The Nifty 50 reversed some of Friday's gains and closed 0.6 percent lower on June 23. The index remained within the previous day's range, indicating indecision among bulls and bears, and suggesting consolidation. In the upcoming sessions, the index is expected to remain in the range of 24,800–25,100 until it gives a decisive close on either side. Above 25,100, the level to watch is 25,200, as sustaining above it could open the door for a bullish trend. However, below 24,800, the immediate support is at 24,700, and a break below this level could drag the index toward 24,500, according to experts.

1) Key Levels For The Nifty 50 (24,972)

Resistance based on pivot points: 25,040, 25,095, and 25,183

Support based on pivot points: 24,863, 24,808, and 24,719

Special Formation: The Nifty 50 formed a small bullish candle with long upper and lower shadows, resembling a high wave candlestick pattern on the daily charts—indicating volatility and indecision among buyers and sellers. Trading volume was significantly lower than the previous day's trade, while the index remained above short-term moving averages and the midline of the Bollinger Bands, which is considered a positive sign. The Relative Strength Index (RSI) at 55.07 remained sideways, while the Stochastic RSI maintained a positive crossover.

2) Key Levels For The Bank Nifty (56,059)

Resistance based on pivot points: 56,198, 56,305, and 56,478

Support based on pivot points: 55,850, 55,743, and 55,570

Resistance based on Fibonacci retracement: 56,643, 57,056

Support based on Fibonacci retracement: 55,600, 55,402

Special Formation: The Bank Nifty also traded within Friday's range, closing 194 points lower and forming a bullish candle with an upper shadow on the daily charts, accompanied by lower volume. The index showed signs of indecision but stayed above short-term moving averages due to intraday recovery. The RSI at 55.31 showed sideways movement, while the Stochastic RSI continued its positive crossover for another session.

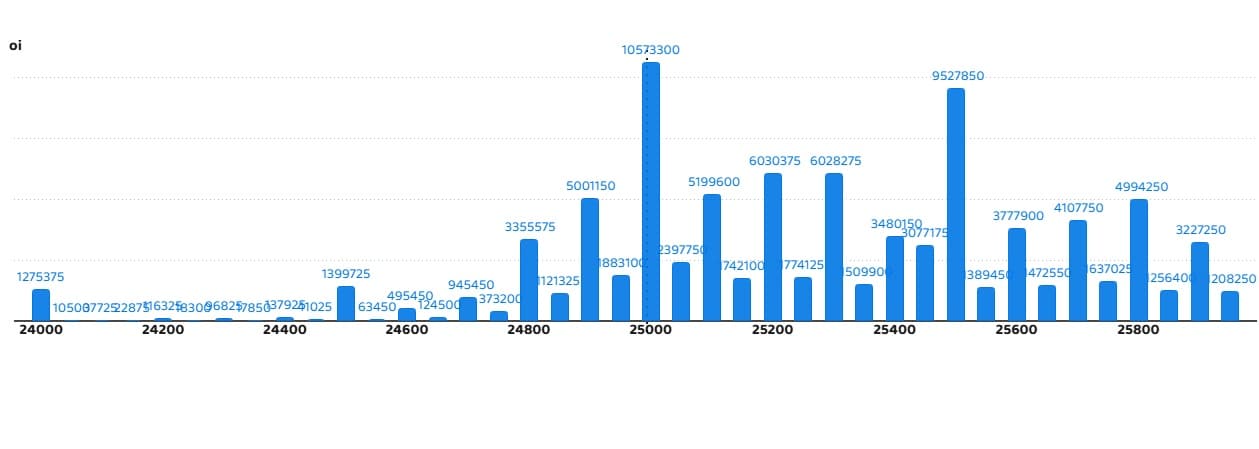

According to the monthly options data, the 25,000 strike holds the maximum Call open interest (with 1.05 crore contracts). This level can act as a key resistance for the Nifty in the short term. It was followed by the 25,500 strike (95.27 lakh contracts), and the 25,200 strike (60.3 lakh contracts).

Maximum Call writing was observed at the 25,000 strike, which saw an addition of 24.31 lakh contracts, followed by the 24,900 and 25,450 strikes, which added 17.9 lakh and 16.63 lakh contracts, respectively. The maximum Call unwinding was seen at the 25,400 strike, which shed 13.88 lakh contracts, followed by the 25,600 and 24,500 strikes, which shed 3.87 lakh and 2.08 lakh contracts, respectively.

