The domestic mutual funds (MFs) maintained their positive momentum in June 2018 as industry average or assets under management (AUM) increased for the 19th consecutive quarter to touch a new high of Rs 23.4 trillion.

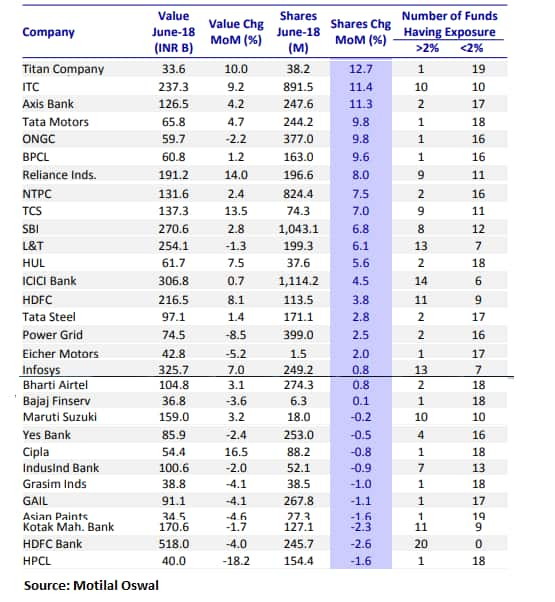

Fund managers are using every dip to add quality stocks to their funds. Among the Nifty50 names, the current hot favourites of fund managers, in which they have more than 2 percent exposure, are 30 stocks.

For example, in ITC as many as 10 funds have more than 2 percent exposure. In the case of L&T, as many as 13 funds have more than 2 percent exposure while 7 funds have less than 2 percent exposure, according to a report by Motilal Oswal.

In the banking pack, ICICI Bank, HDFC, HDFC Bank, and Kotak Mahindra Bank are prominent names in which more than 10 funds hold over 2 percent exposure.

On a year-on-year (YoY) basis, average AUM increased 19.8 percent (Rs 3.9 trillion) in June 2018, primarily on account of inflows in equity, balanced and liquid funds, and backed by strong participation from retail investors and phenomenal growth in SIP, the domestic brokerage firm said in a note.

Equity AUM, as a percentage of India’s market capitalisation, is at an all-time high of 5.4 percent (+70bp YoY), but it declined marginally in the June driven by the flattish performance of the markets.

However, the month saw a notable change in the sector and stock allocation of funds. On a month-on-month (MoM) basis, the weights of healthcare, technology, consumer, oil & gas, and metals increased, while those of capital goods, infrastructure, chemicals, cement, utilities, private banks and autos moderated.

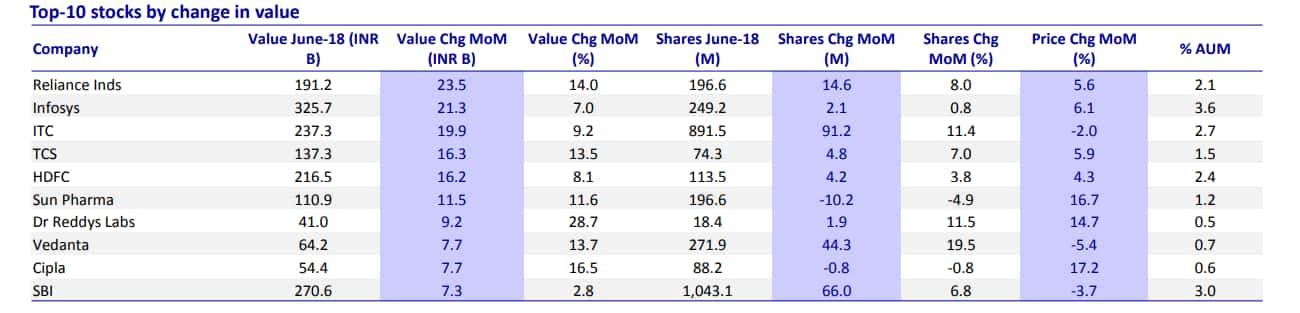

The top 10 stocks in terms of value increase on a MoM basis, five were from technology and healthcare. Reliance Industries saw a value increase of Rs 23.5 billion in June, as the stock was up 5.6 percent. Notably, the stock saw net buying by 14 of the top 20 funds.

ITC was also one of the preferred stocks among MFs in June with net buying by 13 funds. Value increased by Rs 19.9 billion, despite the stock delivering negative return of 2 percent in the month.

Vedanta, which entered the Sensex-30, also featured in MFs’ preferred stocks list in June, with net buying by 8 funds. Value increased by Rs 7.7 bn, despite the stock delivering negative return of 5.4 percent during the month.

Top 10 stocks which saw positive change in value in June include names like RIL, Infosys, ITC, TCS, HDFC, Sun Pharma, Dr Reddy’s Laboratories, Vedanta, Cipla, and SBI.

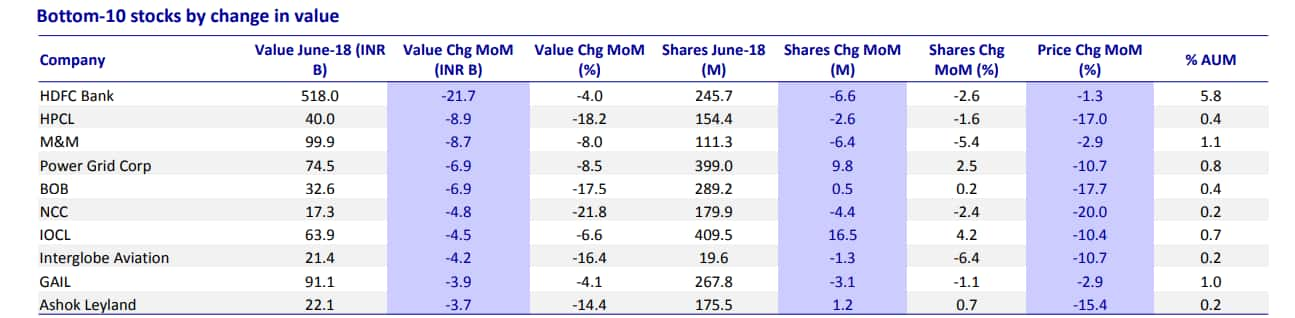

Top 10 stocks which saw a negative change in value or which were on fund managers’ radar to sell in June include names like HDFC Bank, HPCL, M&M, Power Grid, BoB, NCC, IOC, Interglobe Aviation, GAIL, and Ashok Leyland etc.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.