Dear Reader,

The market concluded the extended week on a positive note, reaching a new record high at the close. One of the notable highlights of the week was the GDP figure, which surpassed market forecasts by a significant margin. As a result, the benchmark index ended the week one percent higher.

Saturday saw the markets open to facilitate testing of NSE backup sites for seamless intraday transition from the primary site to the Disaster Recovery site.

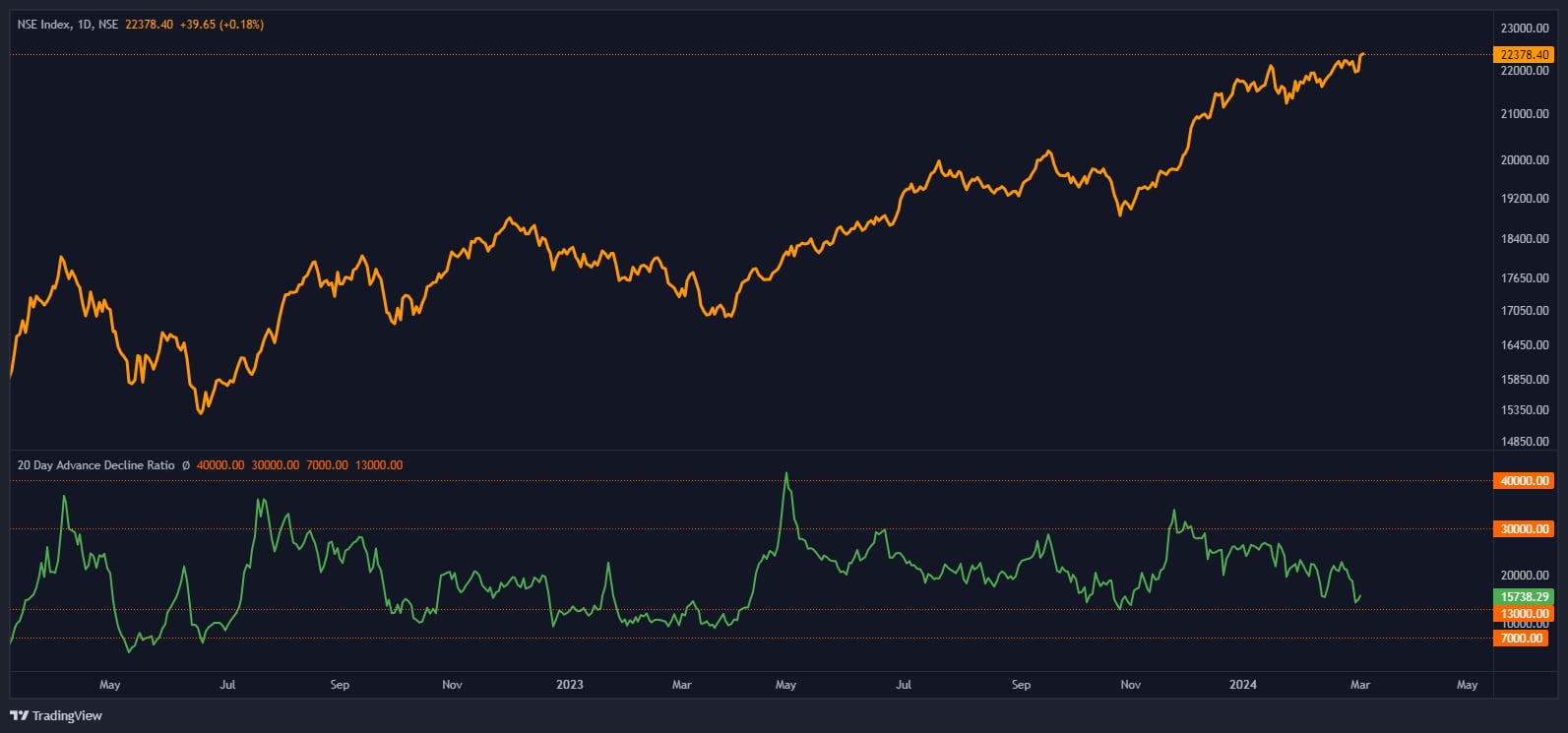

Despite the market reaching new peaks, there is a worrying trend emerging: the number of stocks contributing to the market's ascent is declining. This is evident from the decreasing 20-day advance-decline line depicted in the chart below, indicating diminishing participation of stocks in the upward movement.

