The Indian stock markets witnessed a powerful rally following the recent ceasefire developments, igniting bullish momentum across various sectors. While short-term traders capitalise on brief price swings, investors looking for more meaningful potential returns often turn their gaze toward strategic setups that span weeks or months.

One potential investing strategy is the Heikin Ashi Multi-Time Frame setup, particularly for identifying bullish momentum in volatile segments. The strategy focuses on identifying Bullish Heikin Ashi Candles (Open=Low) across monthly, weekly, and daily charts, a rare but powerful alignment signalling a potential uptrend.

While inherently high-risk and volatile, micro-cap stocks offer exponential growth opportunities when picked with the right technical and fundamental filters. Based on the above setup, here are four microcap stocks with a bullish structure that deserve a spot on your watchlist:

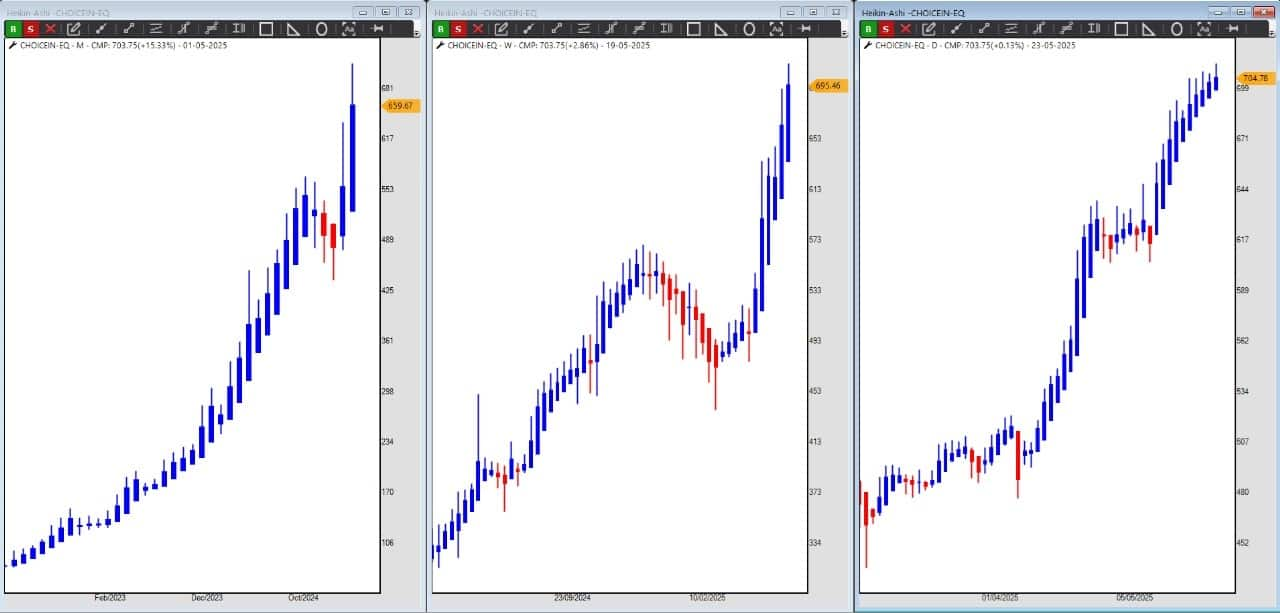

Choice International Ltd. is a diversified financial services company based in India. It operates in various verticals, such as investment banking, retail broking, mutual fund distribution, and advisory services.

The charts show a strong bullish sentiment across multiple time frames. The monthly chart, using Heikin Ashi candles, indicates the start of an upward trend, while both the weekly and daily charts further confirm the emergence of a powerful bullish trend.

