The stock price of Reliance Industries (RIL), India's largest company in terms of market cap, has been up 10 percent since the last few sessions. The upmove comes after the stock underperformed for almost five months versus broader markets. After reaching a high of Rs 2,369 a share in September 2020, the stock saw a correction of almost 22 percent and consolidated at around Rs 1,900, against this backdrop, the stock's upmove is notable.

What are the triggers for RIL going ahead?

The rally on May 28 can be attributed to several factors, including some non-fundamental elements, hence, we believe it is best not to analyse all these aspects in depth. Rather, we see three key drivers for the stock: 1) improving outlook on each business segment; 2) value unlocking in the O2C business and 3) inorganic growth initiatives.

1 Improving business outlook

The outlook for each of RIL's business segments is improving, and we forecast RIL's consolidated earnings to register CAGR (compound annual growth rate) of 19 percent through FY21-23ii. The growth is likely to be broad-based, rather than concentrated in any specific segment. During this period, we forecast the share of RIL's B2C businesses in overall EBITDA (earnings before interest, tax, depreciation and amortisation) at 53-58 percent versus 50 percent in FY21. Consider this:

a) O2C: Integration benefits will play now

RIL's O2C (oil-to-chemical) business is uniquely placed, given its refinery-petrochem integration. While we think petchem margins should soften relative to the current trends, gross refining margins (GRMs) should revive over the next 12 months, with pick up in global oil consumption. And, to that extent, we see low risk to our Rs 44,700 crore/Rs 47,500 crore EBITDA in the O2C segment through FY22ii/23ii, respectively.

If the global recovery is stronger in FY23, there is an upside risk to our estimates. However, it is too early to factor this in. The exploration and production (E&P) business, though relatively smaller compared to O2C, has also surprised positively. We factor-in KG D6 sales volumes of 15/18mmscmd through FY22/23ii, respectively, and assume no material changes in its realisations—around $4 per million British thermal unit (mmbtu).

b) Jio: Heads I win, tails you lose

The recently launched attractive Jio phone plans, the upcoming launch of Google phone and the capacity boost from the 45 percent increase in spectrum holdings after March auctions are likely to result in higher subscriber additions in the next few months (notwithstanding some weakness in April and May due to the second wave of COVID). We do not see significant price hikes in the next six months.

With Vi (Vodafone Idea) facing large cash outflows from December 2021, we forecast either industry-wide price hikes or an accelerated market-share loss for Vi, Jio stands to benefit in any case. Progress on the FTTH (fibre to the home) business remains steady. The key near-term trigger to watch out for would be the pricing of the smartphone to be launched in collaboration with Google and the plans.

Also read: Reliance Industries annual report key highlights: From strong liquidity to growth plans for Jio

c) Retail: Solid ramp up in operations

RIL's retail business, particularly store additions, has ramped up faster than our estimates in a challenging macro environment. While the near-term outlook is moot, given the second COVID wave and the resultant impact on footfalls, we like RIL’s approach of focussing on omni-channel offerings and strengthening its supply chain, while ramping up the JioMart/digital sales channel.

Our FY22ii EBITDA assumes normal operations for three quarters; FY23ii EBITDA growth of 25 percent YoY has an upside, given the pace of the current ramp-up in operations. We, nonetheless, will wait for the current macro environment to phase out. Our forecasts assume 23 percent and 32 percent sales growth estimates in FY22 ad FY23 and EBITDA margins of 6.1 and 6.3 percent versus 5.5 percent seen in FY21ii.

RIL's reported net cash, as of FY21, stood at Rs 2,200 crore and adjusted for the deferred spectrum liabilities and creditors for Capex, net financial liabilities were seen at Rs 83,400 crore. We think that by FY22, RIL shall be able to prune the net debt by 69 percent to Rs 25,900 crore, given the completion of the rights issue and operational cash flows. As such, the capex intensity is incrementally lowering. Effectively by FY23, RIL should be a net-cash company, which bodes well for shareholders.

