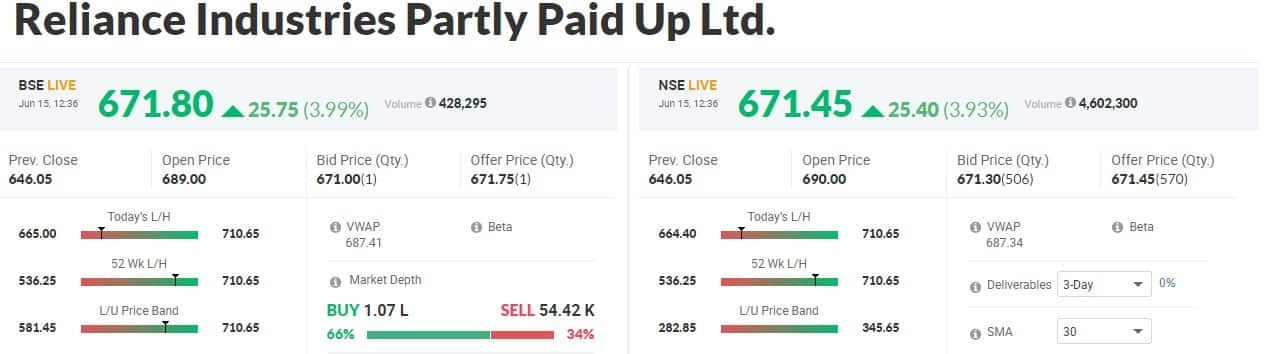

The partly paid-up rights equity shares of Reliance Industries started first trade at Rs 690 per share on the National Stock Exchange, a 6.8 percent premium over previous close of Rs 646.05.

The previous close price formula used by exchanges for RIL partly paid-up shares (Rs 646.05) = Rs 331.8 (i.e. the difference between RIL's Friday's closing price Rs 1,588.80 and rights issue price Rs 1,257) + first instalment of Rs 314.25.

It was quoting at Rs 671.45 on the exchange, up 3.93 percent with volumes of 46 lakh partly paid-up shares at 12:39 hours IST, after hitting an intraday high of Rs 710.65 and low of Rs 664.40.

On the BSE, it was trading at Rs 671.80, up 3.99 percent with volumes of 4.28 lakh partly paid up equity shares.

Reliance Industries partly paid-up rights shares' listing was on expected lines. Analysts who spoke to Moneycontrol were expecting the stock to list in the range of Rs 650-700 per share. First calculation was the difference between RIL share price and rights issue price PLUS first instalment of Rs 314.25 which comes to Rs 646 while the second calculation was the RIL share price MINUS present value of next two instalment Rs 875 on the basis of risk-free return of 6 percent, which comes to Rs 713.8.

The formula to derive the previous closing price can be different as it can be calculated by using other methods too.

Chhitij Jain, Head of Derivatives at Rudra Shares and Stock Brokers told Moneycontrol that all type of investors (whether he/she bought rights shares in secondary market through Rights Entitlement trading, long term investors or intrinsic value basis) earned hefty premium in the range of 30-70 percent on the listing today.

On the basis of intrinsic value of Rs 397.2 (the Reliance Industries Friday's closing price of Rs 1,588.80 divided by 4 as investors also paid 1/4th of rights issue price Rs 314.25 (Rs 1,257/4) on June 3), the listing premium comes to 73.8 percent.

If we consider the closing price of Rights Entitlement of Rs 222 and first instalment of Rs 314.25, then the previous closing price comes at Rs 536. Here the premium is 28.7 percent.

In another method, the premium stood at Rs 48.1 percent. (The previous closing price of Rs 151.90 of Rights Entitlement before listing on May 20 + first instalment of Rs 314.25).

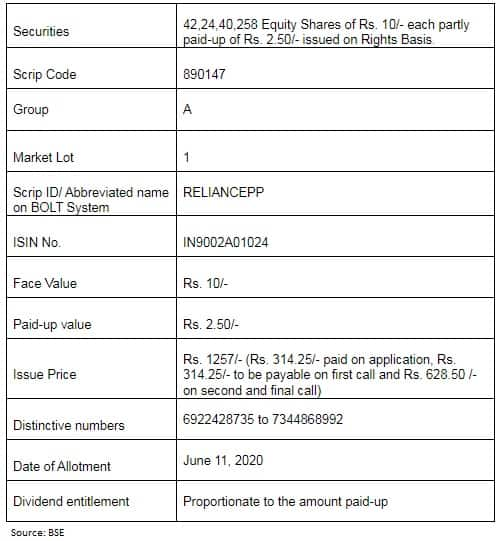

Reliance Industries closed its mega rights issue of Rs 53,124 crore on June 3 and credited partly paid-up rights equity shares to eligible shareholders.

The issue received an overwhelming response from investors as it was oversubscribed 1.59 times with receiving a massive Rs 84,000 crore worth of bids.

It is called partly paid-up rights equity shares because investors paid only Rs 314.25, the first instalment last week, while the balanced will be paid in two intallments. The second installment of Rs 314.25 will be paid by investors in May 2021 and last Rs 628.50 in November 2021. And thereafter these fully paid-up equity shares will be merged with Reliance Industries' existing fully paid-up equity shares.

Mukesh Ambani and his family received 38,39,278 partly paid-up rights equity shares in the allotment, taking their total shareholding to 5,60,01,426 shares (0.85 percent), up from 5,21,62,148 equity shares (0.84 percent) held earlier.

Mukesh Ambani, his wife Nita Ambani, and childern Isha, Akash and Anant Ambani received 5.52 lakh partly paid-up equity shares each of Reliance Industries. They have 0.12 percent stake each in the firm. His mother Kokilaben Dhirubhai Ambani (her name in the shareholding pattern is K D Ambani) has received 10,79,174 partly paid-up equity shares of RIL.

At 10:13 hours IST, Reliance Industries was quoting at Rs 1,578.85, down 0.63 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!