The Indian markets were volatile in February, with analysts warning of high valuations. Foreign investors, however, rushed for consumer services, auto, and healthcare stocks while selling financials.

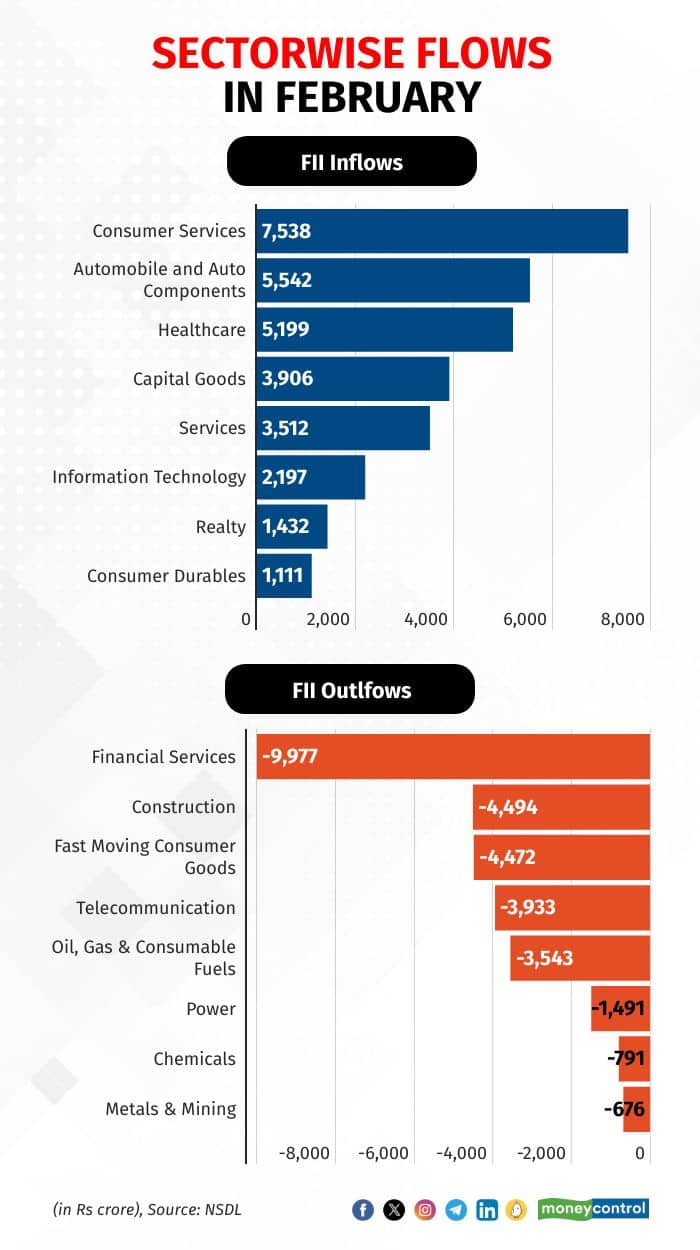

Foreign institutional investors (FIIs) pumped Rs 7,538 crore into consumer services stocks in February, while auto and healthcare drew Rs 5,542 crore and Rs 5,200 crore.

Capital goods, services, IT, realty, and consumer durables saw significant buying interest in February. Capital goods received Rs 3,906 crore, while services and IT stocks received Rs 3,512 crore and Rs 2,197 crore. Realty and consumer durables registered inflows of Rs 1,432 crore and Rs 1,111 crore during the month.

On the selling side, FIIs offloaded financial, construction, and FMCG stocks. They were net sellers of financial services shares, pulling out Rs 10,000 crore from the market in February, after Rs 30,000 crore a month back.

Market watchers say moderating credit demand and the struggle to raise deposits have led to investors going cautious on the banking sector. Since NBFCs are dependent on banks for funds, the banking sector blues might see them in the red in the near term.

Construction and telecom were the other two sectors on the sell list of FIIs last month. They net sold Rs 4,494 crore of construction shares and Rs 4,472 crore of telecom shares. Significant selling was also observed in fast-moving telecom at Rs 3,933 crore, oil and gas at Rs 3,543 crore, power at Rs 1,491 crore, and chemicals at Rs 791 crore, according to the sector-wise data from the National Securities Depository.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.