In 2022, promoters of companies have been voting on their salaries despite poor investor support, according to proxy advisory firm IiAS.

IiAS assessed 201 remuneration resolutions of promoters in 2022 and results showed that 34 percent of these resolutions (or 68 resolutions) would have been defeated if promoters had not been allowed to vote.

“The level of compensation of promoters, the structuring of the compensation, and the disclosure levels in these resolutions remain concerns for investors. That some of these promoters are members of the Nomination and Remuneration Committee adds another layer of conflict of interest,” wrote IiAS in its latest Institutional Eye report, released on June 27.

Also read: 'Absolutely ridiculous': Market veteran Safir Anand calls out investors who backed Byju’s

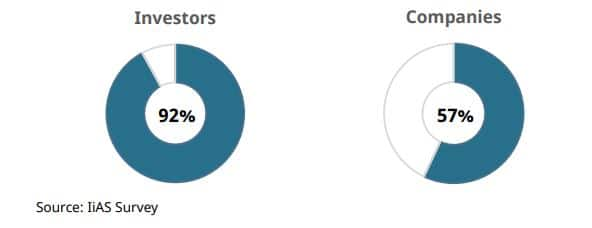

The advisory firm surveyed investors on whether executive remuneration for promoters should be considered a related-party transaction, which would require a majority of minority votes for passing. Ninety-two percent of the investors voted in favour of it.

To correct these, the advisory firm advised putting promoter compensation to a majority of minority vote and mandate a minimum set of disclosures that companies must make on an annual basis and while seeking shareholder approval. The firm also recommended adding malus and clawbacks into the remuneration structure of executive directors, and of promoters that hold non-executive positions but draw compensation that is significantly higher than non-executive directors.

“Promoters voting on their own compensation has an inherent conflict of interest. Therefore, like other related party transactions, these too should be put to a majority-of-minority vote. This will ensure that NRCs become more thoughtful in setting compensation levels, and articulate the reasons or the basis for the compensation payout,” said the report.

Worrying instances

The remuneration paid to promoters has been a cause of concern for a few years now, according to the report. But, during the pandemic, some of the promoters took voluntary pay cuts. However, post the pandemic, “payouts have resumed their pre-Covid trajectory”, stated the IiAS report.

The report shared the example of a handful of companies where promoters have even paid themselves Rs 50 crore and Rs 100 crore as compensation, irrespective of the size of their companies.

It shared the example of a promoter of a commodity-play company whose remuneration for FY22 totalled Rs 132 crore. This was made possible because the promoter had awarded themselves a 0.5 percent flat commission with no mention of expected performance or acknowledgement of the cyclical nature of the industry. When the commodity cycle started looking up in FY22, the promoter was rewarded by the same benefit that was not available to other executive directors and the employee pool, according to the report.

The report also cited an example to illustrate how promoters’ earnings in their non-executive capacity can exceed CEO’s remuneration by many multiples. “The non-executive chairman in a north-based textile company was paid an aggregate remuneration of Rs 576.6 mn in FY22 in a non-executive capacity, while the CEO’s remuneration aggregated Rs 19.2 mn,” stated the report.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.