On the Put side, the maximum Put open interest was seen at the 24,000 strike (with 1.07 crore contracts), which can act as a key support level for the Nifty. It was followed by the 25,000 strike (94.52 lakh contracts) and the 24,900 strike (81.53 lakh contracts).

The maximum Put writing was placed at the 24,900 strike, which saw an addition of 19.54 lakh contracts, followed by the 24,600 and 24,000 strikes, which added 18.35 lakh and 9.92 lakh contracts, respectively. The maximum Put unwinding was seen at the 25,100 strike, which shed 10.96 lakh contracts, followed by the 24,800 and 25,200 strikes which shed 7.44 lakh and 4.64 lakh contracts, respectively.

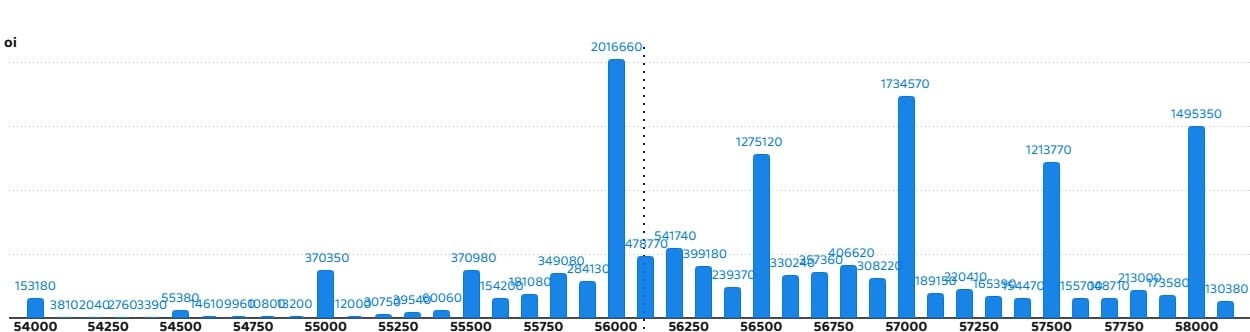

5) Bank Nifty Call Options Data

According to the monthly options data, the maximum Call open interest was seen at the 56,000 strike, with 20.16 lakh contracts. This can act as a key decision level for the index in the short term. It was followed by the 57,000 strike (17.34 lakh contracts) and the 58,000 strike (14.95 lakh contracts).

Maximum Call writing was visible at the 57,000 strike (with the addition of 1.84 lakh contracts), followed by the 57,500 strike (1.81 lakh contracts), and the 56,100 strike (1.79 lakh contracts). The maximum Call unwinding was seen at the 56,000 strike, which shed 1.73 lakh contracts, followed by the 55,500 and 56,500 strikes, which shed 84,420 and 56,340 contracts, respectively.

6) Bank Nifty Put Options Data

On the Put side, the 56,000 strike holds the maximum Put open interest (with 21.16 lakh contracts), which can act as a key decision level for the index. This was followed by the 55,000 strike (14.49 lakh contracts) and the 55,500 strike (10.12 lakh contracts).

The maximum Put writing was observed at the 55,900 strike (which added 1.25 lakh contracts), followed by the 55,300 strike (75,150 contracts) and the 55,800 strike (30,600 contracts). The maximum Put unwinding was seen at the 56,000 strike, which shed 1.93 lakh contracts, followed by the 55,000 and 55,500 strikes, which shed 1.92 lakh and 90,720 contracts, respectively.

