Banking firms HDFC Bank and Kotak Mahindra Bank may see minimal impact on their Tier-1 capital levels following the increase in risk weights for unsecured consumer loans by the Reserve Bank of India (RBI), thanks to their adequate capital levels and inexpensive valuations, said analysts.

“We believe both HDFC Bank and Kotak Mahindra Bank are well-capitalised currently, with no immediate need to raise capital despite the RBI’s new risk-weight norms. The impact of these regulations is likely to be limited. We estimate just about 55-90 basis points (bps) impact on their CET-1 capital adequacy ratio (CAR),” said Dnyanada Vaidya, Senior Research Analyst – Banking, Financial Services, and Insurance (BFSI), Axis Securities.

ALSO READ: Decoding RBI credit risk weight impact across banks, NBFCs; how each lender will lose, gain

HDFC Bank’s CAR stood at 17 percent, while Kotak Mahindra Bank’s CAR stood at 21 percent, suggested data. Both banks’ capital was at healthy levels as per the RBI mandate, which requires private sector lenders to maintain at least 8 percent of CAR levels with the central bank.

On November 17, the RBI revised its risk weight for unsecured consumer loans, encompassing personal loans and credit card loans. Consumer credit, excluding housing, education, vehicle, and jewellery loans, will now attract 125 percent risk-weight assets (RWA). On the other hand, credit cards for banks will see an increase in RWA to 150 percent from 125 percent earlier.

On the overall banking system, VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said that lenders would be able to easily pass on the increased cost to borrowers, without seeing any major drag on their profit pool.

Where do HDFC Bank and Kotak Mahindra Bank stand against peers?According to a Jefferies report, HDFC Bank’s exposure to personal loans stood at 8 percent of its total loan book as compared to ICICI Bank’s 9 percent, IDFC First Bank's 19 percent, and State Bank of India's (SBI) 10 percent. Kotak Mahindra Bank’s exposure to personal loans, on the other hand, was the lowest at 5 percent.

On the credit card loan front, HDFC Bank and Kotak Mahindra Bank were at 4 percent and 3 percent, respectively. Other lenders like ICICI Bank's credit card loan exposure stood at 4 percent, IDFC First Bank at 1 percent, and Axis Bank at 4 percent.

That apart, HDFC Bank and Kotak Mahindra Bank's estimated loans to NBFCs were at 1 percent and 5 percent, respectively. Compared to other lenders, estimated loans to NBFCs for IDFC First Bank was at 3 percent, ICICI Bank at 7 percent, SBI at 8 percent, and Canara Bank at 11 percent.

According to Jefferies report, IDFC First Bank and ICICI Bank may require additional capital consumption of 0.8 percent and 0.7 percent, respectively, whereas Kotak Mahindra Bank and HDFC Bank's additional capital consumption would be 0.6 percent post the RBI's new risk-weight norms.

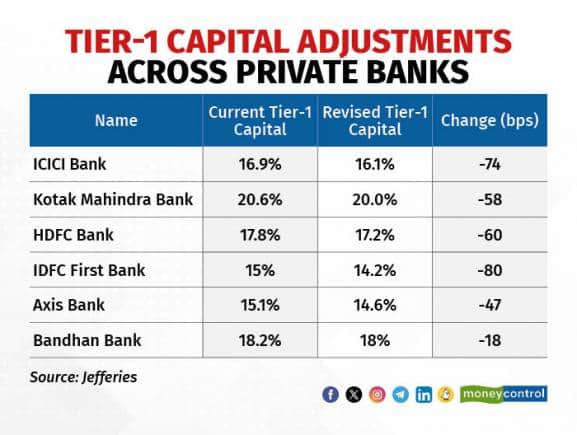

Finally, the revised tier-1 CAR suggested ICICI Bank will take hit of about 74 bps and IDFC First Bank would take a hit of 80 bps, the Jefferies note added. Meanwhile, Kotak Mahindra Bank and HDFC Bank would see a hit of up to 60 bps.

Following the RBI’s tightening over unsecured retail lending, shares of HDFC Bank and Kotak Mahindra Bank remained flat in the past two trading sessions. ICICI Bank, Axis Bank, and IDFC First Bank, however, declined up to 4 percent during the same period.

Kaitav Shah, lead BFSI analyst at Anand Rathi Institutional Equities, believes that this knee-jerk reaction across banking names is only temporary in nature and investor sentiment is likely to improve over the medium term.

“We maintain a ‘buy’ call on Kotak Mahindra Bank with a target price of Rs 2,095 in the next one year. For HDFC Bank, we call a ‘hold’ rating with a target price of Rs 1,698 per share,” Shah added.

Valuation-wise, HDFC Bank was trading at an attractive 20 times (x) price-to-earnings (PE) ratio, lower than sector’s PE mean of 24x. Kotak Mahindra Bank, too, was inexpensive at a 20x PE ratio.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.