Source: web.strike.money

Source: web.strike.money

Global markets also supported a positive move, with the MSCI World rising by 0.90 percent and the S&P500 rising by 0.95 percent as inflation cooled a bit.

Divergence Continues

Wild movement in the Nifty has not brought it out of the rising wedge formation. Prices are now at the top end of the range, and it is not clear if the trend will reverse downward again like the last two times or break out to the upside.

Weekly momentum indicators are whipsawing from sell to buy on the Nifty, not giving a clear indication of which side it will tilt. We should give it another day because of the multiple inter-market divergences. The new high in Nifty is not confirmed by a new high in Bank Nifty or the Nifty Small-Cap 100.

The daily swing at 67 is at a lower top than 74 at the previous top and 84 before that. In other words, we could be making lower highs in the momentum swing and higher highs in the Nifty. This will only be confirmed by an actual trend reversal in Nifty.

Source: web.strike.money

Source: web.strike.money

FIIs were covering shorts into the expiration but have added positions back at the start of March. Now, the net short is at 62761 contracts. Not an extreme from where short covering is seen but high and rising. It does not give a signal except to remain open to both sides.

Source: web.strike.money

Source: web.strike.money

The total futures open interest rose further this week to a record 4.17 lakh crore, and as a ratio to the index, it is at the top end of the range as plotted below. The last time the ratio was here, the Nifty fell for many weeks, and the Small and Mid-cap index fell for the next two years. This indicates excessive leverage in the futures market [stock + index] and is enough reason to retain a cautious view of the markets.

Source: web.strike.money

Source: web.strike.money

Indices and Market Breadth

Indian markets gained one percent during the week based on strong economic data. The Sensex, Nifty and Bank Nifty gained for the third straight week, rising by one percent each. Further, low FII activity also added to the gain. After selling over Rs 50,000 crore in the cash market, FII’s paused and sold only Rs 57.93 crore during the week. In fact, on the day the market touched a new high, FIIs bought Rs 3,568 crore of equities.

The mid-cap index snapped a four-week rally by falling by nearly one percent during the week.

Auto numbers helped pull the Auto index higher, which gained over 1.5 percent, but the star performers were metal stocks, gaining 3.60 percent and banking stocks, especially private sector banks, which gained 1.03 percent.

Among the losers during the week were Media, down by nearly seven percent, and Healthcare stocks, down around 2.5 percent.

L&T, Tata Motors, Tata Consumer and IndusInd Bank were the top gainers among frontline stocks, while Apollo Hospital, Asian Paints, Bajaj Auto and Divis Lab were the top losers.

Global Market

Most developed world markets had a good week, with the S&P500 and Nasdaq closing higher and the Dow Jones Industrial Average closing marginally lower.

European markets were mixed during the week, with the pan-European Stoxx 50 index closing 0.44 percent higher. While DAX closed 1.81 percent higher, CAX and FTSE closed slightly lower.

It was a good week for Chinese and Japanese markets, while Hang Seng and Kospi ended the week in red.

Stocks to watch

ICICI Bank, Tata Consumer, SBI, Cipla, Adani Ports, ABB, M&M, Torrent Pharma and BEL are among the stocks that can witness upside momentum.

Naveen Flourine, Hindustan Unilever, Bata India, Zee, PVR Inox, Kotak Bank and HDFC Bank can remain under pressure during the week.

Cheers,Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.