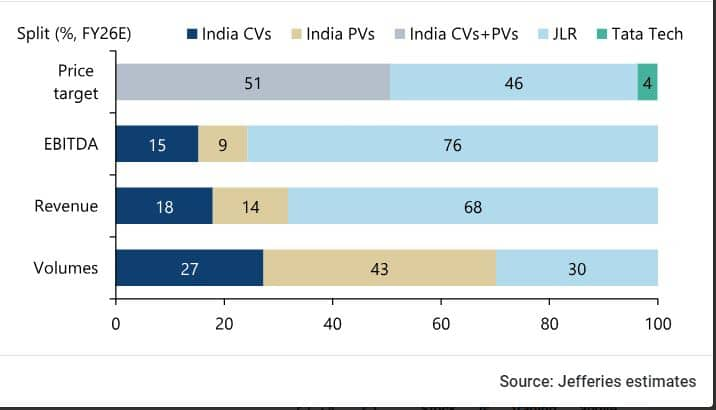

Tata Motors' India business was a big drag in the past decade but now forms 50 percent of the price target set by Jefferies for FY26, wrote the brokerage's analysts in their latest report.

The report came after the company made its presentation on India Investor Day, where the company shared its plans to raise its market share in passenger vehicles (PVs) and increase its non-vehicle revenues in commercial vehicles (CVs).

Also read: Tata Motors shares rise as brokerages reiterate bullish stance on growth prospects

Jefferies' price target is Rs 1,250 on EV/EBITDA estimates for FY26-or 28 percent above the current market price of Rs 989-of which Rs 263 is from India CVs and Rs 370 from India PVs (including electric vehicles) verticals. The remaining is from JLR (Rs 570) and value of Tata Technologies state (Rs 46).

The brokerage has valued the company's India CV business at 10x FY26E EV/EBITDA, India PV at 18x FY26E EV/EBITDA, JLR at 3.8x FY26E EV/EBITDA, the India EV business at Rs 70/sh (0.5x transaction value in stake sale to TPG) and value of the stake in Tata Technologies at Rs 46/sh (25 percent holco discount to market value).

Higher multiple

The analysts noted that, though the company's India business just contributes 25 percent of Ebitda, the vertical get "significantly" higher multiple.

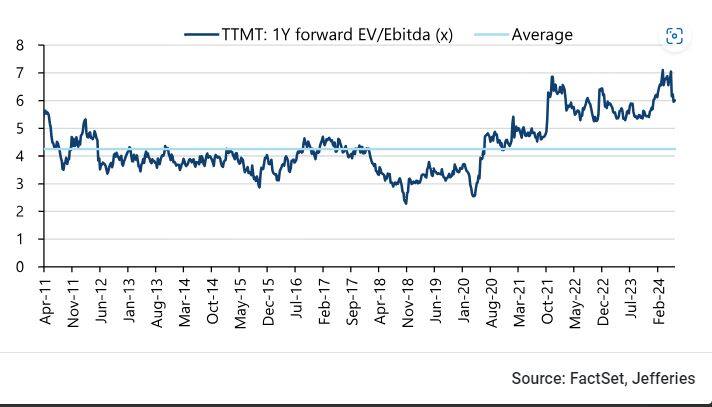

The stock, which is trading at 5.2x FY25 EV/EBITDA according to Jefferies' estimates, is trading above its historical average multiples but the analysts believe it is justified "given improved India PV franchise, strong business cycle at JLR and deleveraging".

The brokerage noted that, in PVs, Tata intends to increase its market share from 14 percent in FY24 to 16 percent in FY27 and 18-20 percent by FY30. In CVs, it intends to gradually increase its market share and deliver strong double-digit EBITDA margin.

To expand its PV business, the company plans to increase its addressable market as percentage of total industry volumes from 53 percent currently to 80 percent with new products. It also plans to launch a new mid-sized SUV Curvv and Harrier electric SUV in FY25, and another mid-sized SUV Sierra and Avinya EVs in FY26.

The report said, "Tata also intends to enhance its PV profitability with scale benefits, improving mix and optimization of cost & capex".

For its CV business, the company's key focus areas include "enhancing product portfolio, investing in alternate fuel technologies, raising share of non-vehicle revenues from early-to-mid-teens in FY24 to 20% in medium-term to reduce business volatility, and deploying digital business".

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.