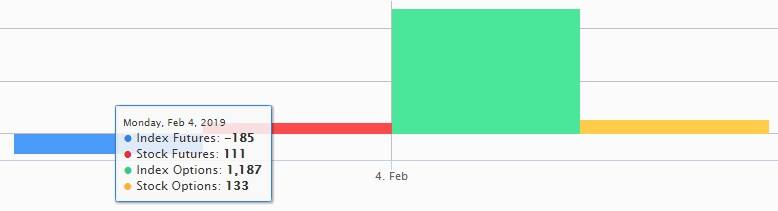

FII & DII data

FII & DII data

Foreign Institutional Investors (FIIs) sold shares worth Rs 112.13 crore and Domestic Institutional Investors sold Rs 65.22 crore worth of shares in the Indian equity market on February 4, as per provisional data available on the NSE.

Fund Flow Picture

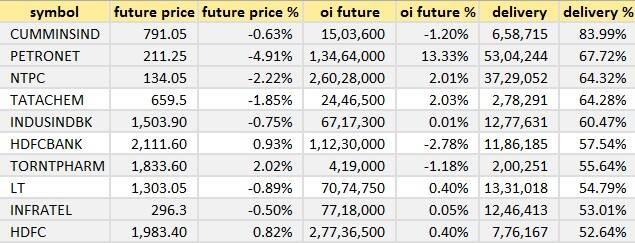

Stocks with high delivery percentage

High delivery percentage suggests that investors are accepting delivery of the stock, which means that investors are bullish on it.

29 stocks saw a long buildup

29 stocks saw a long buildup

20 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

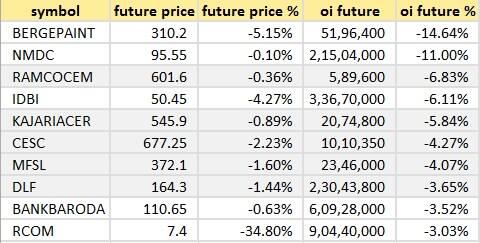

109 stocks saw a short build-up

109 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

41 stocks saw long unwinding

41 stocks saw long unwinding

Bulk Deals on February 4

Bulk Deals on February 4

Amber Enterprises (I): GMO Emerging Domestic Opportunities Fund sold 3,46,788 shares of the company at Rs 680.08 per share on the NSE.

(For more bulk deals, click here)

Analyst or Board Meet/Briefings

Mandhana Retail Ventures: Company will announce its October-December quarter earnings on February 13.

Titagarh Wagons: Company will hold Conference Call to discuss its Q3FY19 financial performance, to be organized by B&K Securities, on February 5.

Eveready Industries India: Company will announce its October-December quarter earnings on February 14.

Bombay Rayon Fashions: Company will announce its October-December quarter earnings on February 14.

CESC Ventures: Company will announce its October-December quarter earnings on February 11.

Everest Kanto Cylinder: Company will announce its October-December quarter earnings on February 11.

Shriram Transport Finance Company: Company's officials will be meeting HSBC Global Asset Management UK in Mumbai on February 5.

Nestle India: Company will announce its October-December quarter earnings on February 14.

Asahi India Glass: Company will announce its October-December quarter earnings on February 12.

GE T&D India: Company will announce its October-December quarter earnings on February 11.

Emami Realty: Company will announce its October-December quarter earnings on February 12.

Oracle Financial Services Software: Company will announce its October-December quarter earnings on February 13.

Karda Constructions: Company will announce its October-December quarter earnings on February 14.

ONGC: Company will announce its October-December quarter earnings on February 14.

Godrej Industries: Company will announce its October-December quarter earnings on February 13.

Corporation Bank: Company will announce its October-December quarter earnings on February 11.

Jaypee Infratech: Company will announce its October-December quarter earnings on February 11.

Ruchi Soya Industries: Company will announce its October-December quarter earnings on February 13.

Kaveri Seed Company: Company will announce its October-December quarter earnings on February 14.

Mcleod Russel: Company will announce its October-December quarter earnings on February 14.

Talwalkars Better Value Fitness: Company will announce its October-December quarter earnings on February 13.

Indian Hotels Company: Company will announce its October-December quarter earnings on February 12.

Stocks in news

Results on February 5: Tech Mahindra, Punjab National Bank, Hindustan Petroleum Corporation, DLF, GAIL (India), ACC, BHEL, Marico, IDFC First Bank, Apollo Tyres, Prataap Snacks, Aditya Birla Capital, Suven Life Sciences, Blue Star, Tube Investments of India, Future Enterprises, Future Enterprises, Praxis Home Retail, Inspirisys Solutions, Aspinwall & Company, AksharChem India, Adlabs Entertainment, Hitech Corporation, Fairchem Speciality, IZMO, Lotus Eye Hospital, Snowman Logistics, Spice Mobility, Pressman Advertising, Piramal Phytocare, Tata Chemicals, Sutlej Textiles, SEL Manufacturing Company, Arshiya, V-Mart Retail, Rossell India, Uttam Galva Steels, Usha Martin, Trent, Bombay Dyeing, Birla Corporation, Jai Corp, HCL Infosystems, Torrent Power, Jai Balaji Industries, De Nora India, GeeCee Ventures, Allied Digital Services, Tata Global Beverages, Asahi Songwon Colors, Symphony, LT Foods, Trigyn Technologies, Oswal Agro Mills, DPSC, Century Plyboards (India), Hotel Rugby, Oswal Chemicals & Fertilizers, United Bank of India, JBF Industries, Ador Welding, Mangalore Refinery and Petrochemicals, Kamat Hotels, Dish TV India, Reliance Infrastructure, PTL Enterprises, Alkali Metals, INOX Leisure, Timken India, Indian Card Clothing Company, Sobha, CESC, RPG Life Sciences, Brigade Enterprises

Coal India: Board approved the proposal for purchase of company's equity shares up to 4,46,80,850 at a price of Rs 235 apiece payable in cash for an aggregate consideration up to Rs 1,050 crore.

