With the Union Budget 2025 just round the corner, most market experts believe that unlike last year, Finance Minister Nirmala Sitharaman will not spring a surprise this year in the form of a hike capital gains tax.

They also believe that while the government could look at some tax measures to boost consumption at a time when growth has taken a hit, the budget will only have a limited impact in terms of acting as a catalyst for reviving growth or earnings.

These are some of the key findings of the latest Moneycontrol Market Poll, which saw participation of nearly 45 respondents across categories including broking firms, mutual funds, AIFs, PMS and independent experts.

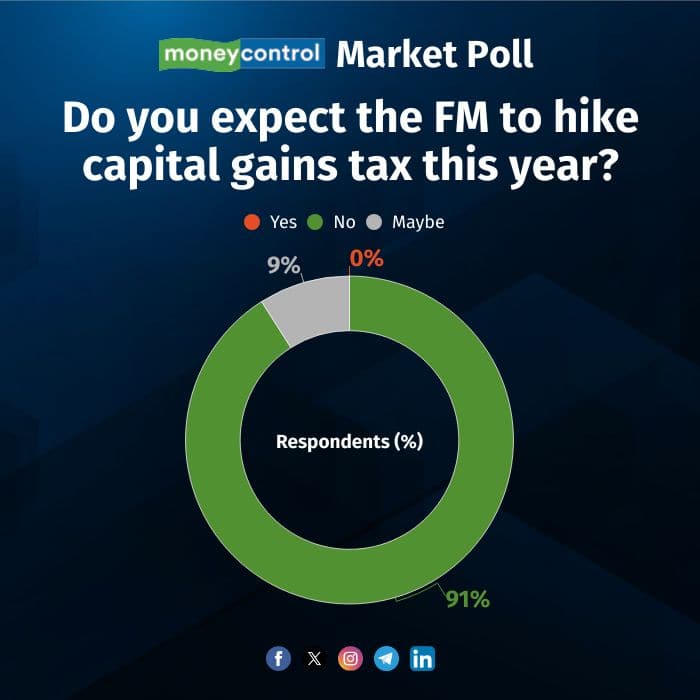

A whopping 91 percent of the respondents said that they do not expect the finance minister to announce any kind of hike in the capital gains tax this year. Interestingly, given last year’s surprise announcement, the balance nine percent said that “maybe” the FM will announce a hike. None of the respondents opted for the “no” option.

This assumes significance as the increase in the capital gains tax last year grabbed many headlines with the markets also taking a huge hit on account of the surprise announcement.

While presenting the Union Budget last year, the finance minister announced an increase in the short-term capital gains tax on equity holdings held for less than one year from 15 percent to 20 percent. Similarly, the long-term capital gains tax on holdings sold after one year was increased from 10 percent to 12.5 percent.

Will the Budget help revive corporate earnings?On a different note, a majority of respondents – 44 percent -- said that the Budget will most likely announce measures to help revive corporate earnings, but those might not be enough to achieve a 15 percent growth in the earnings of Nifty companies.

Another, 21 percent of the respondents clearly said that the Budget could not fix earnings slowdown though 19 percent felt it could. The balance 16 percent of the respondents said that earnings revival would depend on external factors.

Incidentally, brokerages forecast continued slow growth for companies in the December quarter, with only a few sectors expected to report robust earnings. Brokerages predict that top-line growth for the listed firms will remain subdued for the seventh consecutive quarter. Further, year-on-year (YoY) margins are expected to face pressure, resulting in the third consecutive quarter of sub-10% profit growth.

Meanwhile, in terms of capex growth, 51 percent of the respondents said they expect it to be in the range of 8-12 percent in this year’s Budget with 35 percent of the respondents expecting it to be just 5-8 percent. The rest 14 percent said they expect it to be in the range of 12-15 percent.

