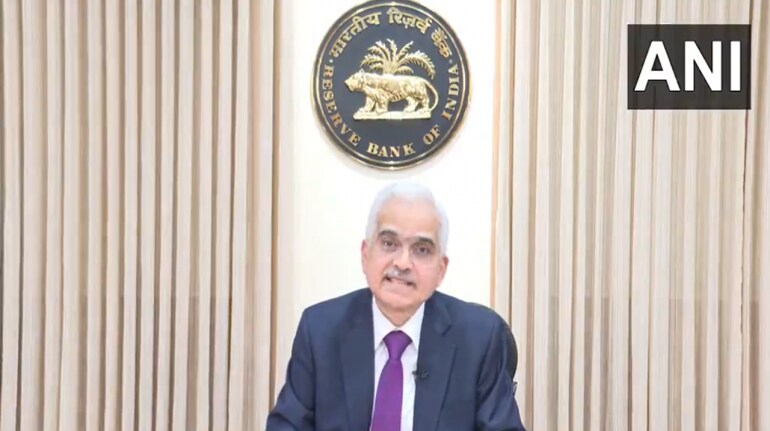

The Reserve Bank of India (RBI), in its monetary policy review, kept the short-term lending rate, or repo rate, unchanged at 6.5 percent on April 5, setting the volatility index higher at 11.50 after a sharp surge of 3 percent ahead of the announcement.

After the rate decision at 11:29am, the Nifty traded down 30 points or 0.14 percent at 22,487.00, while Bank Nifty gained 140 points or 0.28 percent to 48,200.

Good volumes have been seen in some defensive sectors like pharma and FMCG. There have also been good moves in PSU banking stocks followed by select private banks, accompanied by strong traction in the broader markets.

Further rise in volatility expected as the market touches an all-time high (ATH) and the election nears

Arun Kumar Mantri, founder of Mantri Finmart, said India Vix, or the volatility index, will be on the higher side as the election nears and as markets are approaching all-time highs. "We expect a gradual rise in volatility from the current zones, and options pricing will be more on the expensive side in the coming week."

Nifty and Bank Nifty saw lower volatility and an ease in options premiums

"The Nifty and Bank Nifty have witnessed a reduction in implied volatility after the RBI monetary policy, and an ease in the options premium is seen. Long positions have been witnessed in banking stocks, leading to the recovery in Bank Nifty, while no major change is seen in Nifty in the early hours of trade," Mantri said.

Also Read: Option strategy of the day | Bull call spread in Shriram Finance following crossover

Mantri expects the index to revolve in the range of 22,350-22,550 in the near term, while any breach above 22,550 will trigger short-covering towards the 22,700-plus levels in the coming truncated week. "On the other hand, short-term traders may maintain a stop loss of 22,350 spot levels in Nifty, and a breach below the same may trigger some sell-off in the markets. The overall trend seems good as long as the indices are holding the support zones of 22,350 on the lower side," added Mantri.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.