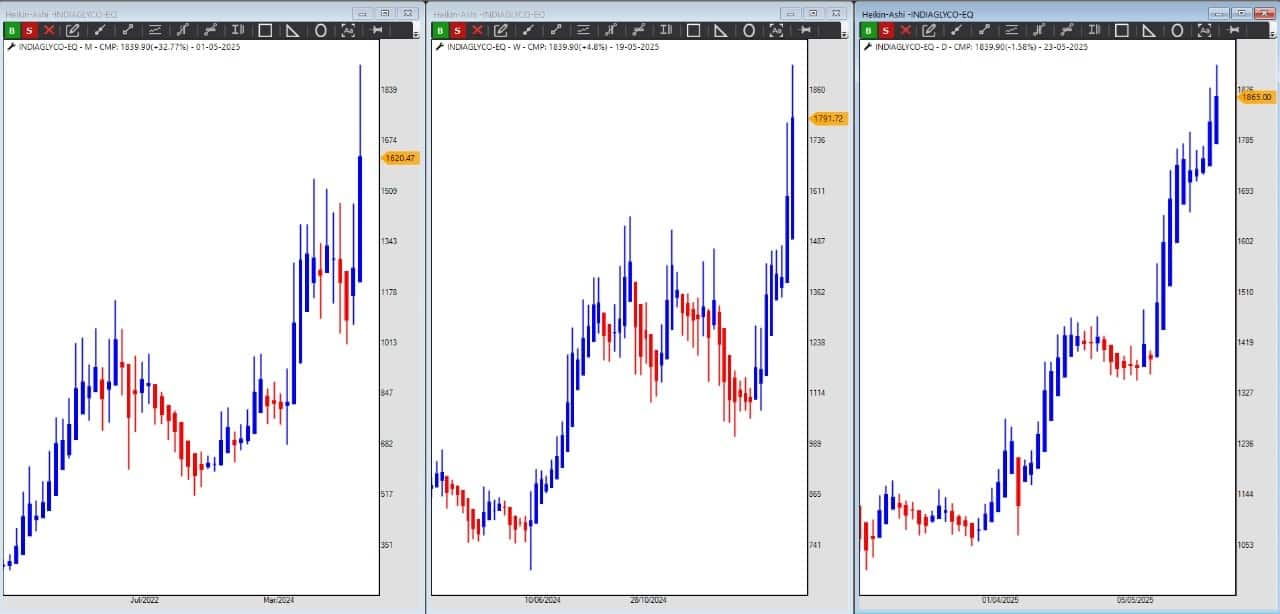

India Glycols is a unique player in India’s speciality and green chemicals space. It is one of the few companies globally manufacturing green chemicals from renewable feedstock. Its product portfolio includes ethylene glycols, performance chemicals, and natural gums, serving industries ranging from pharmaceuticals to personal care.

After an eight-month consolidation on the monthly chart, bullish Heikin Ashi candles return signals that the bulls are back in control. This strong bullish trend is further confirmed by the large-bodied Heikin Ashi candles appearing on both the weekly and daily charts.

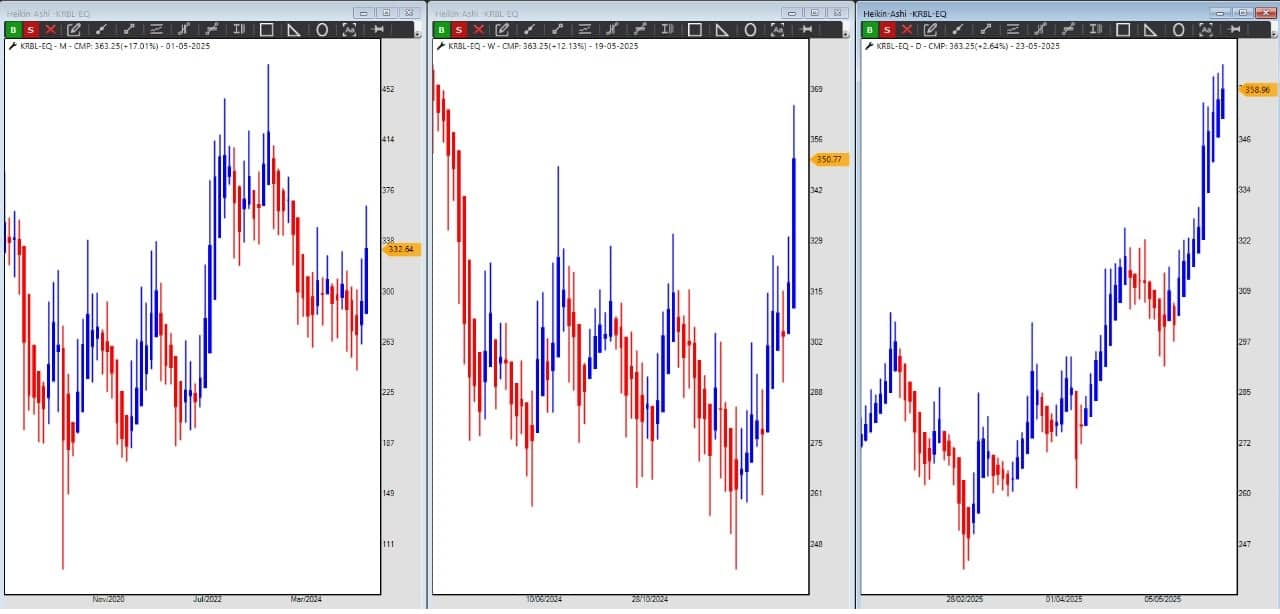

KRBL is one of the world’s largest exporters of Basmati rice, and it is known for its flagship brand, India Gate. With a legacy of over 130 years, KRBL has a dominant presence in the global rice market and a significant domestic footprint. Its integrated operations—from seed development to marketing—allow it to maintain consistent quality and profitability.

