Brokerages remained bullish on well-capitalised, large-capitalized private banks following the Reserve Bank of India’s latest measures to stimulate credit growth.

The central bank has announced a slew of measures that will further ease regulations for the banking sector, along with an aim to strengthen banks’ resilience, improve the flow of credit, and simplify the operating environment for regulated entities.

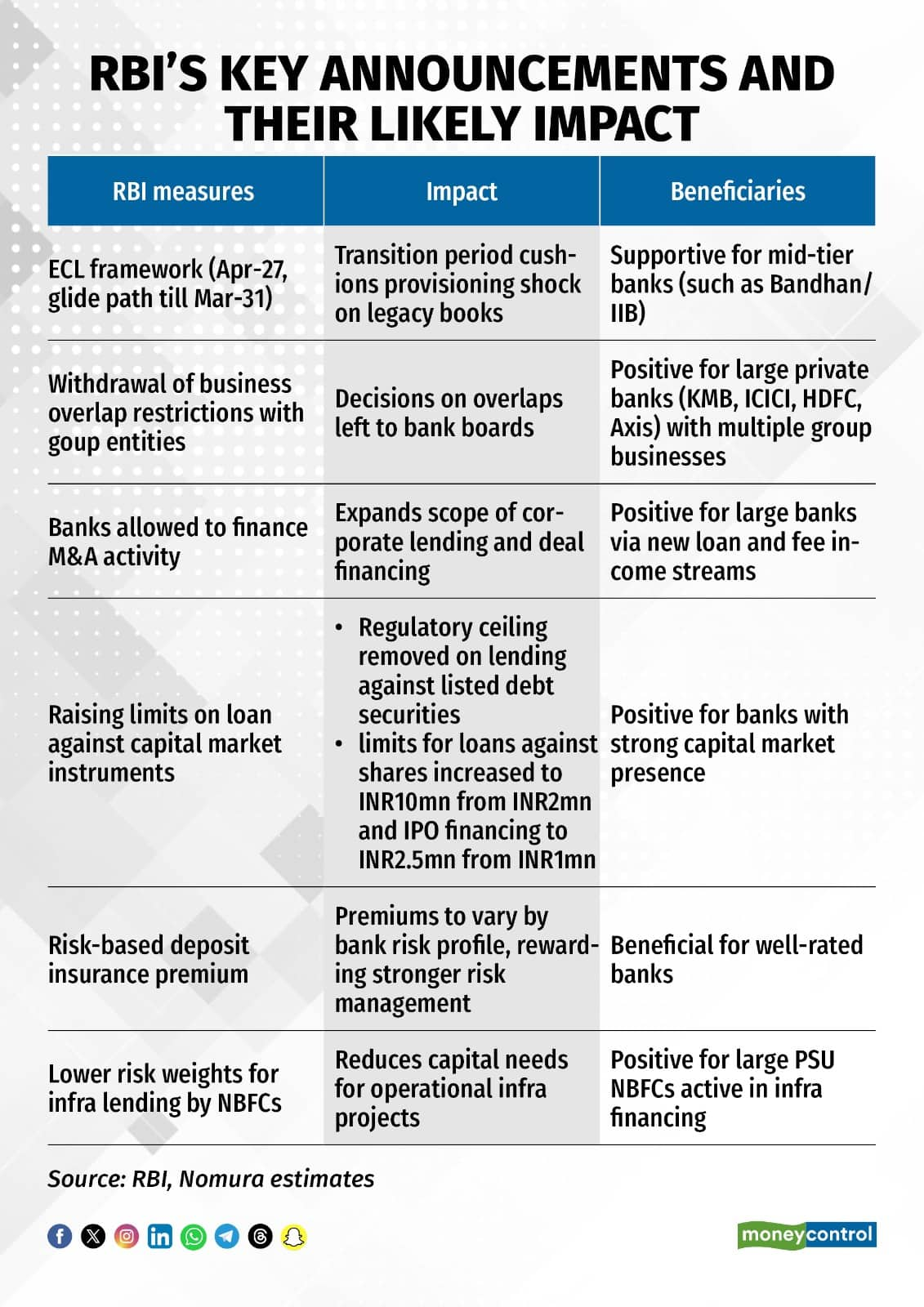

These measures include:

Measure:Shift to an expected credit loss (ECL) provisioning framework from April 2027. RBI also offered a transition period of 5 years.

