The market snapped a four-day losing streak and closed with seven-tenth of a percent gains on July 15, aided by positive global cues. Auto, financial services, FMCG, and HDFC group stocks supported the market.

The BSE Sensex rallied 345 points to 53,761, while the Nifty50 rose 110.5 points to 16,049 and formed bullish candle, which resembles Hammer kind of pattern formation on the daily charts. For the week, there was High Wave kind of pattern formation on the weekly scale, which indicates indecisiveness among bulls & bears, and the index lost one percent.

"It appears to be the week of consolidation on the bourses as the Nifty50 remained in a narrower trading range of 390 points before signing off the week with an indecisive formation. However, on the daily charts, the rally from the lows of 15,183 levels appears to be unfolding in a channelled way," said Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia.

Interestingly, at Thursday's intraday low of 15,858 levels, the index tested the lower end of the said ascending channel and bounced back. Hence, sustaining above 15,858 levels the bulls can make efforts to consolidate in a range of 15,950 and 16,275 levels, the expert said. "In between, a close above 16,150 can confirm some kind of strength for the index."

Contrary to this, he said if the index closes below its 20-day SMA (15,843), it can signal the resumption of the downswing which is in progress from the highs of 16,275. For the time, it looks prudent for traders to avoid directional bets on the index, the market expert advised.

The broader markets also gained momentum with the Nifty Midcap 100 and Smallcap 100 indices rising 0.77 percent and Smallcap 0.34 percent respectively, but the market breadth was not very strong. About 1,031 shares advanced against 892 declining shares.

The cooling down volatility was quite supportive for the market as India VIX fell by 4.04 percent to 17.60 levels. If the volatility sustains below 18 levels then there could be more stability in the market, experts said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,962, followed by 15,875. If the index moves up, the key resistance levels to watch out for are 16,102 and 16,154.

Nifty Bank was up 31.45 points at 34,683 on Friday, forming High Wave kind of pattern on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 34,464, followed by 34,246. On the upside, key resistance levels are placed at 34,900 and 35,118 levels.

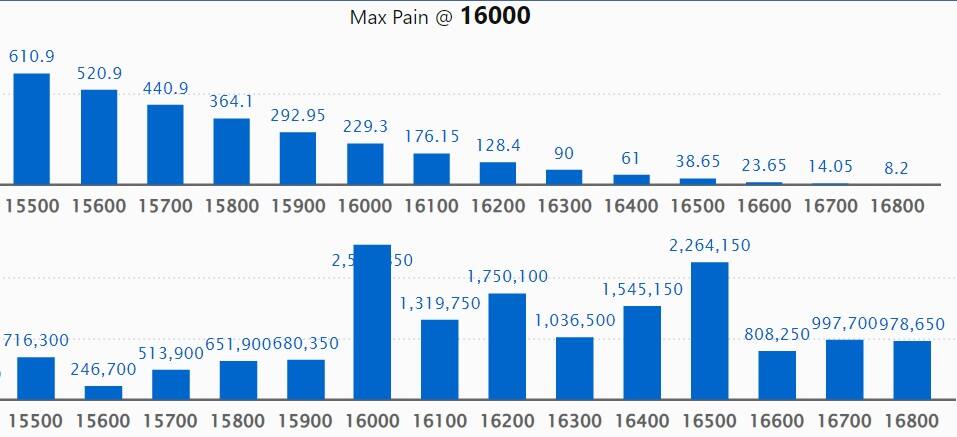

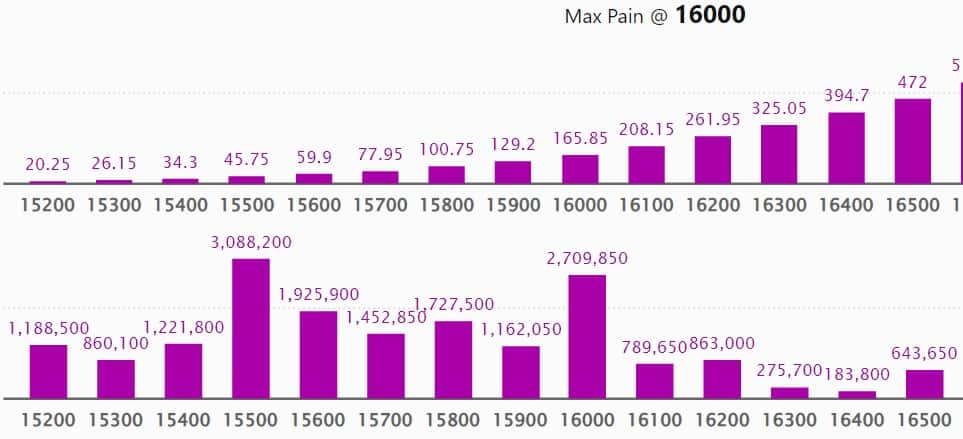

Maximum Call open interest of 25.48 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the July series.

