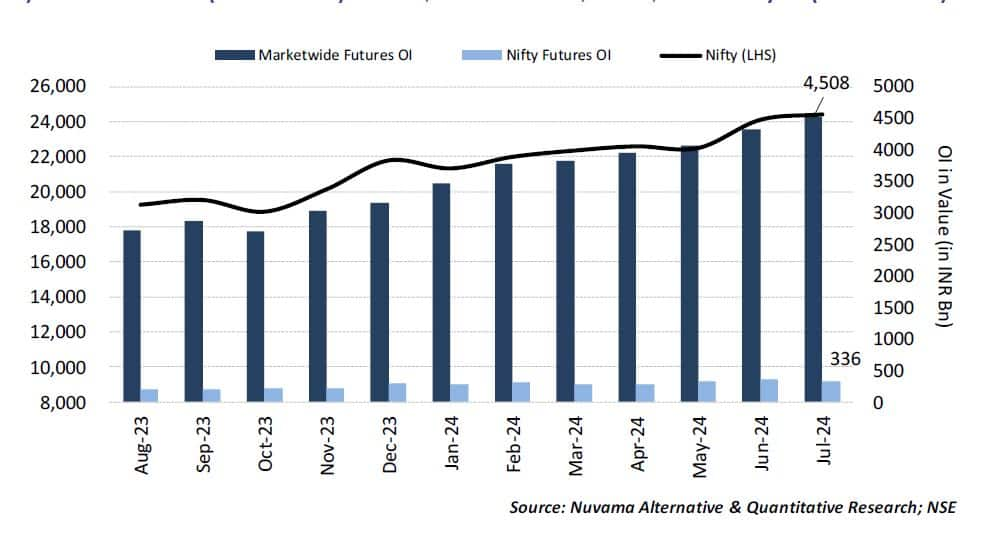

Rollover data shows that market-wide futures open interest at the start of the August series stands at Rs 4.508 trillion (a historic high) compared to approximately Rs 4.321 trillion at the start of the July series. Market-wide rollovers are at 89 percent, higher than the three-month average of 88 percent, said Nuvama Institutional Equities in its rollover report.

Nifty rollovers

Nifty rollover data after yesterday's monthly expiry shows the rollover for Nifty Index futures was lower at 69.69 percent, compared to the previous month's 76.25 percent and the three-month average of 72.57 percent.

"There is lower confidence in rolling over positions. The number of shares rolled declined to 13.7 million compared to 15.1 million last month. Moreover, the rollover cost has witnessed a minor dip to 0.21 percent compared to the three-month average of 0.40 percent," said Sudeep Shah, Deputy Vice President and Head of Technical and Derivative Research at SBI Securities.

Stock futures rollovers

Nuvama's report highlights that stock futures rollovers stand at 93 percent, on par with average rollovers of the last three series at 93 percent. Most frontline names saw their roll cost hovering around 63-65 basis points with an average decrease in roll cost across names being 1-2 basis points day-over-day.

"At the sector level, Banking and Information Technology may underperform, with the exception of HDFC Bank, which should see interest due to the MSCI weight update announcement on August 13th (Indian Standard Time). There is notable interest in HDFC Bank around the 1,550-1,600 level."

Top Stock picks for August series

"Considering seasonality, industrials like Polycab, Havells, ABB, and Crompton Greaves should be viewed with a long bias. Additionally, Trent, a probable Nifty 50 inclusion, is expected to perform well in the August series (strong August seasonality). Within metals, Vedanta has strong support around 430 levels and that should be used as an entry level for a 6 percent target and 2 percent stop loss. Selective auto names should also be looked at from a short-term long idea – Ashok Leyland and Maruti Suzuki," said Abhilash Pagaria, Head of Nuvama Alternative and Quantitative Research.