View: Jefferies noted that the transition period may help banks (especially PSUs) to smooth the impact of the upfront charge; private banks are likely to take this upfront as they are better capitalised. Among large banks, Kotak Mahindra Bank will likely be the most impacted due to its lower buffer and Axis Bank will see a very mild impact, noted Nuvama Institutional Equities.

ECL will impact microfinance banks: AU, RBL, IDFC First, IndusInd Bank, said Nuvama. It will also impact state banks on existing loans. Three years ago, SBI had disclosed a shortfall of Rs 25,000 crore for existing loans, which in our view would have reduced to below Rs 20,000 crore, added the brokerage.

Measure: Removal of proposed restriction on the overlap of group businesses

View:The revised stance provides much-needed operational flexibility and regulatory clarity, enabling banking groups to better leverage synergies between their bank and NBFC arms.

“This should support more efficient capital deployment, sharper customer segmentation, and competitive product structuring, thereby enhancing the overall franchise value of these groups,” said Motilal Oswal.

Jefferies noted that the move can be positive for HDFC Bank (and HDB Financial Services) as well as Kotak Bank and Axis Bank, which also have NBFC subsidiaries. Nuvama suggested that Kotak Mahindra Bank, HDFC Bank-HDB Financial, Canfin Homes, PNB Housing and Bajaj Finance could see some relief.

View:Revised Basel III capital adequacy norms

Measure:This would lead to lower risk weights on residential real estate (including housing) and MSME. The RBI will likely ensure that the lower risk weights are passed on in the form of softer rates through strict monitoring to accelerate growth, in Nuvama Institutional Equities’ view.

Motilal Oswal said that the reduction in risk-weights will ease capital requirements and improve capital efficiency, particularly benefitting banks with a higher share of MSME and mortgage portfolios.

“This should support incremental lending to these sectors at finer pricing, potentially boosting credit growth. However, this also increases the need for robust underwriting to avoid complacency in risk assessment,” added the brokerage.

Measure: Reduced risk weights on NBFC lending to operational infra projects

View: With provisioning norms for project finance already eased, the proposed reduction in risk weights can materially lower capital costs for NBFCs engaged in infrastructure lending. This will enhance their ability to fund viable projects at more competitive rates, supporting stronger growth in the infra pipeline.

“A decline in borrowing costs is thus likely as the benefits of lower risk weights are passed on. However, the effectiveness of this measure will depend on a clear definition of ‘high-quality’ projects and robust ongoing monitoring to mitigate potential slippages,” noted Motilal Oswal.

Measure:The RBI also took steps to boost credit flow to aid credit growth:

View:Jefferies believes that the steps and transition timelines offered are balanced enough to support credit growth. Private banks with higher capital adequacy and buffer provisions are better placed to transition to the ECL regime. “We continue to prefer larger private banks in India, with HDFC Bank, Axis Bank, and ICICI Bank; among PSU banks, we like SBI,” said the international brokerage.

Nomura concurred. The Japan-based brokering house expects credit growth to improve to 12 percent YoY FY26, compared to 10 percent YoY currently. “We prefer to be positioned in stocks with stronger return profiles, lower asset-quality risks and better liability franchises. We prefer large banks over mid-tier banks. Our top picks are ICICI Bank, State Bank of India and Axis Bank,” it said.

Also Read | RBI policy unshackles banks; heralds coming of age of Indian banks and banking regulation

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.