The stock experienced a significant correction, falling from Rs 450 to 250, as indicated by bearish or Doji candles on the monthly Heikin Ashi chart. However, the emergence of a bullish Heikin Ashi candle in the current month suggests a potential reversal and the start of a new upward trend. This potential bullish momentum is further supported by the bullish Heikin Ashi candles observed on the weekly and daily charts.

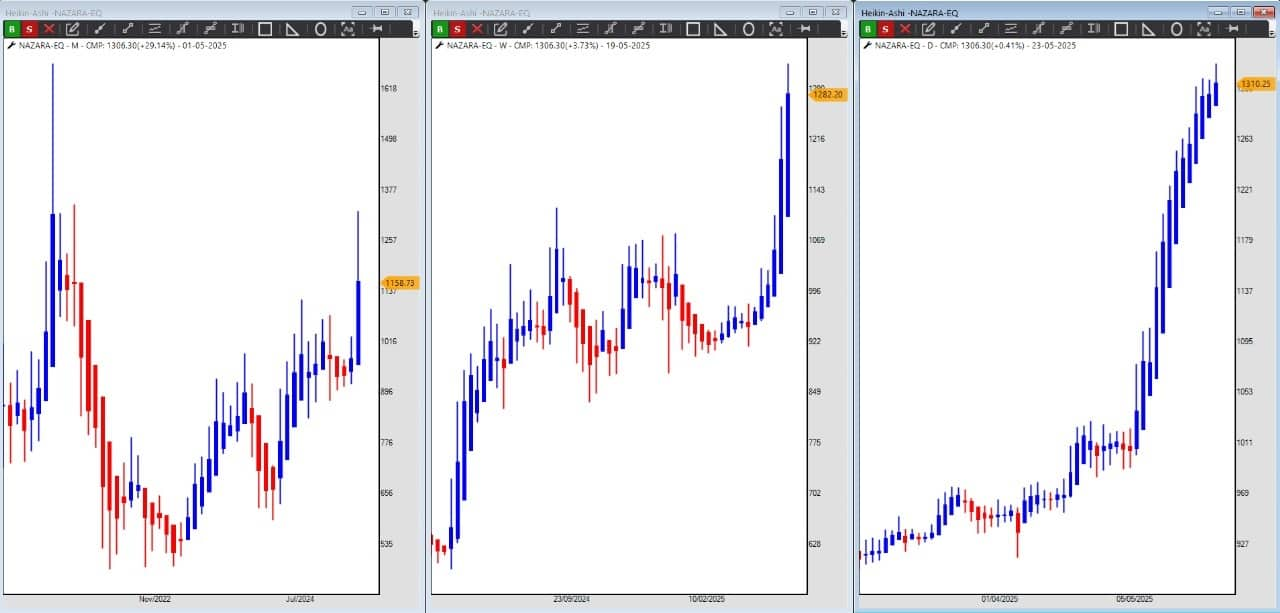

Nazara Technologies is a leading Indian gaming and sports media platform. With operations spanning across India, North America, and Africa, Nazara has a diversified portfolio that includes esports, gamified learning, and mobile gaming. It has strategically invested in platforms like Nodwin Gaming and Sportskeeda, positioning itself at the intersection of entertainment and digital consumption trends. As mobile internet penetration deepens in emerging markets, Nazara is well-placed to capitalise on the growing digital gaming ecosystem.

The stock price had been consolidating for eight months on the monthly chart within a bullish Pennant pattern. The appearance of a bullish Heikin Ashi candle above the Pennant breakout signals a clear resumption of bullish momentum.

Additionally, the weekly and daily charts are showing a series of bullish Heikin Ashi candles, which further strengthens the indication of a potential bullish trend.

While each of these microcap stocks carries inherent risks, the current technical setup supported by the Heikin Ashi Multi-Time Frame alignment signals a potential for bullish breakouts.

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. This article is strictly for educative purposes only.Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.