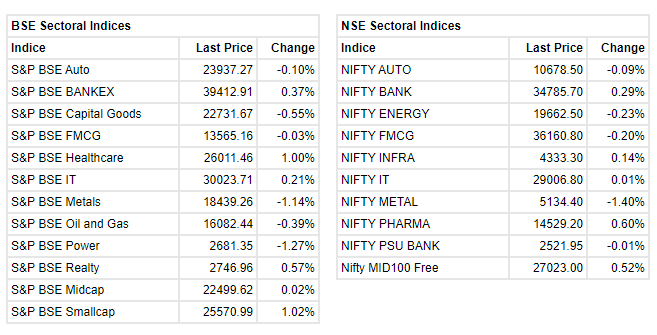

Taking Stock: Market Snaps 4-day Losing Streak; Smallcaps Outperform, Metals Drag

Gland Pharma, Divis Labs, ICICI Bank, Reliance Industries and Coal India were among the top gainers on the Nifty. Top losers were Tata Steel, Britannia Industries, JSW Steel, Power Grid Corp and…... Read More