By Rakesh Arora · Founder, Go India Advisors

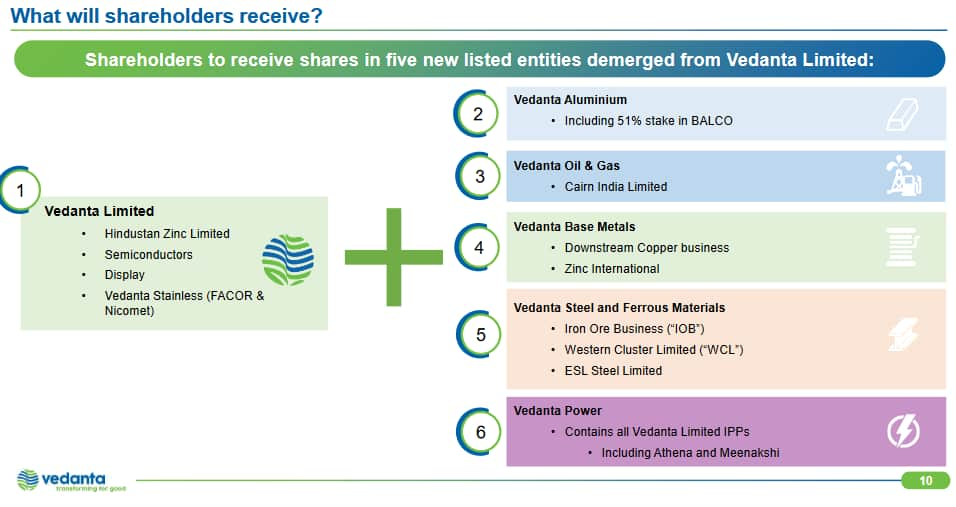

Vedanta Ltd has announced a restructuring plan to demerge all its business verticals into separate listed entities. It’s a clean split, with existing shareholders of Vedanta Ltd getting one share of each of the five demerged entities. The deal is expected to take 12 months to complete.

Vedanta's Demerger

Vedanta's Demerger

This is in total contrast to the amalgamation scheme, which was announced in 2013. At that time, below were the reasons given for the merger of all the companies. And now, with the demerger scheme, the rationale is also the same — a simplification of the group structure!

So, clearly, this is a straightforward strategy of convenience and is driven by whatever suits the promoters. It’s no big secret that the promoter is struggling to repay the loan at the holding company level. It resorted to big dividends but now has exhausted the large cash balance it had in Vedanta Ltd and its subsidiary Hindustan Zinc Ltd. Still another $6.5 bn debt needs to be taken care of — nearly $6 bn is due before March 2025.

