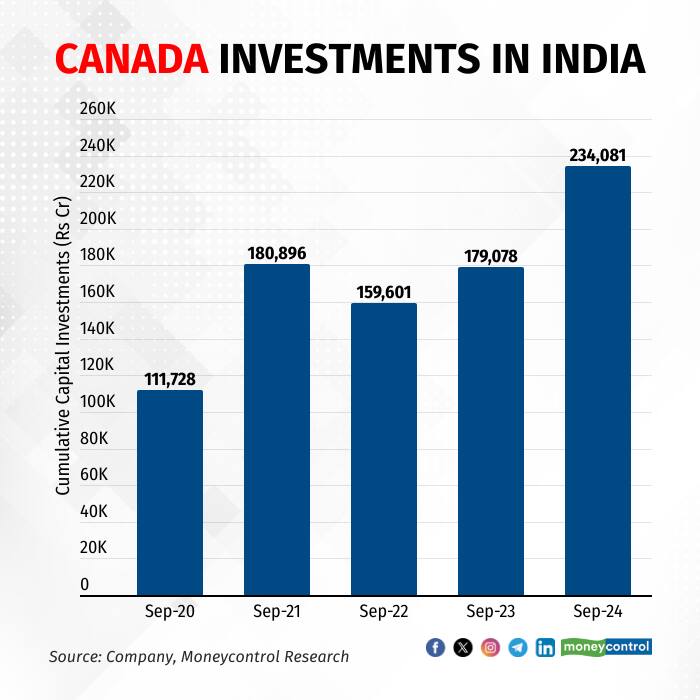

Canada's big-money investments in India are holding strong, even as political ties between the two nations hit an all-time low. Despite the tense diplomatic standoff, Canadian investments in India have surprisingly grown, with Canadian holdings in Indian equities nearing Rs 2 lakh crore as of September 2024.

The spark that ignited this fire came in September 2023 when Canadian Prime Minister Justin Trudeau alleged that Indian agents were linked to the assassination of Sikh leader Hardeep Singh Nijjar on Canadian soil. The rift deepened when India expelled six Canadian diplomats, including the acting High Commissioner on October 14, just hours after recalling its own diplomats from Canada.

With this once-cordial relationship strained, the big question on everyone's mind is: will this steady flow of investments continue, or will Canadian investors begin to pull out, denting India's access to foreign capital in key sectors?

According to data from NSDL, Canadian investors seem undeterred and are still pouring money into Indian markets.

A report by the Asia Pacific Foundation in May titled 'Canadian Pension Fund Investments in the Asia Pacific' showed that Canadian pension funds are picking safe and stable assets for their investments in India. "Real estate, industrial transportation, and financial services—often considered to be stable assets—accounted for around 60 percent of Canadian pension fund investment flows in India from 2008-23," the report said. It's a long-term strategy—one that could face challenges if diplomatic ties worsen, but for now, Canadian investors have stayed the course in India.

Moneycontrol reported that despite strained relations, Canada's capital inflows to India are expected to remain steady—so long as politics doesn't interfere with economics.

Rallis India (Rs 368, +14%)

Shares surged after the company reported all-round growth on key parameters of revenue, profit and profitability in Q2.

Bull Case: Q2 showcased green shoots of recovery for chemical players, suggesting a comeback in domestic demand which can improve earnings growth. Plans to turn aggressive in the crop nutrition business, targeting double-digit growth can lift earnings if successful.

Bear Case: Company has had a history of generating hope as regards a turnaround which, at times, has been met with disappointments, notes Elara Capital. Hence, execution of guidance and the new management's ability to achieve its target will remain crucial for better stock price action.

Also Read | How Justin Trudeau's domestic political agenda could be driving a wedge between India and Canada

BSE (Rs 4,495, -5.4%)

Jefferies downgrades BSE to 'underperform'

Bull Case: The new F&O norms released by SEBI turned out to be more lenient-than-expected. Experts suggest the new norms will be worse for BSE’s competitor, the NSE and that BSE is poised to benefit. Additionally, the listing of NSE will hike BSE's market share.

Bear Case: The recent run-up in BSE shares is fueled by expectations of market share gains; the stock has risen over 100 percent, more than doubling, since the release of SEBI's new F&O framework, to a PE of 40x FY26. However, to Jefferies, the valuation seems stretched and fails to capture the risks from the higher impact of the F&O framework on the overall market. Investors might be over-optimistic with their assumption of large market-share gains, added the brokerage.

Bharti Airtel (Rs 1,734, +1%)

Shares rose after HSBC upgraded the counter to buy from hold.

Bull Case: Airtel’s EBITDA/EPS could rise at a compound annual growth rate (CAGR) of 16%/ 78% respectively over FY24-27e driven by an increase in mobile average revenue per user (ARPU), robust growth in broadband subs and margin expansion.

Bear Case: Price wars or aggressive pricing strategies by competitors could pressure Airtel's market share and margins, affecting its growth potential.

(With inputs from Vaibhavi Ranjan, Zoya Springwala, and Veer Sharma)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.