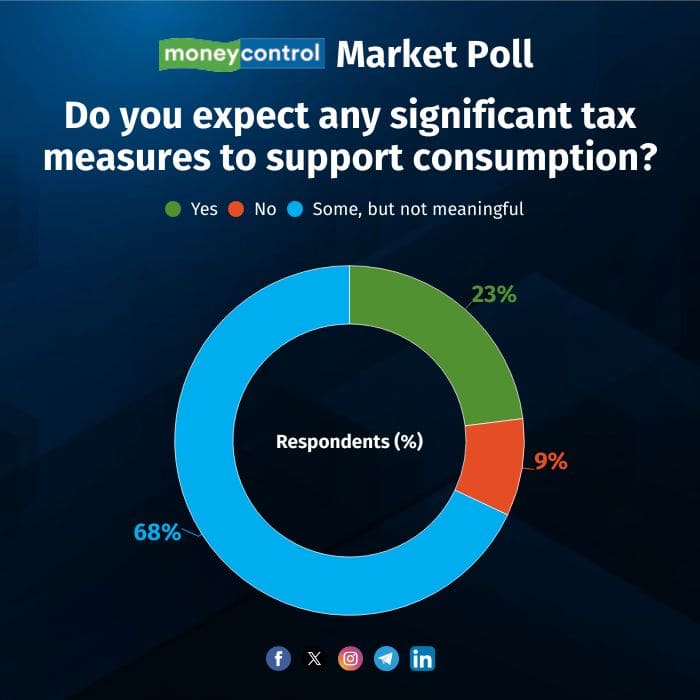

Tax measures to boost consumption, focus areas, core sectorsWith economic growth already subdued – India’s growth is set to dip to 6.4 percent in FY25, its lowest level in four years, according to preliminary data released on January 7 – market experts believe that the Budget would include some tax measures to boost consumption.

However, a majority of the respondents – 68 percent – believe that while there would be some tax-related announcements to boost consumption, they will not be “meaningful”.

Only 23 percent of the respondents believe that there would be tax-related announcements to boost consumption. The rest nine percent said they do not expect any such announcement in the Budget.

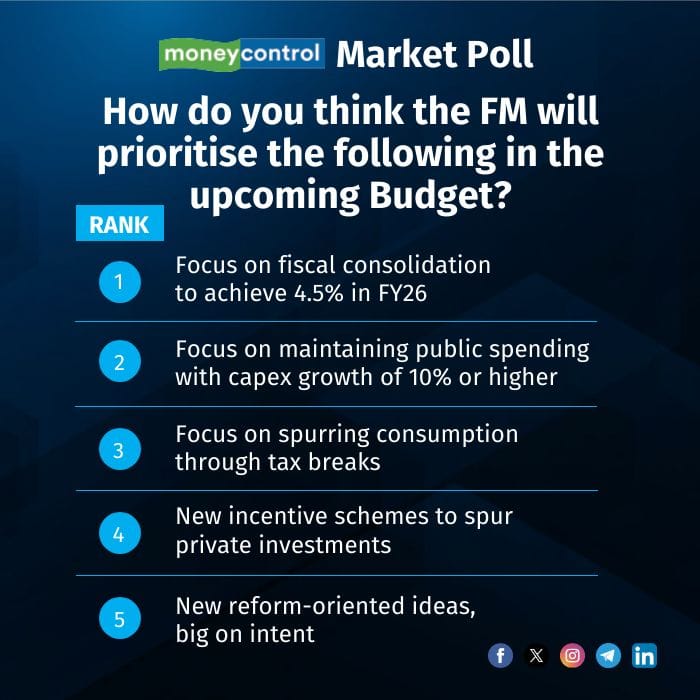

In terms of priority areas, most market experts said that the finance minister could "focus on fiscal consolidation to achieve 4.5% in FY26" followed by focusing on “maintaining public spending with capex growth of 10% or higher” followed by “new reform-oriented ideas, big on intent”.

Other priority areas that experts believe would on the FM’s radar are: focus on spurring consumption through tax breaks, new incentive schemes to spur private investments, and New reform-oriented ideas.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.