Also read: Reliance Industries sees big opportunity in global consensus against climate change

2 Value unlocking in O2C business

RIL is set to transfer its O2C business to a 100 percent subsidiary in FY22. The company is also well poised to induct a strategic investor in this business, which will fast-track its growth plans in the segment and meet the net carbon zero target by 2035.

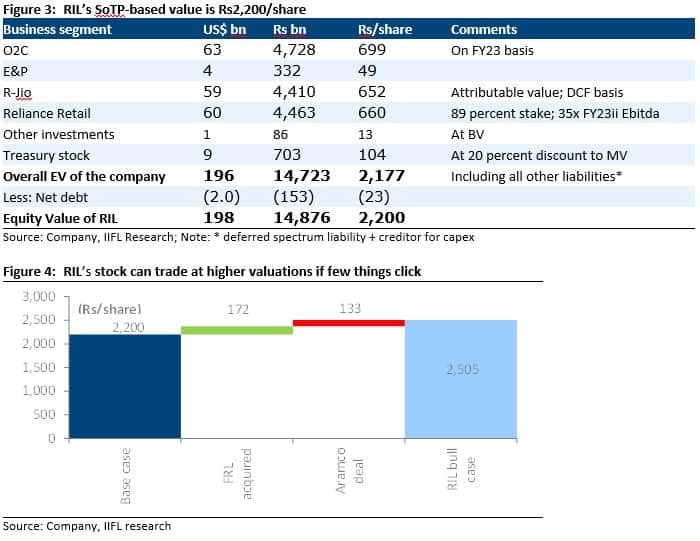

In the base case, we value the business at an enterprise value (EV) of $63 billion, and strategic stake sale to a global player such as Aramco at a higher valuation (eg $75 billion) will help unlock the value.

3 Inorganic growth initiatives

RIL's proposed takeover of the retailing and logistics business assets of the Future Group is facing legal issues and awaits the Supreme Court judgment. FRL's (Future Retail) asset takeover will help RIL fast-track ambitions to grow its footprint in the organised retail segment.

As such, the 26 percent per annum EBITDA growth forecast in the retail business is without integrating the assets of FRL. Take over, if completed in the next six-eight months, can add Rs 1,00,000-1,20,000 crore EV to RIL’s retailing business.

Also read: Jio accelerating rollout of digital platforms, indigenously-developed 5G stack: RIL annual report

What should investors do with RIL stock?

We maintain our positive bias on the stock. We value RIL's O2C business at $63 billion; note that such valuation is lower by 16 percent versus the speculated $75-billion valuation attributed to the possible stake sale to ARAMCO.

IIFL's telecom team values Jio's EV at $82.9 billion, which is based on discounted cash flow (DCF) and assumes revenue market share (RMS) of 51 percent in a steady state, post FY24.

We now value Reliance Retail at EV of $67 billion, based on 35x FY23ii EBITDA. We are impressed by the pace of sales per EBITDA ramp-up at Reliance Retail and the faster-than-expected normalisation of operations would compel us to move the retail valuation even higher.

Reliance Retail successfully consummating the FRL acquisition could lead to significant value creation for the overall retail business. Our base case does not ascribe any option value for such a takeover. Against this backdrop, we value RIL at SoTP of Rs 2,200 per share.

If RIL is able to induct a strategic investor at $75 billion valuation, the SoTP (Sum of the parts) would move up by Rs 133 per share; the FRL acquisition can lead to an uptick in SoTP by Rs 172 per share over the next 12-18 months. And if the much-awaited increases in telecom ARPU come through (say tariff hikes of Rs 50 in the next 12-18 months), RIL's SoTP swings up by around Rs 200 per share.

We reiterate our "buy" rating on RIL and believe the stock will remain sensitive to news flow on the deal with ARAMCO and the Supreme Court verdict on Future Retail.

Disclosure: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.