November 02, 2022 / 16:10 IST

Ajit Mishra, VP - Research, Religare Broking

Markets traded dull and ended marginally lower, taking a breather after the recent surge. After the flat start, profit taking pushed the index gradually lower however marginal rebound in the final hours trimmed losses. Consequently, the Nifty index settled at 18,075; down by 0.38%.

Most sectoral indices traded in tandem with the benchmark and ended with a marginal cut. Meanwhile, movement on the stock-specific front kept participants busy till the end.

Markets will react to the outcome of the US Fed meet in early trades and then the focus would shift to the MPC’s special meet. The outcome of these events could trigger some volatility but the market tone is likely to remain positive. We thus recommend focusing more on accumulating quality stocks on dips.

November 02, 2022 / 16:07 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty opened gap up on November 02 however couldn’t build upon the early gains. The bulls took a breather today after stretching their arms recently. On the daily chart, the index has formed a bearish outside bar along with an Engulfing bear candle. This makes today’s high of 18178 a key resistance.

The hourly chart also shows that weakness is creeping in again.

Going ahead, 18000 will be the make or break level to watch out for. The short term trajectory can remain positive as long as the Nifty sustains above 18000. On the flip side, breach of 18000 on a closing basis will drag the index in consolidation mode.

November 02, 2022 / 16:03 IST

Vinod Nair, Head of Research at Geojit Financial Services.

With the FOMC's outcome around the corner, profit booking and a risk-off mood dragged the domestic market to trade with cuts.

Meanwhile, strong US employment figures dented expectations for a slowdown in rate hikes. Since the market has already priced in a 75 bps rate hike by the Fed, market movement will be determined by their comments on its next moves.

November 02, 2022 / 15:45 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

After having rallied sharply over the past week or so, markets finally took a breather ahead of the Fed's decision on policy rate hike.

Traders preferred to book some profit in selective counters to avoid being caught off guard on worries of a sharp correction worldwide in case the rate hike is above the expectation and the Fed maintains a hawkish stance.

Technically, on daily charts the Nifty has formed a small bearish candle with double top formation on intraday charts. For the index, 18,000 and 17,950 would act as key support zones, while 18,200-18,250 would be the immediate hurdle.

November 02, 2022 / 15:35 IST

Market Close

: Indian benchmark indices snapped four-day winning streak and ended lower with Nifty below 18100.

At Close, the Sensex was down 215.26 points or 0.35% at 60,906.09, and the Nifty was down 62.60 points or 0.34% at 18,082.80. About 1752 shares have advanced, 1615 shares declined, and 135 shares are unchanged.

Bharti Airtel, Apollo Hospitals, Maruti Suzuki, Eicher Motors and Britannia Industries were among the top Nifty losers, while gainers included Hindalco Industries, Sun Pharma, ITC, ONGC and Tech Mahindra.

On the sectoral front, selling was seen in the Auto, Bank, Capital Goods, Information Technology, PSU Bank, Power and Realty names. On the other hand, Metal and Pharma indices ended on positive note.

The BSE midcap index ended flat, while smallcap index was up 0.2 percent.

November 02, 2022 / 15:33 IST

Rupee Close:

Indian rupee closed lower at 82.78 per dollar against previous close of 82.70.

November 02, 2022 / 15:26 IST

Adani Transmission Q2 results:

Adani Transmission has posted 24 percent fall in its Q2 net profit at Rs 206.2 crore versus Rs 272.5 crore and revenue was up 32.6% at Rs 3,251.4 crore versus Rs 2,451.4 crore, YoY.

Adani Transmission was quoting at Rs 3,300.00, down Rs 37.45, or 1.12 percent.

November 02, 2022 / 15:25 IST

Cabinet approves mechanism for procurement of Ethanol by public sector OMCs and also approve under ethanol blended petrol programme for Ethanol supply year 2022-23, reported CNBC-TV18.

November 02, 2022 / 15:22 IST

DCX Systems IPO subscribed 62 times on final day

The public issue of defence system integration company DCX Systems has received overwhelming response across all categories of investors as increasing government focus on defence, decent financials and healthy orderbook, reasonable valuations, and positive equity environment inspired markets.

Investors bid for 89.47 crore shares against offer size of 1.45 crore, subscribing the initial public offering (IPO) 61.66 times on November 2, the final day of bidding.

Retail investors have remained at the forefront since day one, buying their quota 54.52 times.

Non-institutional investors have also remained active since first day of IPO, subscribing their portion 39.47 times while the quota for qualified institutional buyers was bought 74.23 times.

November 02, 2022 / 15:21 IST

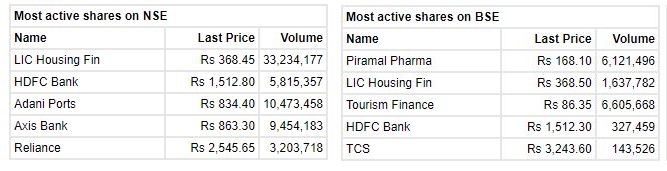

Morgan Stanley On LIC Housing Finance

-Kept underweight call, target at Rs 375 per share

-Profit 70% lower than estimate, driven by lower NII

-Stage 2+3 ratio flat QoQ, provision cover higher

-Loan growth in-line with estimate, led by home loans, reported CNBC-TV18.

November 02, 2022 / 15:16 IST

Nomura On Kansai Nerolac

-Buy call, target at Rs 650 per share

-Earnings below est but QoQ margin performance better than Asian Paints

-Q3 demand could be subdued for decorative biz due to high base, early festive season, reported CNBC-TV18.

Kansai Nerolac Paints was quoting at Rs 468.75, down Rs 15.15, or 3.13 percent.

November 02, 2022 / 15:10 IST

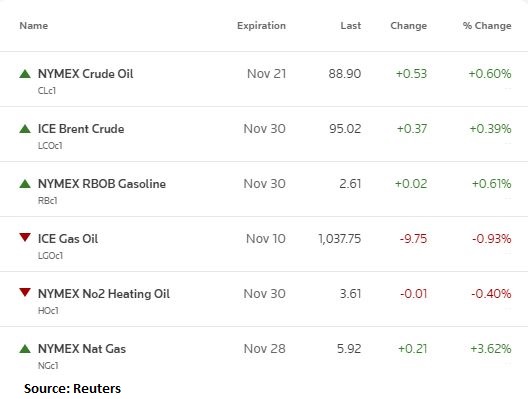

Energy Prices Update:

November 02, 2022 / 15:02 IST

Market at 3 PM

Benchmark indices were trading lower with Nifty below 18100.

The Sensex was down 267.96 points or 0.44% at 60853.39, and the Nifty was down 77.40 points or 0.43% at 18068. About 1672 shares have advanced, 1536 shares declined, and 122 shares are unchanged.