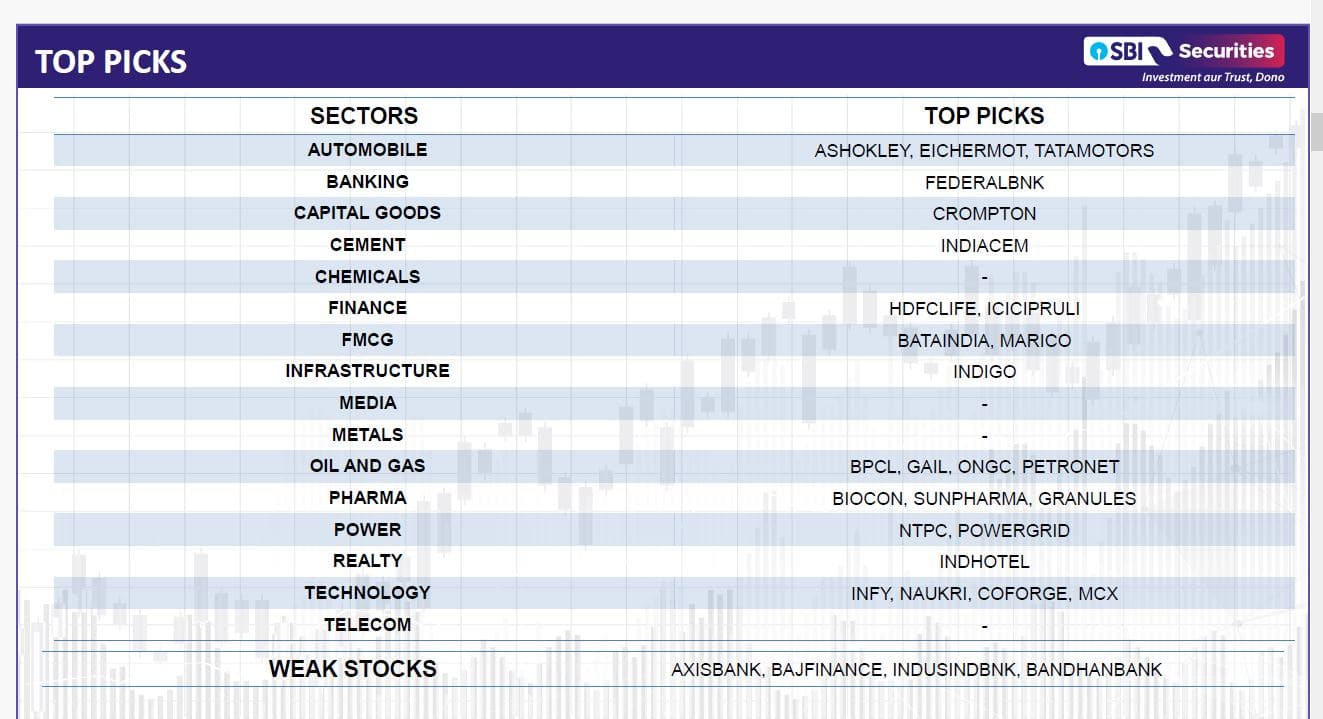

SBI securities' top picks include:

Rollover action - Sector Specific:

"At the start of the August series, meaningful open interest addition is seen in Fast-Moving Consumer Goods (Rs 294 billion, long side), Pharmaceuticals (Rs 227 billion, long side), Oil & Gas (Rs 341 billion, long side), Banks (Rs 860 billion, short side), Metals (Rs 300 billion, short side) and Chemicals (Rs 104 billion, long side) sectors," said Pagaria.

Pagaria also noted that historic high open interest is seen in Auto (Rs 339 billion), Financial Services (Rs 397 billion), Information Technology (Rs 342 billion), Capital Goods (Rs 287 billion), Consumption (Rs 100 billion), and Consumer Durables (Rs 61 billion).

Reviewing July series performanceIn the July series, the Nifty index showcased a modest yet intriguing performance, trading within a tight range of 1,000 points and ultimately closing with a 1.5 percent gain at 24,400 levels. The overall index volatility appeared limited, primarily due to significant sectoral rotations. IT, FMCG, and Pharma sectors drove the gains with impressive increases of 11 percent, 10 percent, and 8 percent respectively. Conversely, the Banking sector exerted downward pressure, with Nifty Bank ending 3.5 percent lower, and Metals seeing a 6.5 percent decline.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!