After making a lifetime high of 12,108.80 in December 2018, Nifty Auto has been in correction phase. The index has already retraced 33 percent from its peak and has made a probable bottom at 8,035 in February 2019.

The index has also made a positive divergence in Stochastic on the monthly chart. Therefore, some up move is expected from the current level in this sector.

"So we recommend traders and investors to start their investments in the auto sector," said Narnolia Financial Advisors.

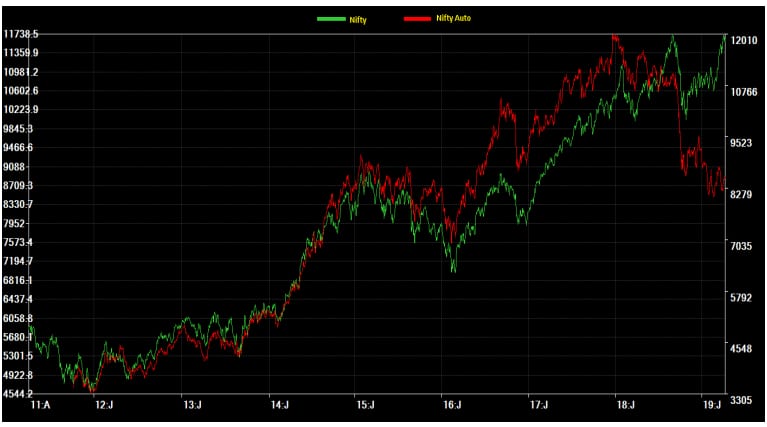

Narnolia charted out Nifty and Nifty Auto's performance since the inception of the index. The comparative study shows that Nifty Auto moved in line with the benchmark index from the year 2011 to mid-2014.

It outperformed Nifty from mid-2014 to mid-2018 and thereafter it has been continuously underperforming the benchmark Nifty.

Currently, the performance gap between the two indices has increased sharply. So, it is expected that Nifty Auto will converge towards Nifty very soon, said the report.

Here are 4 auto stocks picked by Narnolia Financial Advisors that can give double-digit returns in 6-12 months:

Tata Motors: Buy at Rs 205 & 190 | Target 1 - Rs 230, Target 2 - Rs 274| Stop Loss: Rs 164| Upside 34%

The stock gave a price-volume breakout above Rs 200 and thereafter it is successively keeping above this level since last few trading days. There is no major supply area of the stock below Rs 274. So, the current demand is likely to lift the stock smoothly to higher level.

TVS Motor: Buy at Rs 482 & Rs 450| Target: 1 - Rs 534, Target 2 - Rs 598 | Stop Loss: Rs 415 | Upside: 24%

The stock has made an 'Inverted Hammer' pattern after downtrend recorded on the monthly chart. This is a strong reversal pattern.

Apart from this, the formation of positive divergence on Stochastic is indicating some short-term pullback from the current level. Therefore, we recommend initiating a fresh long position in the stock for trading as well as for short-term investment.

Ashok Leyland: Buy around: Rs 91 & Rs 89 | Target: 1- Rs 98, Target 2 -Rs 109| Stop Loss: Rs 83| Upside: 20%

The stock has given a good reversal from its downtrend with decent volumes. The oversold position of RSI & Stochastic is giving an indication of some short-term up move in the stock from the current level.

Eicher Motors: Buy around: Rs 20,900 |Target: 1 - Rs 22,994, Target 2 - Rs 25,638 | Stop Loss: Rs 18,698 | Upside: 23%

The stock has made an 'Inverted Hammer' pattern after downtrend on the monthly chart. This is a strong reversal pattern. Formation of positive divergence on Stochastic is indicating some short-term pullback from the current level.

(Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.