Benchmark indices sharply fell and struggled to regain momentum on 4 June, the day of election results. NSE Nifty 50 plummeted 500 points, and Sensex fell as much as 2000 points. At 10:37 am, the Sensex was down 1,975.30 points or 2.58 percent at 74,493.48, and the Nifty was down 584.90 points at 22,679.00. The market breadth was overwhelmingly negative, with About 614 shares advancing, 2575 shares falling. 87 shares were unchanged.

Long-Short ratio: 28:72

India VIX: 28.83 up 7.90 or 37.71 percent today

The early trading hours showed heightened volatility as markets reacted sharply to the unfolding election results, which showed NDA leading with narrower margins than what the exit polls showed.

Near-term supports intact, but traders must wait until volatility settles

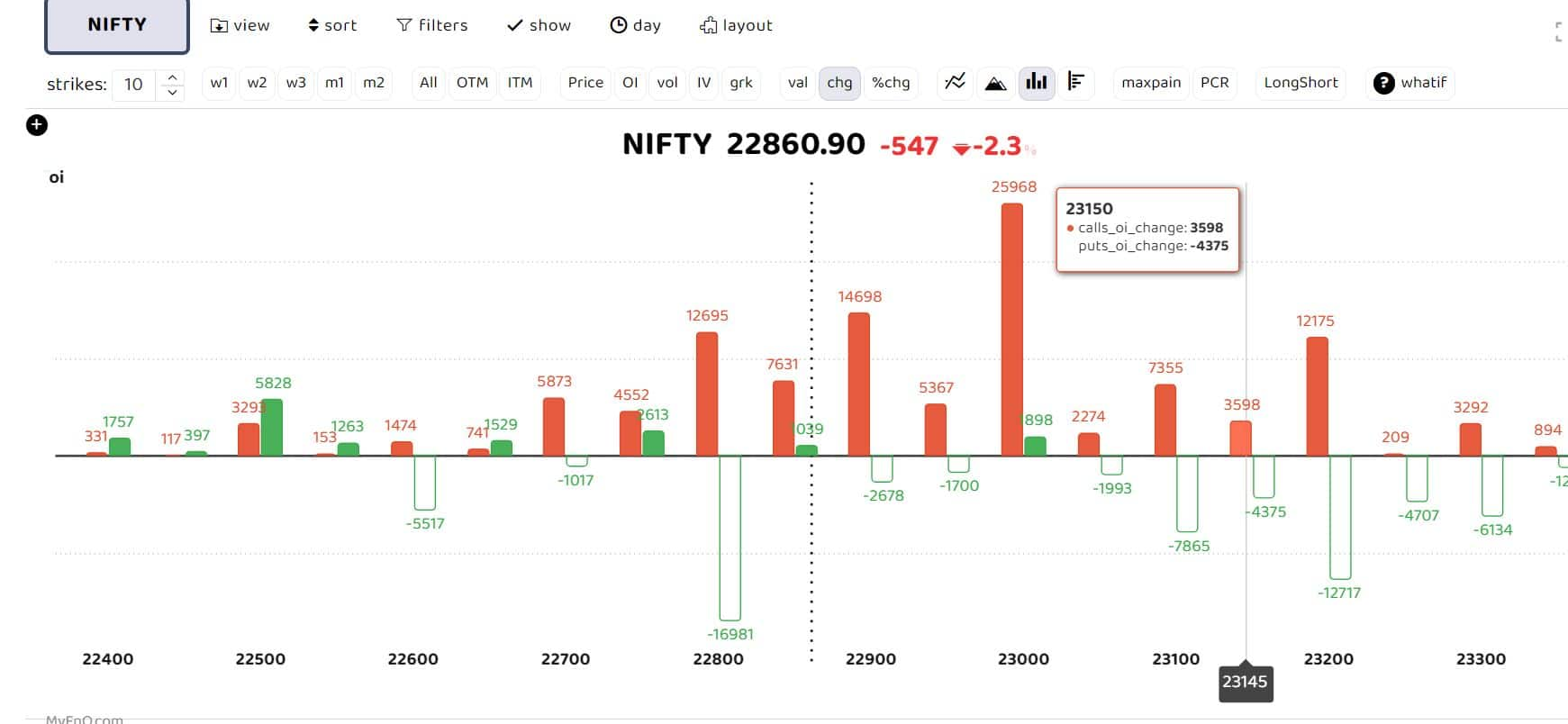

Options data revealed heavy call writing at the 23,000 and 23,200 levels, indicating resistance, whereas substantial put writing at 22,500 suggested strong support. Ruchit Jain, Lead Research at 5paisa.com, noted the market's nervous response to the initial results. “Markets have shown higher volatility at the start of the day as they react to the election results. Although the important near-term supports have not been breached, traders might prefer to wait on the sidelines until the volatility settles. The 40 DEMA in Bank Nifty, situated in the 48,800-48,700 range, is a crucial support zone to monitor," Jain said.

Nifty technical outlook: Check resistance, support

Adding to the technical analysis, Shilpa Rout, Head of Derivative Research at Prabhudas Lilladher, pointed out specific technical levels affecting market movements. "The market is very volatile, having reached the 161.8 percent retracement level at 23,400. Now, the lower end of the rising channel support is at the 22,100 zone. With the option chain reflecting PE OI unwinding at the weekly expiry and the 22,800 zone emerging as a new resistance, we could see an aggressive 500 to 800 point move post-results," Rout said.

Amid the turbulence, Arun Kumar Mantri, Founder of Mantri Finmart, advised traders to adopt a cautious approach until a clearer trend emerged post-11 AM. "As the election outcomes become clearer, we expect volatility to spike. A firm government majority could stabilise the markets, but indecisive results might trigger panic. Traders would do well to stay on the sidelines during the morning session," he recommended.

Follow our live blog for all market action

Rajesh Srivastava, a Derivatives Trader, observed an interesting shift in trading patterns. "Today’s variation in Nifty futures' open interest from the usual pattern suggests a possible end to the initial shorting trend seen at market open," Srivastava noted.

Vinay Rajani- Senior technical and derivative analyst at HDFC Securities noted that, "Semblance of support seen at 22380 in Nifty, sustainable level below which could drag Nifty towards 21800 in short term. Unless we see close above 23000, trend of Nifty could remain bearish."

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!