Equity market benchmarks ended lower on December 5 after the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) maintained status-quo on rates as against a widely-anticipated 25 basis points (bps) rate cut.

The BSE Sensex fell 70 points to 40,780 while the Nifty 50 closed 25 points lower at 12,018.

Market experts expect the consolidation to extend and advise traders to continue with a stock-specific trading approach. "We suggest preferring index majors and keeping positions on both sides. Also, maintain a close watch on global markets for cues," said Ajit Mishra, VP - Research, Religare Broking.

Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in, told Moneycontrol if Nifty manages to sustain above 12,081 in the next trading session then the upswing can get extended up to 12,113, whereas on the downsides, the breach of 11,998 can drag the index down towards 11,950.

We have collated 14 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 11,984.4, followed by 11,950.4. If the index moves up, key resistance levels to watch out for are 12,066.8 and 12,115.2.

Nifty Bank

Nifty Bank closed 0.83 percent down at 31,712.95. The important pivot level, which will act as crucial support for the index, is placed at 31,518.5, followed by 31,324.1. On the upside, key resistance levels are placed at 32,017.1 and 32,321.3.

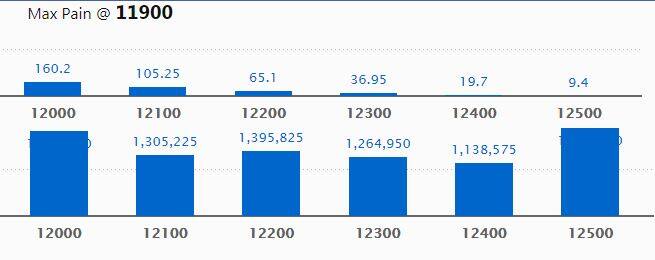

Call options data

Maximum call open interest (OI) of 18.66 lakh contracts was seen at the 12,500 strike price. It will act as a crucial resistance level in the December series.

This is followed by 12,000 strike price, which holds 18.2 lakh contracts in open interest, and 12,200, which has accumulated 13.96 lakh contracts in open interest.

Significant call writing was seen at the 12,200 strike price, which added 1.83 lakh contracts, followed by 12,400 strike price that added 77,925 contracts and 12,100 strike which added 59,775 contracts.

Call unwinding was witnessed at 11,900 strike price, which shed 7,425 contracts, followed by 12,500 which shed 4,950 contracts.

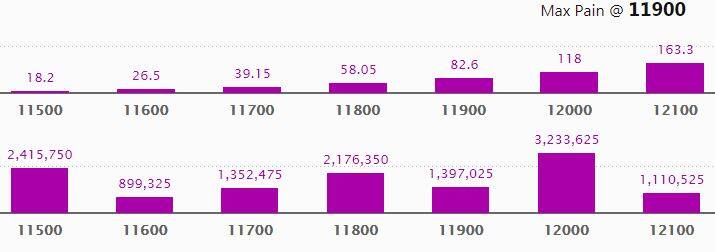

Put options data

Maximum put open interest of 32.34 lakh contracts was seen at 12,000 strike price, which will act as crucial support in the December series.

This is followed by 11,500 strike price, which holds 24.16 lakh contracts in open interest, and 11,800 strike price, which has accumulated 21.76 lakh contracts in open interest.

Put writing was seen at the 11,800 strike price, which added nearly 2.65 lakh contracts, followed by 11,900 strike, which added 1.13 lakh contracts.

Minor put unwinding was seen at 12,500 strike price, which shed 975 contracts.

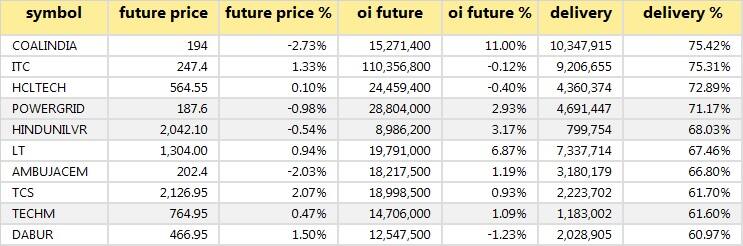

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

29 stocks saw long buildup

Based on open interest (OI) future percentage, here are the top 10 stocks in which long buildup was seen.

