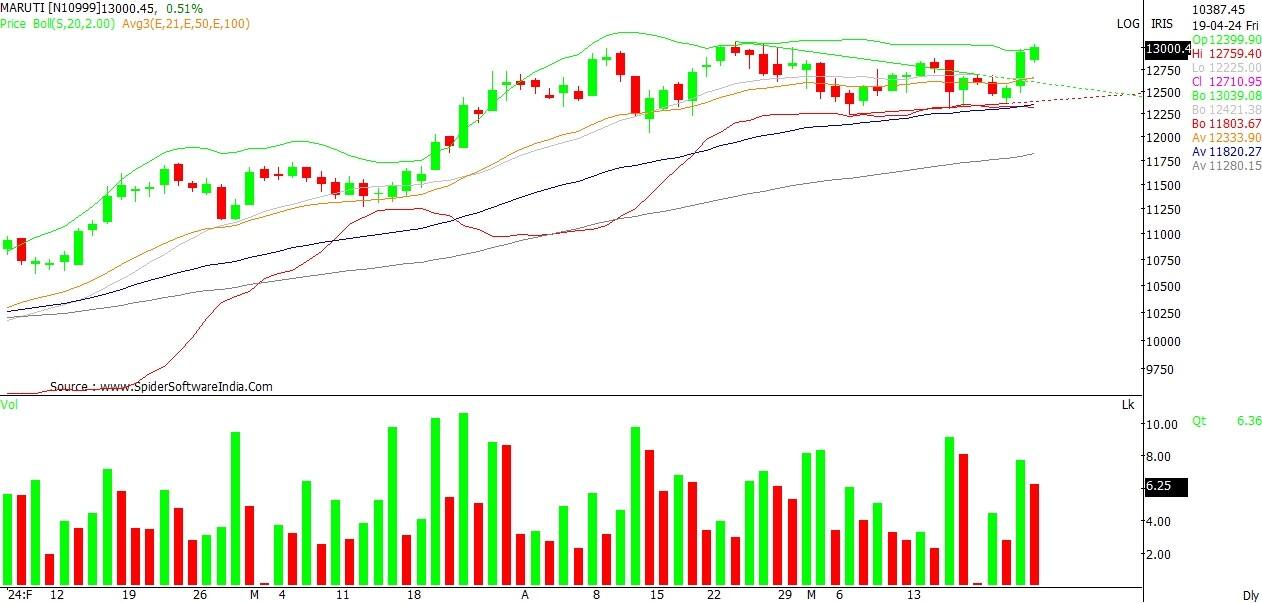

Maruti shares have been making higher highs and higher lows and are looking strong on all major time frames. On May 27, the stock was trading at Rs 12,908, down 0.71 percent from the previous close.

"Maruti stock volumes have been encouraging in the latest bullish move followed by good price action. The structure seems bullish with RSI pointing northwards in the comfortable zones," said Arun Kumar Mantri, Founder Mantri Finmart.

Follow out LIVE blog for all the market action

Mantri recommended taking a long call strategy on the stock to capture this momentum.

Trade details:

Position: BUY MARUTI JUNE 13300 CE

Position: BUY MARUTI JUNE 13300 CE

Entry: 350-360

Target: 510-530

Stop loss: 230

Holding period: 5-6 trading sessions.

Technical data:

Maruti is rolling on the upper band of the Bollinger band (20,2) on the daily charts. "The counter is looking strong on the weekly time frame as well and is all set to surpass 13000 mark decisively in the coming trading sessions. The price is trading above the major moving averages and is all set to surpass the all-time high," said Mantri.

Mantri highlights that the support for the stock is placed at Rs 12800-12850 for short-term perspective while resistance is at Rs 13300-13400 on the higher side.

Derivatives Data:

Option chain analysis of the stock for the May series, the counter is standing at the strike price of the highest CE which is at 13000 strikes. "On the other hand, we expect the call writers of the said strike to face the heat and further short covering is expected in the coming 3-5 trading sessions. The counter has also added good OI interest in the few sessions indicating up move is likely to continue in the near term and the price is expected to test 13300-13400 levels, " he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.