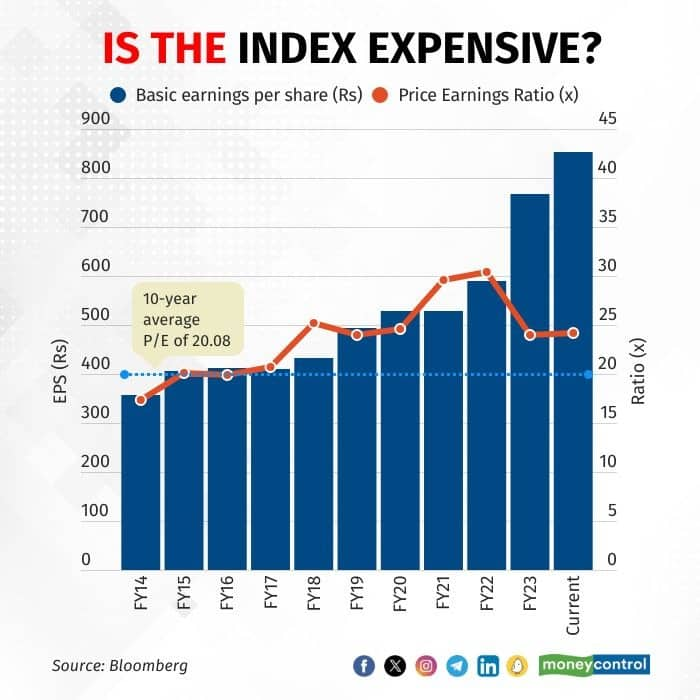

NSE Nifty 50 hit a fresh all-time high, topping 21,000 on December 8, prompting a few voices of caution over valuation, which appear to be far higher than the 10-year average. While it may trigger a correction in the short term, analysts say the benchmark index is ‘not expensive’ as the nation’s growth expectations have not been priced in.

Nifty’s one-year forward PE is at 21.35, while the 10-year average stands at 20.08. Market experts expect some correction in the near-term, followed by a long-term rally.

Also read Nifty conquers 21,000 as RBI stands pat on 6.5% repo rate

Growth expectations“Some consolidation is expected before the elections, but post-elections the index rally will continue,” said Kranthi Bathini, director and equity strategist at WealthMills. Even so, Indian equity markets are in a value zone right now, and not in an expensive zone, given that the growth prospects for the country look stronger than that ten years ago.

“We should call it an aggressively priced market, not an expensive market,” said Nirav Karkera, head of research at Fisdom. He said that domestic stability, expenditure on capacity expansion, and no change in RBI’s interest rate decision together paint a picture for companies to post strong earnings growth.

Ridham Desai, managing director and head of research at Morgan Stanley, expects Nifty earnings to compound over 20 percent in the coming years.

Earlier, on December 8, the Reserve Bank of India kept the repo rate unchanged for the fifth time in a row. The central bank also raised its GDP growth forecast for 2023-24 by a whopping 50 basis points to seven percent, following the big upside surprise in the July-September data. Also, BJP winning three of the four state elections have encouraged a feeling of certainty for the upcoming general elections 2024.

Earnings visibility, FII inflows, global bond yields to support Indian equitiesIndependent market expert Hemag Jani said: “Valuations are not looking screeched for Nifty as it is still quoting at 18.5 times next year EPS with strong growth visibility for FY24.” He said that the next big trigger for the markets would be global bond yields movement and flows into emerging markets.

FIIs, which sold in October, are expected to return to India, say experts. The US bond yields surged to as high as five percent in October, but have since receded by around 50 basis points in November. When US bond yields increase, investors remove money from riskier assets like markets, and put money in safe assets like bonds, and vice-versa.

The Nifty 50 touched a new high of 21,005, and the Sensex hit a fresh record of 69,888. The gains followed the Reserve Bank of India’s decision to maintain the repo rate at 6.5 percent, in line with market predictions.

Nifty 50 witnessed its longest winning streak since December 2020, marking a sixth consecutive week of gains. This week's surge of three percent represents the best weekly performance since July 2022. Moreover, nine stocks on the Nifty 50 hit their all-time highs in the last two-three sessions.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.