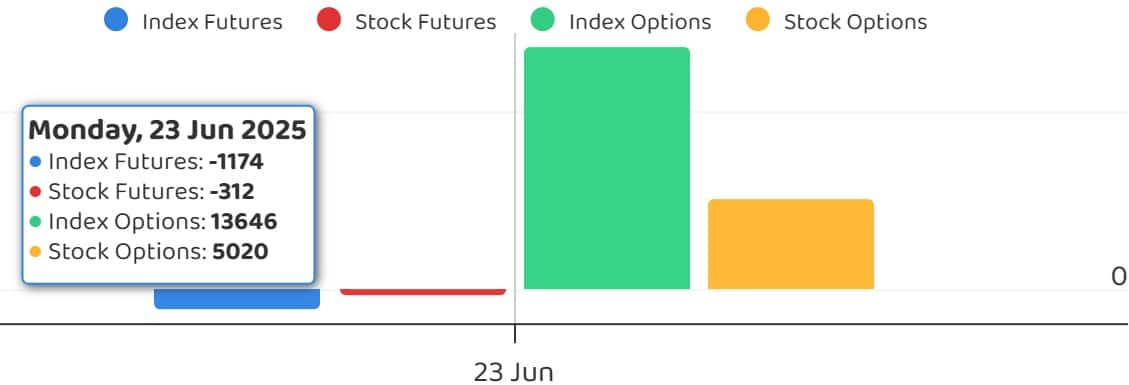

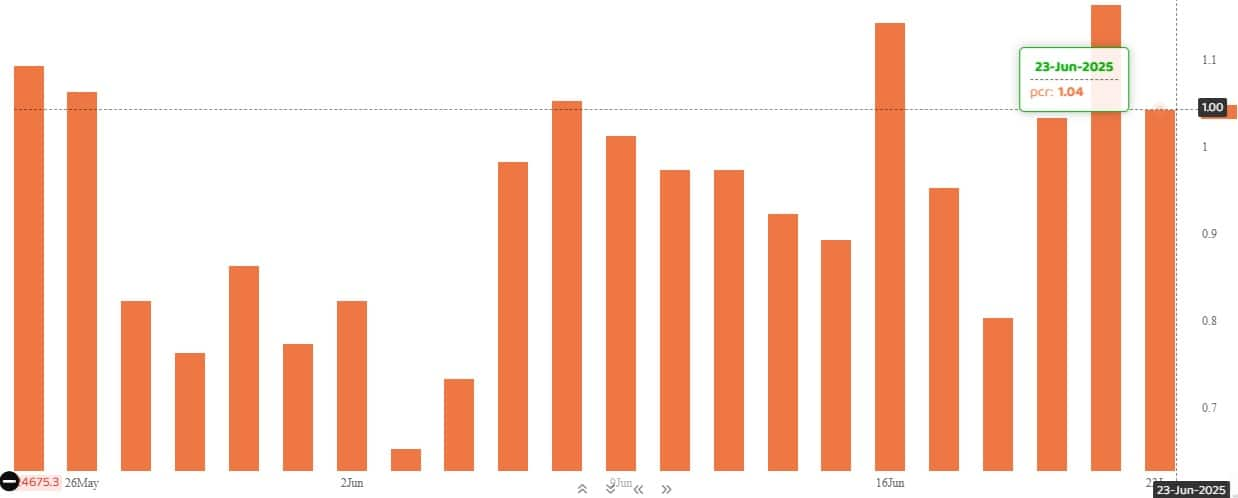

The Nifty Put-Call ratio (PCR), which indicates the mood of the market, dropped to 1.04 on June 23, compared to 1.16 in the previous session.

The increasing PCR, or being higher than 0.7 or surpassing 1, means traders are selling more Put options than Call options, which generally indicates the firming up of a bullish sentiment in the market. If the ratio falls below 0.7 or moves towards 0.5, then it indicates selling in Calls is higher than selling in Puts, reflecting a bearish mood in the market.

9) India VIX

The fear index, India VIX, snapped a five-day downtrend and finished at 14.05 levels, up 2.74 percent. However, it remained below the 15 mark, which is considered supportive for the bulls.

A long build-up was seen in 68 stocks. An increase in open interest (OI) and price indicates a build-up of long positions.

11) Long Unwinding (28 Stocks)

28 stocks saw a decline in open interest (OI) along with a fall in price, indicating long unwinding.

12) Short Build-up (67 Stocks)

67 stocks saw an increase in OI along with a fall in price, indicating a build-up of short positions.

13) Short-Covering (61 Stocks)

61 stocks saw short-covering, meaning a decrease in OI, along with a price increase.

Here are the stocks that saw a high share of delivery trades. A high share of delivery reflects investing (as opposed to trading) interest in a stock.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Stocks added to F&O ban: Nil

Stocks retained in F&O ban: Biocon, RBL Bank

Stocks removed from F&O ban: Aditya Birla Fashion and Retail, Titagarh Rail Systems

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.