The Indian market rallied over 20 percent so far in 2017 largely on account of fund flows from domestic and global investors, but there was one thing which went missing and that was earnings recovery.

The June quarter earnings story does not offer confidence and the whole bull market scenario looks a bit shaky at current levels, given the fact that benchmark indices are already trading above their long-term averages.

Given the current slowdown in industrial activity and credit growth, it would be naïve to expect sustained earnings recovery will revive in the short-term, suggest experts. The market is unlikely to see any significant upside in the rest of 2017 in absence of any big triggers.

One factor which is supporting the market at current levels is domestic funds. The assets under management of MF are already hovering near Rs 20 lakh crore mark. If the domestic funds stop pouring money, the decline could be much worse for Indian markets.

“If the tide goes out and domestics investors stop being net buyers, I think the market is quite vulnerable at these levels. What we require the market to be in places is flows to be there and more importantly, we need to see evidence that economy is doing better,” Adrian Mowat, MD & Chief Asian, and Emerging Market Equity Strategist at JPMorgan told CNBC-TV18.

“If earnings fail to pick up, domestic flows weaken then the decline could be deeper as valuation appear stretched. We are neutral on India as it appears to be an expensive market. I am concerned about India’s relative earning revisions as emerging markets have upgrades while India saw earnings downgrade,” he said.

Mowat further added that India is expensive with earnings downgrade. The forward PE is around 17x MSCI India and the forecast is 20% growth. We are not underweight on India just because there is strong flows of domestic funds coming into markets.

The global earnings revision picture, especially in the developed world, appears relatively better which gives analysts some confidence that India should catch up on upward earnings revision but with a lag.

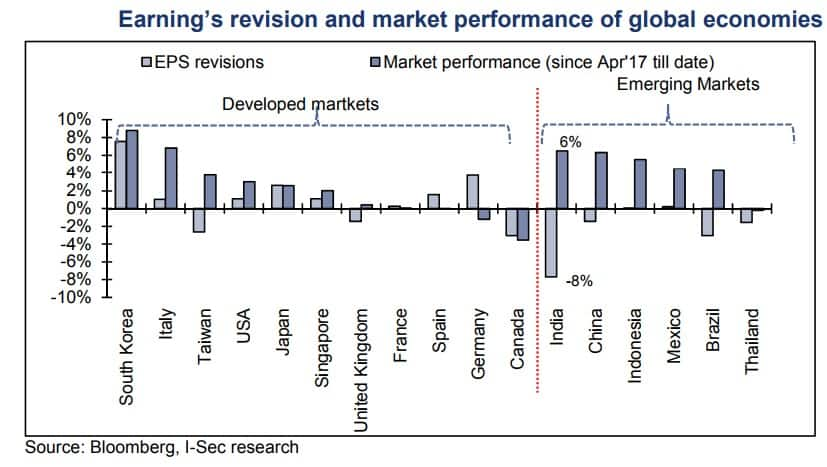

“India stands out as the country with highest one-year forward earnings downgrade at 8 percent so far in FY18 amongst global peers,” ICICI Securities said in a report.

“Ironically, India has been the best performing emerging market (6% FYTD) during the same period which further validates our thesis that investor focus has shifted from near-term worries to longer-term optimism while continued institutional flows support equity markets,” it said.

For Nifty, ICICI Securities expect 16 percent earnings CAGR over FY17-20 ( the bulk of the high growth coming towards the back-end), building in further earnings downgrades for FY18 and FY19. Our a one year forward target for Nifty stands at 10,500 based on Sep 2019 EPS of 610 and target multiple of 17.2x (+ 0.5 standard deviation of LTA).

Among Nifty stocks, pace of downgrade reduced from 32 stocks in Q4FY17 to 29 stocks in Q1FY18. Sectors which saw maximum downgrades were healthcare, IT, auto and energy.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.