Investors have been swiftly exiting small-cap stocks in recent days due to concerns about inflated valuations impacting their risk tolerance. Despite this, data indicated that equity-focused small-cap funds have only seen a moderate decline of up to six percent over the past week. Analysts caution that this downturn may not have reached its bottom yet and advise investors to remain cautious.

Hrishikesh Palve, Director, Anand Rathi Wealth, expects temporary outflows from certain funds with weaker stress results in the coming days.

Valuation-wise, majority of smallcap and midcap stocks are still trading quite expensive, especially in the context of their business models and their own history, said analysts at Kotak Institutional Equities. They remain watchful of investing behaviour trends of retail investors as a result of recent correction and cautionary statements of the regulator.

"The mid-and small-cap funds of domestic institutional investors had become ‘passive’ conduits for ‘active’ non-institutional investors who were probably more focused on momentum and narratives than fundamentals and numbers. We are not sure if the correction marks a reversal of the market to fundamentals and numbers from sentiment and narratives. If it is the former, many low-quality stocks may still have a long way to fall," they said.

ALSO READ: Experts line up top 10 bets for next 3-4 weeks as Nifty hints at range-bound movement

Smallcap funds yearly gains override recent correction; are we at the bottom yet?In the last month, the Nifty Smallcap 100 index has dropped by over nine percent, contrasting with the relatively stable or positive movement of the benchmark Nifty 50. However, this correction is minor compared to the significant gains of the previous year, where the Nifty Smallcap 100 index surged by 58 percent.

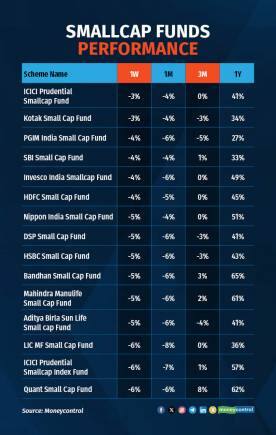

Specific to smallcap funds, LIC Small Cap Fund was the worst performer in the past one month as it declined over 8 percent followed by ICICI Small Cap Fund and BNP Paribas Small Cap Fund that slipped over seven percent each, Moneycontrol data showed.

Despite this recent correction, all smallcap funds continued to give positive returns on an annual basis. Bandhan Small Cap Fund was the top performer as it gave over 64 percent returns in the past one year, followed by Quant Small Cap Fund with 62 percent returns, and Mahindra Manulife Smallcap Fund with 61 percent returns.

ALSO READ: Keep your portfolio in green even when market turns red: Here's a blueprint from experts

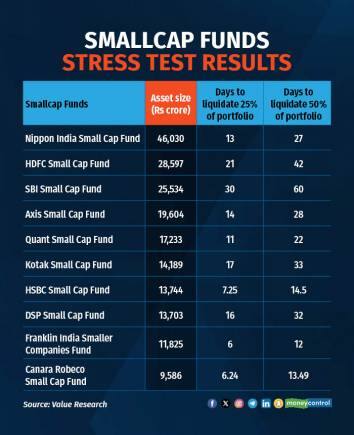

As per market regulator Sebi's directions, mutual fund houses shared their liquidity stress test results on midcap and smallcap funds to meet sudden market redemptions.

Among the leading funds, Nippon Small Cap Fund, which is the largest smallcap fund by AUM (Rs 46,044 crore), said that they will take 27 days to sell 50 percent of their portfolio. On the other hand, HDFC Small Cap Fund would take atleast 42 days to divest 50 percent of its portfolio, and SVI Mutual Fund said it would take 60 days for the same.

Going ahead, analysts on a consensus advised investors to adopt a 'wait-and-watch' strategy as midcap and smallcap stocks witness volatility. At this time, VK Vijayakumar, Chief Investment Strategist of Geojit Financial Services recommended investors to buy largecaps in capital goods, banking, telecom and automobiles on dips.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.