IRB Infrastructure Q3: Profit rises to Rs 218.9 crore versus Rs 207.3 crore; revenue increases to Rs 1,788.5 crore versus Rs 1,296.2 crore YoY.

Balrampur Chini Mills Q3: Profit jumps to Rs 120.32 crore versus Rs 61.42 crore; revenue falls to Rs 940.91 crore versus Rs 1,001.91 crore YoY.

Novartis India Q3: Profit dips to Rs 12.87 crore versus Rs 18.74 crore; revenue falls to Rs 135.62 crore versus Rs 156.1 crore YoY.

NRB Bearings Q3: Profit rises to Rs 26.75 crore versus Rs 21.28 crore; revenue increases to Rs 242.6 crore versus Rs 207.3 crore YoY.

Future Retail Q3: Profit rises to Rs 201.43 crore versus Rs 183.14 crore; revenue jumps to Rs 5,301 crore versus Rs 4,693.4 crore YoY.

Bharat Financial Inclusion: Company assigned a pool of receivables of an aggregate value of Rs 751.19 crore to one of the largest private sector banks on a Direct Assignment basis. With this transaction, the company has completed Direct Assignment transactions worth Rs 5,448.40 crore in FY19.

Lakshmi Machine Works Q3: Profit rises to Rs 62.38 crore versus Rs 56.34 crore; revenue jumps to Rs 647.9 crore versus Rs 542.42 crore YoY.

Future Retail: Board approved too issue and allot upto 3,96,03,960 warrants convertible into 3,96,03,960 equity shares of Rs 2 each at a premium of Rs 503 per share aggregating to Rs 1999.99 crore Future Coupons Limited (promoter group entity) on a preferential basis.

Lakshmi Vilas Bank Q3: Loss widens to Rs 373.5 crore versus loss Rs 39.2 crore; net interest income falls to Rs 138.8 crore versus Rs 219.67 crore YoY.

Reliance Naval and Engineering Q3: Loss at Rs 371.6 crore versus loss Rs 166.31 crore; revenue falls to Rs 52.06 crore versus Rs 54 crore YoY.

IL&FS Transportation Networks: Interest due and payable on February 4 on the NCDs was not paid to the debenture holders due to insufficient funds.

SREI Infrastructure Finance Q3: Profit falls to Rs 91.56 crore versus Rs 118.85 crore; revenue rises to Rs 1,621.11 crore versus Rs 1,543.90 crore YoY.

Kilitch Drugs India: Shailesh Mirgal has resigned from the post of Chief Financial Officer of the company.

SRF Q3: Consolidated profit rises to Rs 165.71 crore versus Rs 131.22 crore; revenue jumps to Rs 1,964 crore versus Rs 1,397 crore YoY.

Reliance Communications: Telecom Disputes Settlement and Appellate Tribunal (TDSAT) cancels Rs 2,000 crore demand on company and asked Department of Telecommunication to return Rs 2,000 crore bank guarantee to company.

Godrej Agrovet Q3: Consolidated profit declines to Rs 48.56 crore versus Rs 57.90 crore; revenue rises to Rs 1,454.11 crore versus Rs 1,220.66 crore YoY.

Greaves Cotton Q3: Profit falls to Rs 42.71 crore versus Rs 55.61 crore; revenue rises to Rs 506.46 crore versus Rs 447.3 crore YoY.

Ashok Leyland: Company acquired 4,50,005 shares, constituting 11.25 percent in the paid-up share capital of Ashley Aviation. Consequent to the said acquisition, the company's shareholding in AAL stands increased from 88.75 percent to 100 percent making it a wholly-owned subsidiary of the company.

Titagarh Wagons Q3: Profit rises to Rs 5.9 crore versus Rs 3.92 crore; revenue rises to Rs 216.3 crore versus Rs 87.15 crore YoY.

KEI Industries Q3: Profit rises to Rs 48.39 crore versus Rs 39 crore; revenue increases to Rs 1,087.5 crore versus Rs 888.66 crore YoY.

HEG: Gulshan Kumar Sakhuja will be designated as Chief Financial Officer of the company. OP Ajmera, who has been working as Chief Executive Officer of Bhilwara Energy Limited Since 2011, will take additional responsibility of being group Chief Financial Officer. Manish Gulati, Chief Marketing Officer, will now be re-designated as Chief Operating Officer & Chief Marketing Officer of the company.

Reliance Communications: Company moved the National Company Law Appellate Tribunal (NCLAT) for withdrawal of its appeal, to pursue the resolution plan through National Company Law Tribunal (NCLT) process. NCLAT directed Ericsson to file its reply in the matter by February 8, 2019.

Two stocks under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For February 5, DHFL and IDBI Bank stocks are present in this list.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.