This is followed by 17,000 strike, which holds 23.28 lakh contracts, and 16,500 strike, which has accumulated 22.64 lakh contracts.

Call writing was seen at 16,400 strike, which added 2.43 lakh contracts, followed by 16,000 strike which added 2.02 lakh contracts and 16,600 strike which added 1.69 lakh contracts.

Call unwinding was seen at 16,800 strike, which shed 1.12 lakh contracts, followed by 15,800 strike which shed 72,400 contracts and 16,100 strike which shed 55,500 contracts.

Maximum Put open interest of 30.88 lakh contracts was seen at 15,500 strike, which will act as a crucial support level in the July series.

This is followed by 15,000 strike, which holds 30.47 lakh contracts, and 16,000 strike, which has accumulated 27.09 lakh contracts.

Put writing was seen at 16,000 strike, which added 5.05 lakh contracts, followed by 15,600 strike, which added 3.77 lakh contracts and 15,800 strike which added 2.68 lakh contracts.

Put unwinding was seen at 15,100 strike, which shed 81,550 contracts, followed by 16,500 strike which shed 31,250 contracts, and 15,300 strike which shed 27,500 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Crompton Greaves Consumer Electricals, Asian Paints, HDFC, Hero MotoCorp, and Honeywell Automation, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Syngene International, Dalmia Bharat, Whirlpool, Federal Bank and Mahindra & Mahindra, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Bandhan Bank, Aditya Birla Fashion and Retail, PFC, ONGC, and Nippon Life India, in which long unwinding was seen.