22 stocks saw long unwinding

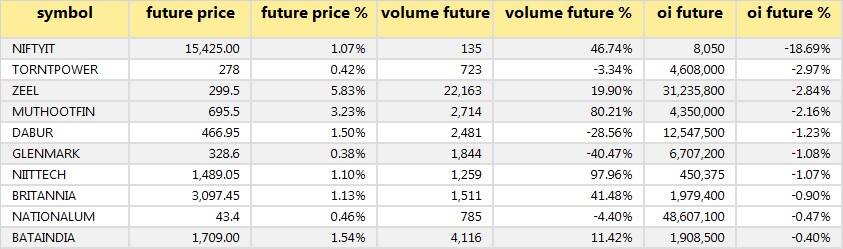

Based on open interest (OI) future percentage, here are the top 10 stocks in which long unwinding was seen.

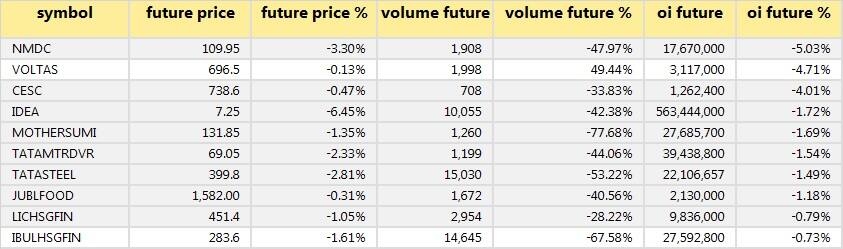

84 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

14 stocks witnessed short-covering

As per available data, 14 stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering. Based on open interest (OI) future percentage, here are the top 10 stocks in which short- covering was seen.

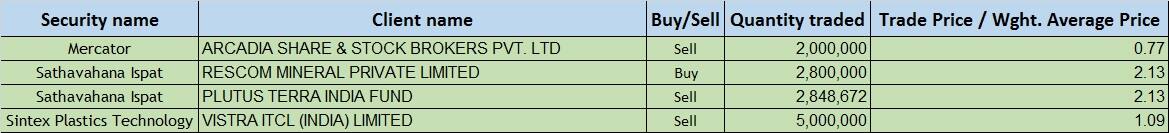

Bulk deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

The board of ABans Enterprises will meet on December 6 to consider and approve the interim dividend.

The respective boards of United Credit, Rolta India, Ekam Leasing & Finance Company and Centrum Capital will meet on December 6 to consider and approve their quarterly results.

The respective boards of Cosboard Industries, IRB Infrastructure and Punjab & Sind Bank will meet on December 6 for general purposes.

The board of SSPN Finance will meet on December 6 to consider and approve the declaration of bonus equity shares issue of the company.

Stocks in the news

Yes Bank: Moody's downgraded bank's ratings and assigned negative outlook.

Allcargo Logistics: The company will buy 1.04 crore shares of Gati at Rs 75 per share and to make an open offer for 26 percent Gati stake at Rs 75 per share.

Bank of Baroda: Board approved raising up to Rs 1,850 crore in Tier-I bonds.

Tata Motors: JLR November UK sales fell to 8,199 units against 9,055 units YoY.

Mahindra & Mahindra: The company acquired 36.63 percent of the equity share capital of Meru in the first tranche of investment.

FII and DII data

Foreign institutional investors (FIIs) bought shares of worth Rs 653.36 crore, while domestic institutional investors (DIIs) sold shares of worth Rs 410.49 crore in the Indian equity market on December 5, provisional data available on the NSE showed.

Fund flow

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!