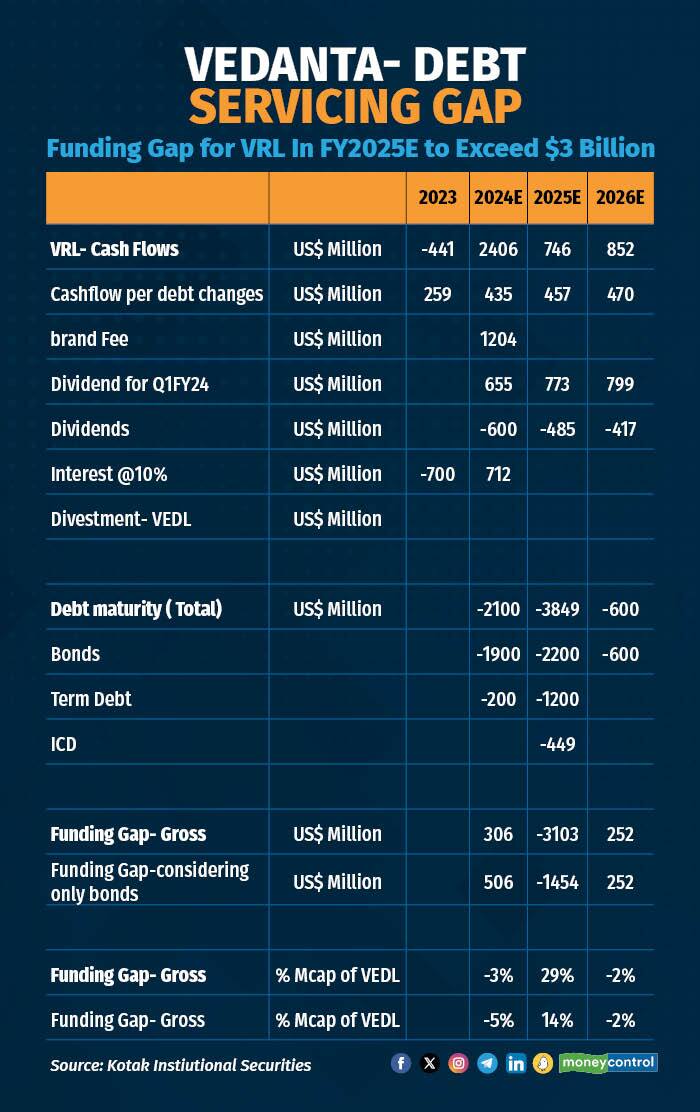

In a note, Kotak Securities has succulently summarised the funding gap faced by Vedanta’s holding company. For the current year's repayment of $2.1 bn, funding is largely sorted. The main challenge is the clubbing of almost $3.8 bn of repayments in FY25E. Kotak estimates a huge gap of $3.1 bn in cash flows. Vedanta's promoters know this well, and this restructuring is planned to deal with potential threats in case the rollover of the debt turns difficult.

Vedanta's Debt Trap

Vedanta's Debt Trap

How does this deal help promoters raise cash?

The current structure is not so conducive to raising cash by selling stakes: The recent stake sale of 6 percent in Vedanta Ltd by the promoter has led to an almost 25 percent correction in the stock price. And no major, reputed buyers have emerged in this sell-down. Clearly, there is very little interest from funds in buying a minority stake in a company plagued by corporate governance (CG) issues and the overhang of promoter debt. Promoter stake has fallen to 63.7 percent from a peak of 69.7 percent and almost all of it is pledged to lenders. The distress sell-down will put the stock in a further downward spiral, leading to total collapse. In this scenario, the strategic sale of some of its businesses makes more sense because it will maximise value and make it easier to find buyers.

Vedanta can sell some business segments in the existing structure too, but a demerger will be highly tax-efficient for the promoters to take out cash. In the current structure, any cash inflow from selling stakes will entail double taxation — one is the profit from the sale of assets, and the second is the dividend payout. While on demerger, promoters will pay only for long-term capital gains.

What benefits do minority shareholders get?