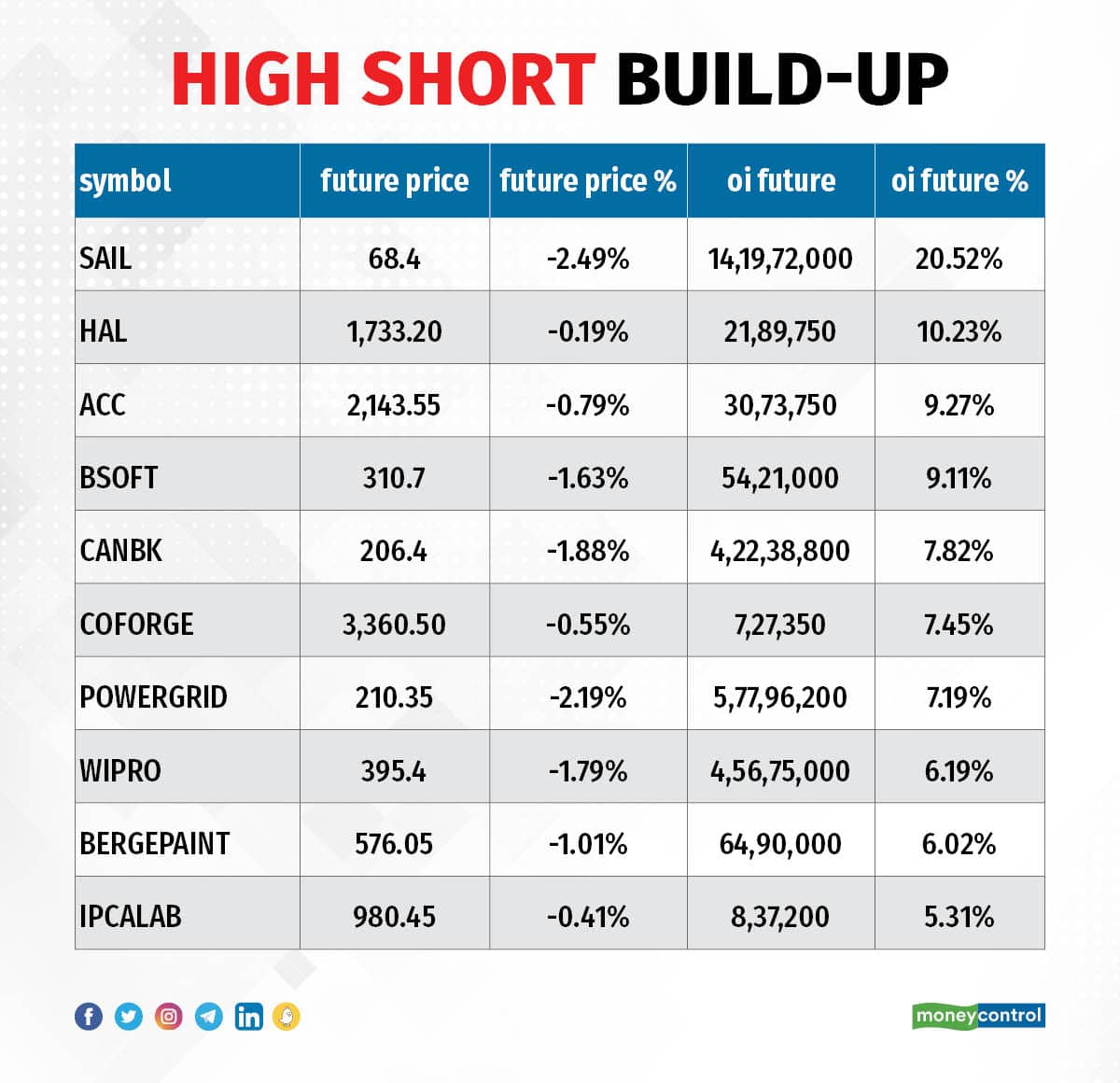

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including SAIL, Hindustan Aeronautics, ACC, Birlasoft, and Canara Bank, in which a short build-up was seen.

60 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including L&T Infotech, Kotak Mahindra Bank, HDFC, Cholamandalam Investment, and Coal India, in which short-covering was seen.

(For more bulk deals, click here)

HeidelbergCement India, Nelco, Bank of Maharashtra, Bhansali Engineering Polymers, Alok Industries, Ganesh Housing Corporation, Onward Technologies, Sudal Industries, Tanfac Industries will be in focus ahead of quarterly earnings on July 18.

Stocks in News

HDFC Bank: The country's largest private sector lender reported a 19% year-on-year growth in standalone profit at Rs 9,196 crore for the quarter ended June 2022, led by fall in provisions for bad loans. Net interest income rose 14 percent YoY to Rs 19,481.4 crore, driven by loan growth of 22.5 percent and deposits increase of 19.2%. Pre-provision operating profit increased 14.7 percent YoY to Rs 15,367.8 crore during the quarter.

Bharat Electronics: The state-owned defence company clocked a 1,401 percent year-on-year growth in consolidated profit at Rs 366.33 crore for the quarter ended June 2022, driven by strong operating income. The base was low in year-ago quarter due to second Covid wave. Revenue in Q1 grew by 90.5 percent to Rs 3,140.6 crore compared to corresponding period last fiscal.

ICICI Prudential Life Insurance Company: The insurance company swung to a standalone profit of Rs 155.7 crore in quarter ended June 2022, against loss of Rs 185.73 crore in same period last year. Net premium income grew by 4.3 percent to Rs 6,884.2 crore compared to same period last year.

Just Dial: The company posted a wider net loss of Rs 48.3 crore for the quarter ended June 2022, against loss of Rs 3.5 crore in same period last year, driven by other income which stood at Rs (-60) crore for the quarter due to mark-to-market (MTM) losses on treasury portfolio owing to significant increase in bond yields (135-150 bps QoQ for 2-3 year AAA bonds) during the quarter. Operating revenue at Rs 185.6 crore grew by 12.2 percent YoY in Q1FY23.

Oberoi Realty: The Mumbai-based real estate company reported a five-fold year-on-year increase in Q1FY23 profit at Rs 403.48 crore as against Rs 80.81 crore in same period last year. Revenue tripled to Rs 934.81 crore from Rs 294.77 crore during the same period, and EBITDA surged nearly four-fold to Rs 513.87 crore from Rs 135.39 crore in the same period.

Jindal Steel & Power: The steelmaker reported 23 percent year-on-year decline in Q1FY23 adjusted profit at Rs 1,929 crore on lower operating profit, partially offset by lower finance costs. Funds from JPL divestment further strengthened company's balance sheet with consolidated net debt declining further by Rs 1,149 crore in Q1FY23 to end the quarter at Rs 7,727 crore. Consolidated gross revenues increased 26 percent YoY to Rs 14,738 crore during the quarter. The numbers adjusted for one-off forex gain of Rs 446 crore.

Medplus Health Services: The company has incorporated a wholly-owned subsidiary namely, MedPlus Insurance Brokers. The subsidiary will carry on the business of direct insurance broking business in life and general insurance, and all kinds of guarantee and indemnity business.

Den Networks: The digital cable TV service provider reported a 69 percent year-on-year decline in consolidated profit at Rs 12.71 crore in the quarter ended June 2022, dented by lower revenue and weak operating performance. Revenue fell 6.5 percent YoY to Rs 283.36 crore in Q1FY23.

L&T Technology Services: The engineering services company clocked a 27 percent year-on-year growth in Q1FY23 profit at Rs 274 crore, while revenue grew by 23 percent YoY to Rs 1,874 crore during the quarter. The revenue in dollar terms increased 20 percent YoY to $239.5 million and topline in constant currency grew 20 percent YoY. During the quarter, LTTS won a $50 million plus deal.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 1,649.36 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 1,059.46 crore on July 15, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Delta Corp - remained under the NSE F&O ban list for July 18 as well. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.