The National Stock Exchange — India’s number one bourse — may have paid out anywhere between Rs 500-1,000 crore in rebates to trading members on options trades in FY22-23, according to calculations by Moneycontrol. The numbers may vary depending on assumptions and could even be higher, as market share of brokers by turnover is not available publicly.

The NSE declined to give details of how much rebate it paid to its trading members in FY22-23.

The rebate is offered on the exchange transaction charges that brokers collect from clients and pass on to the bourse. Brokers receive the highest rebate on options transactions, compared to that on cash market and futures transactions. Stock exchanges offering rebates to brokers is a global practice, and in the US, brokers like Robinhood get rebates from exchanges as well as from market makers, to whom they route their clients’ orders.

Industry watchers say the rebates from the NSE partly subsidises the low brokerage that discount brokers charge clients. For instance, many discount brokers charge a flat fee of Rs 20 per trade or 0.02 percent of the transaction value, whichever is lower. In fact, some brokers impose zero charges, making up for that in other ways.

The math

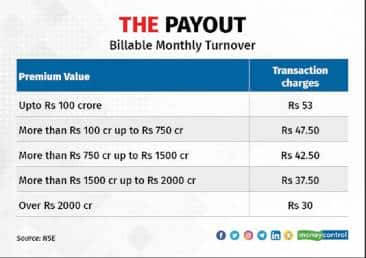

If a broker has a monthly turnover of over Rs 2,000 crore in options premia, the exchange transaction charge applicable is Rs 30 per lakh on the incremental turnover (above Rs 2,000 crore), compared to Rs 50 per lakh for the first Rs 100 crore of turnover.

Brokers almost always charge their clients Rs 50 per lakh, but have to pay only Rs 30 per lakh to NSE when their turnover exceeds Rs 2,000 crore a month, thus earning Rs 20, or 0.02 percent, in the process.

This means that once the turnover crosses Rs 2,000 crore, the broker is getting an additional 0.02 percent, over and above the fee charged from clients.

The payout

For the first nine months, the peak exchange transaction was Rs 50 per lakh of turnover for the first Rs 100 crore, and from January to March, it was Rs 53 per lakh. Assuming brokers collected transaction charges from their clients at the highest rates of Rs 50 and Rs 53, that works out to a total of Rs 6,054 crore owed to the NSE, excluding rebate.

Options turnover (premium only) on the NSE in FY22-23 was Rs 119 trillion, a near four-fold jump over the previous year. A broker with a 1 percent share in the options market would do roughly Rs 1.2 trillion (Rs 1.2 lakh crore) of premium turnover annually, or Rs 10,000 crore a month.

Applying the various slabs mentioned above, a broker doing Rs 10,000 crore of options (premium) turnover a month stands to earn around Rs 1.75 crore a month, or Rs 21 crore annually. A broker with a 10 percent market share could earn around Rs 20 crore a month, or Rs 240 crore a year through rebates.

Market share

Using data available on the NSE website, it is possible to calculate the market share of brokers as a percentage of the active client base (32.6 million) at the end of FY22-23. However, the share of active clients need not always be proportional to the share of turnover value, though there could be a direct correlation to an extent.

Brokers with a small base of high-volume algo traders can always gross a much higher turnover than a broker with a much larger base of clients. According to the SEBI annual report, the top 10 brokers accounted for 58 percent of the notional turnover in NSE’s derivative market in FY21-22, up from 51 percent the previous year. Data for FY22-23 is not yet available.

Options trading in India has seen an explosive growth over the last three years, with annual turnover of options premium climbing from little over Rs 10 trillion in FY19-20 to Rs 119 trillion in FY22-23. It has also helped the NSE retain its position as the world's largest derivatives exchange in terms of number of contracts traded for the fourth year in a row, according to statistics by the Futures Industry Association (FIA), a derivatives trade body.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.