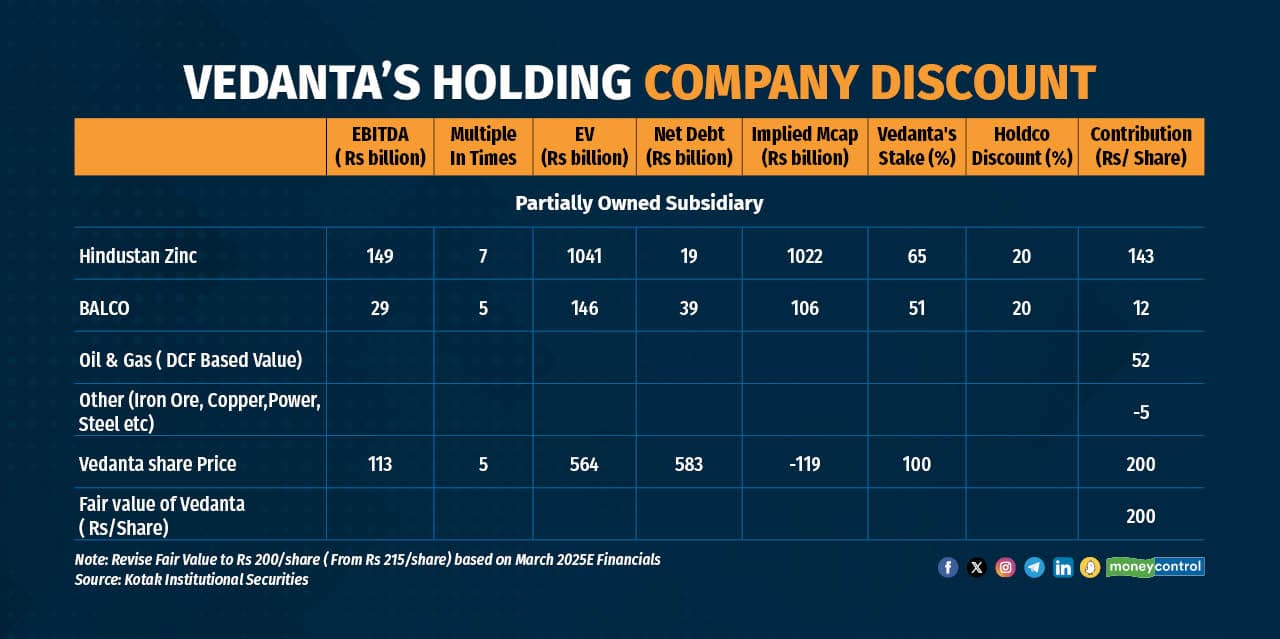

Normally, one would expect value unlocking as the conglomerate discount reduces. Let’s look at how the street is currently valuing various parts of the business. Below is a table from the Kotak Securities report. They have ascribed a 20 percent holding company discount to both Balco (51 percent held by Vedanta) and Hindustan Zinc (64.9 percent held by Vedanta) as they are only partly held by Vedanta Ltd. In the proposed structure, Hindustan Zinc, the main driver of value, will continue to be held by Vedanta Ltd. So, the holding company discount will not go away. In fact, it might increase materially as Vedanta Ltd largely becomes a pure holding company. The average discount for such holding companies is in the range of 40-80 percent. Check out Grasim, JSW Holdings, and Bajaj Holdings. The distribution of Hindustan Zinc shares to the shareholders of Vedanta Ltd would have made this deal lucrative.

Balco will remain a subsidiary of Vedanta Aluminium. However, since both the parent and Balco are in the same line of business, the holding company discount might be reduced. However, Balco is not a big driver of overall value.

Investors do get to pick and choose what businesses they want to retain. And if Vedanta is hard-pressed to sell some businesses, as they have indicated for the iron and steel business, there could be some value unlock.

The other risk factor that emerges from the proposed structure is the intercompany transfer of funds. This malaise has plagued this group in the past too.

Will this deal go through?

Since it is a clean split with no requirement for valuing any company, it should be relatively easy to get shareholder approval. Lender approval is also required and probably should not be a problem, as individual units are easier to sell in cases of duress. One of the issues that is not yet fully clear is the distribution of existing debt among businesses. While it might not impact shareholders as much, lenders can take a different view. The timeline suggested for completion is almost one year. Most likely, the deal can be done in the suggested time frame.

Will Vedanta's promoters make it through this debt trap?

The total receipt annually by Vedanta promoters is estimated to be $1.25 bn in the form of royalty and regular dividends from Vedanta Ltd. This cash flow is good enough to cover $4 bn of debt. Promoters are well covered for the payment due in 2024 but need another $3 bn to tide over in 2025. We think that they will be able to roll over the term loan and inter-corporate deposits (ICDs). Also, since its bonds are trading at 50-60 cents to a dollar. If the promoters are able to bring in, say, $1 bn, i.e. half the bond amount, they stand a good chance of rolling over the bonds partially. Thus, the real shortfall might be around $1-1.5 bn in 2025.

Vedanta's Need To Tide Over Debt

Vedanta's Need To Tide Over Debt

Already, the company has hinted at a possible sell-off of the iron ore and steel business. This business segment combined makes around Rs 2,500-3,000 crore of earnings before interest, taxes, depreciation, and amortisation (EBITDA) and can probably be sold for Rs 10,000-15,000 crore. Even international zinc and power businesses can find buyers.

While there is a lot of work to be done, most likely, Vedanta promoters should be able to scrape through this squeeze.

What is the play here?

In conclusion, the stock has corrected sharply, and valuations are now reasonable. A dividend yield of 6+ percent will also provide support. There could be a trading bounce given the demerger hype. However, the big drivers for the stock will be news flow on the rollover of the debt and some progress on the sell-off of the iron and steel assets.

Restructuring Plan – Yes

Buying the stock - Maybe

Never a dull moment with Vedanta.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.