Stock prices in the United States are exhibiting odd behaviour by being on a downward trend despite Federal Reserve's intention to lower interest rates, remarked Yardeni Research in its recent Quick Takes.

Yardeni Research is a sell-side consultancy founded by noted economist and investment strategist Ed Yardeni.

A note co-authored by Yardeni said that the stock prices' behaviour can be attributed to the unwinding of the yen carry trade.

Carry trade is an investing strategy that involves borrowing money in a currency that has low interest-rates and investing that money in asset classes that offer higher returns. Interest rates in Japan have been negative for a long time and, in March 2024, the country's central bank announced its first rate hike in 17 years. It raised the rates from -0.1 percent to a range of 0 percent to 0.1 percent. In July, it raised it even further to 0.25 percent.

Also read: What is carry trade and how does Bank of Japan’s rate hike affect it?

The rate-hike announcements and probability of the rates remaining elevated for longer term have caused investors to unwind their positions built on the yen carry trade.

According to Yardeni Research's latest note, the current US stock market behaviour is from the continuing impact of the unwinding of this trade.

"Something doesn't make sense. Why are stock prices falling when the Fed is set to lower interest rates to avert a recession and to stop the unemployment rate from rising by boosting economic growth? We had a glimpse of the answer in early August: The carry trade is still unwinding," the note said.

"Expectations that the Fed will lower our interest rates, while the Bank of Japan raises their interest rates are boosting the yen and forcing traders to unwind their carry trades, which were executed when they borrowed yen at near-zero interest rates to buy assets with higher returns in other currencies, especially the Magnificent 7 and semiconductor stocks in the US," it added.

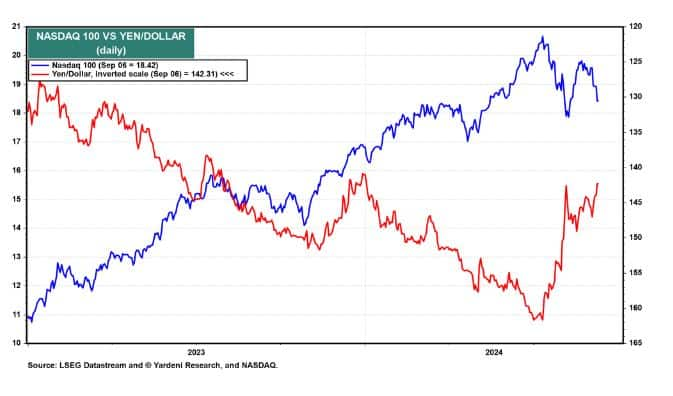

The note also pointed out that there has been a strong inverse correlation between the yen and the Nasdaq 100 since the start of 2023.

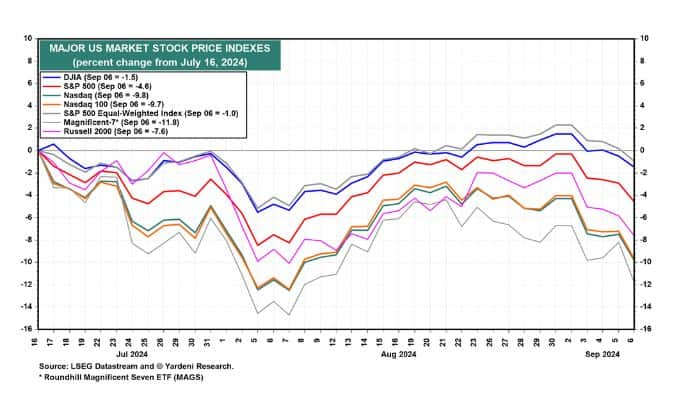

It further said that this was why stock prices with the most upside momentum have lost the most since S&P 500 peaked on July 16.

On September 3, the Bank of Japan Governor Kazuo Ueda reiterated the bank's stand of raising interest rates if the economy and prices perform as expected by the central bank.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.