As we approach the year's final month, readers are always on the lookout for that one sector that could outperform and deliver strong returns. While many rely on traditional analysis methods like technical charts and fundamentals, seasonality analysis is an often overlooked strategy that could be the key to identifying hidden opportunities.

This method uses historical trends to predict how stocks or markets perform at specific times of the year. As we step into December 2024, seasonality analysis is becoming increasingly relevant—especially when it comes to the Metal sector.

In this article, we will explore how seasonality works and why December is shaping up to be a strong month for metals.

What’s on Nifty?

November ended almost flat for the Nifty50, down just 0.3%, but with a spread of over 1,100 points (the difference between the High and Low for the month). This widespread trend indicates heightened market volatility, yet the bulls have reason to remain optimistic.

Despite the fluctuations, the index successfully held above the crucial 200-day Exponential Moving Average (200DEMA), signalling that the overall trend remains bullish. While the broader market shows promise, one sector in particular is standing out—Metals.

Historically, the metal sector has been a key driver of bullish movements, particularly in the final months of the year.

Let us look at the seasonality of the Metals (Commodities) and then move on to the Nifty Metals Index.

The Seasonality of MCX Metals (Commodities)

The performance data from 2013 to 2023 show some intriguing trends for the commodities traded on the Multi Commodity Exchange (MCX).

>>Copper stands out as the leader in this sector, with an average monthly return of 2.10% in December and a positive return ratio of 75%. This strong historical performance makes copper an attractive candidate for seasonality-based investing during December.

>>Aluminium has an average return of 1.15%, while zinc averages 0.94% for December.

These figures are important because a high average return and a high positive return ratio make a stock or commodity an appealing investment opportunity. This seasonality trend in commodities sets the stage for our deeper dive into the Nifty Metals Index and its potential for December 2024.

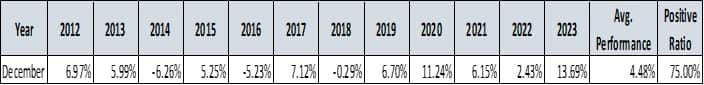

Seasonality of the Nifty Metals Index

Let us look at the Nifty Metals Index and its historical seasonality patterns.

From 2012 to 2023, the average monthly return for December has been an impressive 4.48%, with a positive return ratio of 75%. These numbers suggest that December is typically a strong month for the Nifty Metals Index, making it a compelling sector to watch as we move into the final month of 2024.

But what does the current chart of the Nifty Metals Index tell us? Is the index in line with its historical seasonal performance?

Nifty Metals Index Chart

The Nifty Metals Index shows signs of reversal from a key support zone on the daily chart. This suggests that the bulls are gaining control, and the support zone is turning into a demand zone, a potential signal for upward movement.

Additionally, a positive divergence on the Relative Strength Index (RSI) further strengthens the case for a bullish reversal.

When viewed through the lens of seasonality, these technical indicators suggest that the Nifty Metals Index may be potentially poised for a strong December performance, continuing its historical trend of outperformance.

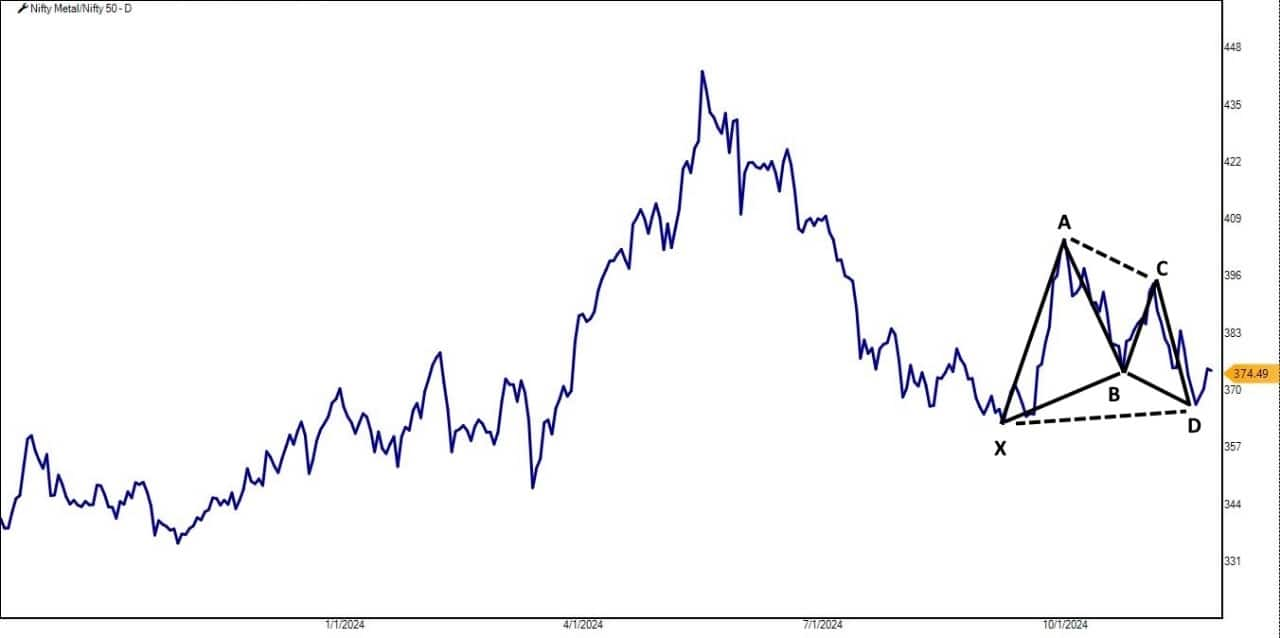

Can Nifty Metals Outperform the Nifty50?

The ultimate question is whether the Nifty Metals Index has the potential to outperform the broader Nifty50 index. To answer this, we can analyse the ratio chart of NiftyMetals/Nifty50.Nifty Metal/Nifty50 Ratio Chart

The daily ratio chart of Nifty Metal/Nifty50 shows a Bullish Gartley Harmonic Pattern, often associated with potential reversals.

Harmonic patterns are calculated based on Fibonacci ratios, and a bullish reversal suggests that the Nifty Metals Index could potentially outperform the Nifty50 in the coming month.

This pattern, coupled with the seasonality data, reinforces the idea that the Metal sector could lead the charge in the final month of the year.

Seasonality Analysis of Nifty Metals Constituents

To further refine our analysis, let us check the seasonality performance for the individual stocks that comprise the Nifty Metals Index.

The Bulls of December 2024 are?

The Bulls of December 2024 are?

As we approach December, the seasonality analysis of both MCX metals and the Nifty Metals Index provides compelling evidence that metals could be potentially poised for a strong bullish run. With a solid historical performance in December, technical signs of reversal, and the potential for outperformance relative to the broader Nifty50 index, the Metal sector seems like a potential candidate position for a profitable December.

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is not a recommendation. This article is strictly for educative purposes only.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.