As India’s per capita income inches up and consumers turn more discerning, consumer players riding the premiumisation theme offer higher long-term growth visibility compared to peers. Among this, companies like M&M, InterGlobe Aviation, and Eicher Motors are poised to benefit.

India’s per capita income rose above $2,600 in FY2025, and according to estimates, it will cross $5,000 by FY2030. During this rise, the share of non-essentials in the average consumption basket has risen from 36 percent to 43 percent, as a result of the premiumisation push and expanding middle class.

With strong policy support for infrastructure and domestic manufacturing, rising equities, appreciating gold, and surging real estate prices, households are feeling the wealth effect, which in turn is fuelling spending power.

Further, India’s rapid urbanization, coupled with the growing trend of nuclear families, is reshaping consumption patterns and transforming key sectors such as housing, transportation, education, and lifestyle services, noted a Franklin Templeton report.

“This demographic evolution is creating a sizable and increasingly addressable market for premium and luxury brands across categories such as automobiles, electronics, fashion, travel, and wellness,” said the financial services firm.

International brokerage Jefferies added that the combination of consumers increasingly opting for higher-end products, as well as the corporate push for higher margins, has pushed the trend so far. Additionally, the recent GST rate cuts and the personal income tax cuts earlier in the year are supportive of overall consumption.

Here’s a look at key segments that are playing the theme:

Automobile

India’s automobile segment is witnessing the rapid rise of luxury four-wheelers and SUVs, while the demand for entry-level passenger vehicles have fallen. International brokerage Jefferies noted that the share of SUVs in passenger vehicle sales has risen from 14 percent in FY12 to 65 percent in FY25 gaining share from small car sales.

The same pattern is replicated across the two-wheeler segment. Entry-level motorcycles have lost ground to the extent of 21 percentage points of market share declining to 28 percent to more premium models over the past 13 years.

Jefferies’ stock pick: Eicher Motors, Mahindra & Mahindra

Travel and aviation

At the current juncture, India’s domestic travel is now expanding at a pace comparable to China’s 11.2 percent CAGR from 2009 to 2019, supported by rising disposable incomes, better regional connectivity, and improved tourism infrastructure, Franklin Templeton noted.

Within this segment too, the premiumisation thrust is visible. The number of passengers opting for air travel and AC trains has grown at a significantly faster pace of 3.1x and 2.3x over FY14-25 compared to those using non-AC trains which has actually declined by 20 percent over the same period, stated Jefferies.

Jefferies’ stock pick: InterGlobe Aviation, GMR Airports

Real estate

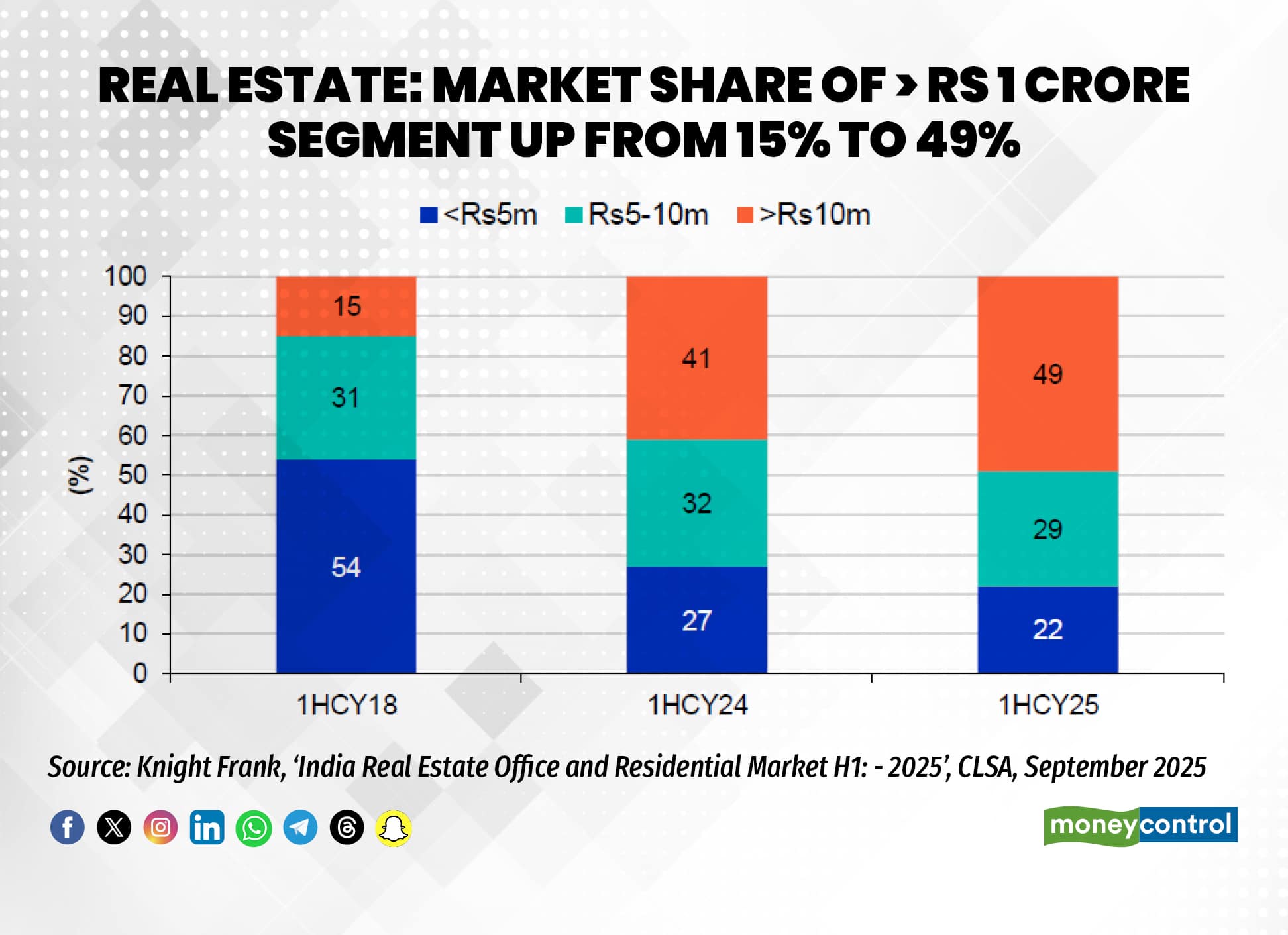

Not just consumer discretionary, but even in housing, buyers are exhibiting a preference towards larger houses, at a higher ticket size. The size of the average home has increased by roughly 35 percent over the past five years. The segment offering houses worth over Rs 1 crore has risen in market share from 15 percent to 49 percent from 2018 to 2025.

Jefferies’ stock pick: Lodha Developers, DLF

Consumer discretionary

The Indian appliances and electronics market is poised for rapid expansion, projected to grow from $75 billion in 2024 to $130-150 billion by 2029, which implies a 12-15 percent CAGR. Premium and aspirational offerings currently make up nearly half of the overall appliances market and are expected to rise to approximately 58 percent by 2029, as a result of increasing consumer willingness to pay for superior quality and innovation.

For example, between 2012 and 2024, the sale of air conditioners have grown over 3.5 times.

Jefferies stock pick: Amber Enterprises

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.