William O'Neil India

Currently, the market is in a downtrend, as Nifty is trading near its six-month low. All sectoral indices are trading below their 50-DMA, indicating broad weakness.

The losses were higher in Nifty Midcap and Smallcap stocks, as they are down 30 percent and 46 percent from their all-time highs.

In such a scenario, it is advised to trim positions and stay in cash rather than making huge losses. The importance of taking small losses is emphasized in this article.

Highly successful stock pickers go through training on how to cut their losses short. This means selling a stock when it is down 7-8 percent of your purchase price.

Sounds simple, but many investors have learned the hard way how difficult it is to master the most important rule in investing.

No one wants to sell for a loss. It is an admission that you made a mistake. But, if you can set your ego aside, you can take a small loss and still be fit enough, both financially and mentally, to invest the next day.

Cutting losses quickly prevents you from suffering a devastating fall that's too steep to recover from.

The mathematics of investment losses:

Consider the math. Say you buy a stock at Rs 100. For whatever reason, it drops 8 percent to 92 during the next few days. You promptly unload it and move on.

To reclaim that loss, you need to make an 8.7% gain on your next purchase with your remaining capital, which shouldn't be hard to do.

What if you hold on?

You are sure that the stock will snap back. Your research convinces you that it's worth Rs 200, so why get scared by a minor setback?

There's one problem. The market doesn't care who you are, what you think or how much you believe in stock. It says you miscalculated, at least in the short term—a message that gets louder as the stock drops 25 percent to Rs 75.

To get back even, now you need a 33 percent gain, which is much tougher to come by than that easy 8.7 percent.

What if the market doesn't like your stock and slices it in half to Rs 50? You don't need a calculator for this one. Now, to recover a 50 percent loss, it requires a 100 percent gain. How many stocks did you pick last year that doubled in price?

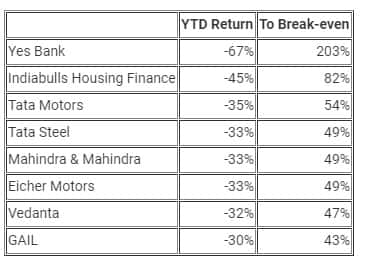

The following stocks in Nifty50 have fallen more than 30 percent in 2019:

The second column refers to the percentage gain required to break-even from the losses made.

If you limit losses on initial purchases to 7-8 percent, you can stay out of trouble, even if only 1 out of 4 buys delivers a modest profit of 25-30 percent. You can be wrong three out of every four times and still live to invest another day.

You can still win big with many small losses

Successful investors calmly take a small loss and look for the next potential winner.

So, leave your emotions behind. Cutting losses with discipline will help keep your head clear when it's time to return to the market.

A great paradox of investing is that the ripest buying opportunities occur just after bear markets — when the major stock averages have declined 20 percent or more.

That's exactly when most investors who haven't cut their losses are reeling and don't want to be hit again. It's hard to think straight after losing lakhs of rupees. But the market always recovers. What kind of shape will you be in?

Disclaimer: The views and investment tips expressed by research houses on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!