After years of snoozing, PSUs have finally woken up and wowed investors, making FY24 the year they stole the show. The PSU index returns of 92 percent have left Nifty 50's 28 percent in the dust.

According to domestic brokerage Motilal Oswal, the government’s infrastructure and capex push, which gathered steam post-pandemic, along with cleaner balance sheets, improved governance, margin boosts for commodities, and burgeoning order books, have all driven this stellar PSU performance.

Let’s dive into the details of this rally and see what's next.

1. PSU market-cap surges

From FY14-24, PSUs’ market cap shot up from Rs 14 lakh crore to a whopping Rs 66 lakh crore, a solid 16.66% CAGR. Meanwhile, the private sector's market cap rocketed from Rs 55 lakh crore to Rs 323 lakh crore, achieving a 19.37% CAGR.

India’s overall market cap also saw an astronomical rise, zooming from Rs 69 lakh crore in FY14 to Rs 389 lakh crore in FY24, and currently standing at Rs 440 lakh crore. While PSUs have made impressive gains, their return rate over the past decade still trails behind the private sector.

Also Read | NFL, FACT, RCF, other fertiliser stocks zoom up to 20%; here's what's fuelling the rally

2) Gaining weight, but...

Back in FY14, PSU stocks commanded 20.8 percent of the total market capitalization. This plummeted to a low of 10.5 percent in FY22.

However, the PSU stock rally has helped them regain ground, and they now hold 17.5 percent of the total market cap. That perhaps means there’s still room to grow and reclaim past glories.

3. The earnings story

Over the past five years, PSUs have seen a steady rise in profit pool, after a big drop in the previous five years. PSU profits surged 4.3x from Rs 1.3 lakh crore in FY19 to Rs 5.5 lakh crore in FY24.

PSU earnings during this period saw a dazzling 33.8 percent CAGR, outshining the private sector’s 18.6 percent CAGR. PSUs’ share of the profit pool expanded to 36 percent in FY24, a significant leap from the 17-30 percent range of previous years.

4. Bankable again

PSUs operate largely in cyclical industries like metals, oil & gas, or financials, making them more susceptible to market swings. From FY14-24, public-sector banks cleaned up their balance sheets, initially taking a toll on overall PSU profits since these banks formed one-third of the profit pool of Indian PSUs.

Motilal Oswal noted that the profits of PSU Banks soared to Rs 1.6 lakh crore in FY24 from a reported loss of Rs 30,000 crore in FY19. About 68 percent of the profits during FY19-24 came from BFSI, with Oil & Gas and Metals chipping in 21 percent and 5 percent, respectively.

5. Of comebacks and turnarounds

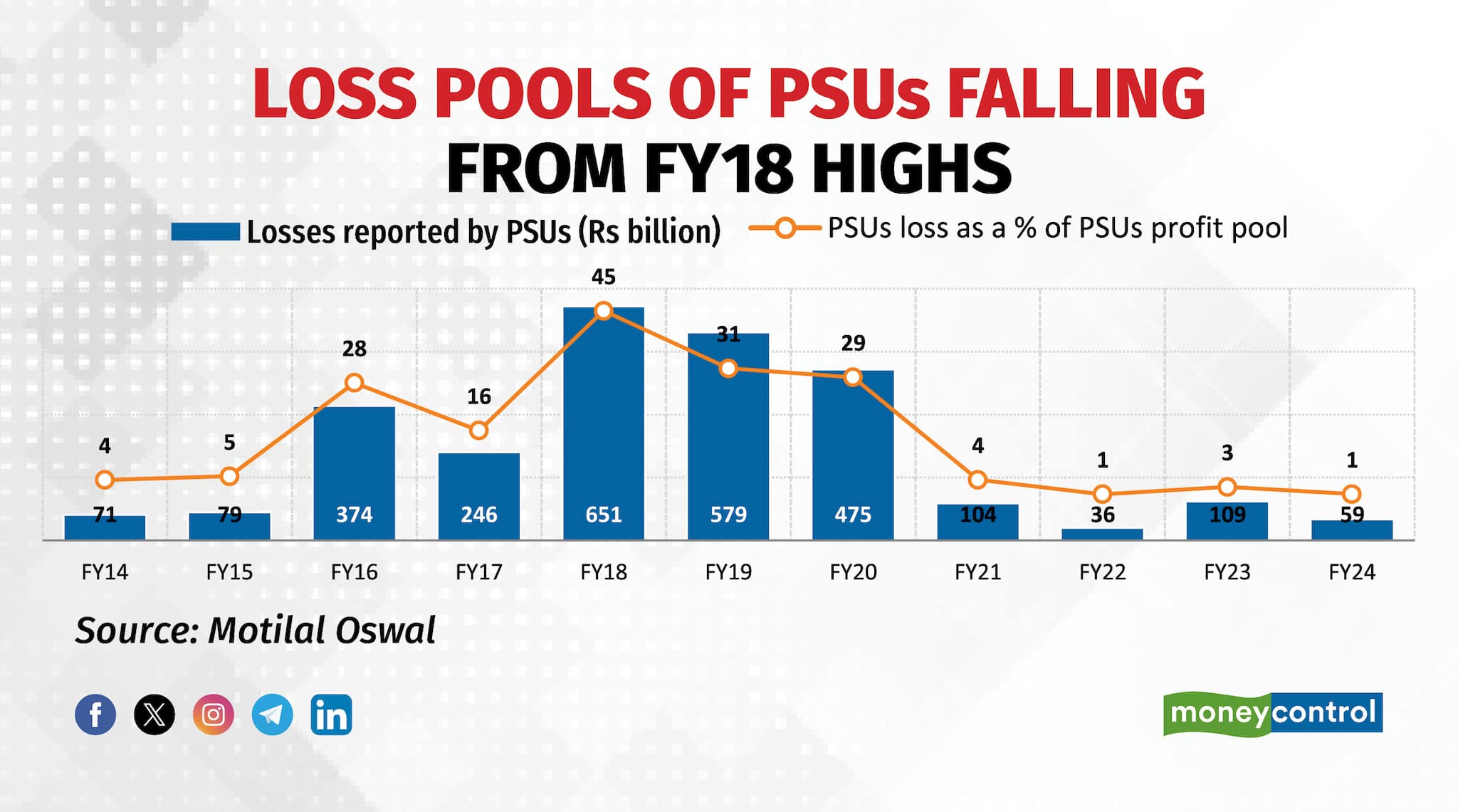

The number of loss-making PSUs has significantly dropped over the past five years. The contribution of loss-making companies has plummeted from 45 percent in FY18 to just 1 percent of the profit pool as of FY24.

Over the past decade, two-thirds of the PSU universe have generated between five to seven years of positive returns. Of the top 25 stocks, 13 belong to the BFSI space.

6) Apna time aa gaya!

PSU stocks have made a fantastic comeback from FY20 to FY24. The BSE PSU index reported a 9 percent compounded decline during June 2014 to June 2020, but clocked an impressive CAGR of 45 percent during the past four years (June 2020 to June 2024).

The index P/E ratio expanded to 12.8x as of June 2024, as against Nifty 50's P/E ratio of 22.4x.

The outperformance continues in FY25, as the Nifty 50 has gained around 5.5 percent, while the PSU index has raced ahead, recording a sharp uptick of 18 percent.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.