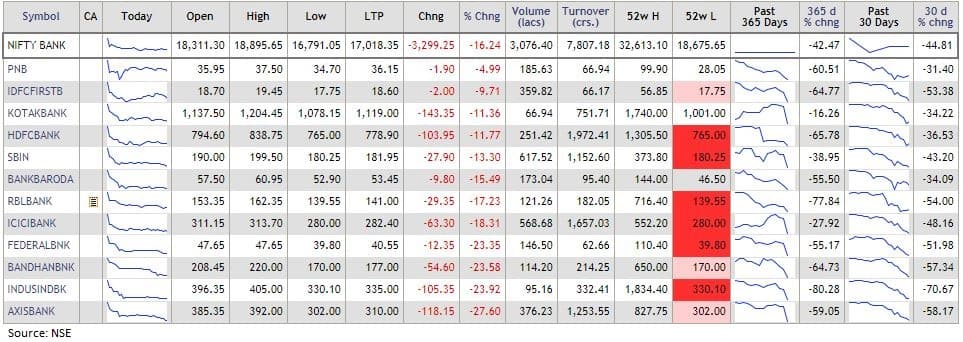

The Nifty Bank index closed with a massive loss of 3,400 points, or 16.73 percent, at 16,917.65 on March 23, registering its biggest single-day fall.

All 12 components of the index ended in deep red. With a loss of 28 percent, shares of Axis Bank emerged as the top loser in the index, followed by those of IndusInd Bank and Bandhan Bank that cracked 24 percent.

With a loss of 5 percent, Punjab National Bank ended as the stock that lost the least in the Nifty Bank index.

The index underperformed the benchmark Nifty for the second consecutive session. The BSE Sensex dropped 3,935 points, or 13.15 percent, to record its worst-ever one-day decline in absolute terms. The index closed at 25,981.

The Nifty 50 fell to a 4-year low registering its worst fall in absolute terms. It shed 1,135 points, or 13 percent, to end at 7,610.

"Bank Nifty underperformed the benchmark index for the second consecutive session and fell by around 17 percent, which is the worst fall for banking index since inception. It formed a big bearish candle on the daily chart," said Chandan Taparia, Vice President and Derivatives Analyst at Motilal Oswal Financial Services Limited.

Taparia highlighted that the banking index fell below 17,000 mark after a formation of an inside bar pattern on a daily scale, which is a negative sign for the index.

"Bank Nifty closed below its support of 78.60 percent retracement level (17,517) of its previous rally from 13,407 to 32,613 and yet there is no sign of a reversal in the index," he said.

"Looking at the current scenario, traders should avoid ‘catching the falling knife’ as ongoing correction may continue towards 16,000 - 15,500 levels. On the flipside, resistance is now shifting lower to 18,300 – 19,000 zone," Taparia added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.