Finding value in the Indian market is hard, especially at a time when markets are trading at record highs. Benchmark indices have rallied over 17 percent in the last one year but there are a lot of stocks which have already more than doubled in the same period.

To find value in markets even when most of the stocks have already doubled in the last one year could be a tough task. To make the job easier for investors, there is one ratio which is easy to calculate and is readily available i.e. PEG ratio.

PEG ratio or price/earnings to annual EPS growth which can provide a more holistic picture of the stock especially in a bull market where P/E ratio tends to look inflated.

A Price to Earnings ratio (PE) can be calculated by dividing market value per share by earnings per share (EPS). The relationship between the PE and Earnings growth gives a complete overview if the stock and valuation compared to P/E on its own.

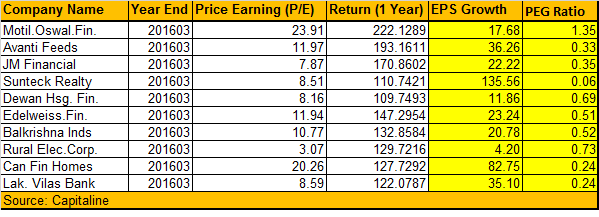

There are a number of stocks which saw huge price appreciation if tracked based on PEG ratio. For simplicity, we have taken a list of top ten stocks which more than doubled investors’ wealth and still has a lower PEG ratio, of less than 1.

Some stocks which have a PEG ratio of less than 1 include names like Avanti Feeds, JM Financial, Sunteck Realty, Dewan Housing Finance, Edelweiss Financial Services, Balkrishna Industries, REC, Can Fin Homes, and Lakshmi Vilas Bank.

“PEG is a good yardstick to assess the valuation of a stock, particularly during bull markets when PE indicates overvaluation. It is true that PEG less than 1 leaves a margin of safety even when the stock looks fully priced,” Dr VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services told Moneycontrol.

“Stocks with PEG of less than 1 merits investment. But, we should not jump to the conclusion that a PEG more than 1 indicates overvaluation and high risk. In recent times, some stocks with PEG of more than 1 have delivered good returns,” he said.

Theory suggests that a PEG ratio less than 1 indicates that the stock is undervalued and the analysts' consensus estimates are currently set too low. On the other hand, a PEG ratio of more than 1 suggests that market expectation of growth is higher than consensus estimates.

The ratio can’t be applied to all sectors. It works best for stocks which have some cyclical nature to it, and for it to be more effective, investors should use growth rate based on last 3 years, suggest experts.

“For growth, investors should consider longer term growth (at least 3 years past growth). This shall reduce the element of cyclicality in growth and reduce the error while calculating the ratio,” Shashank Khade, Chief Equity Advisor and Director at Entrust Family Office Investment Advisors told Moneycontrol.

What should investors do?

Even though PEG is a good indicator, it should be used along with other criteria. An indicator not widely used, but important, is Earnings Yield, suggest experts.

Earnings yield is EBIT divided by enterprise value. “Earnings yield greater than 5 percent is good which can be used with PEG ratio,” said Vijayakumar of Geojit Financial Services.

While using PEG ratio investors must also see that if the company is growing earnings but similar growth is not seen in the free cash flow then it needs further investigation.

“While using PEG ratio, one must also adjust the earnings growth for the one-off items and also should pay attention to the return ratios,” Shrikant Akolkar, Sr. Equity Research Analyst, Angel Broking Pvt Ltd told Moneycontrol.

“Study of the balance sheet is important and one must see if the company is taking too much debt or eroding working capital conditions. PEG ratio should not be seen isolated but should be seen along with other ratios like ROE, ROCE, ROIC, FCF growth rate, etc.,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.