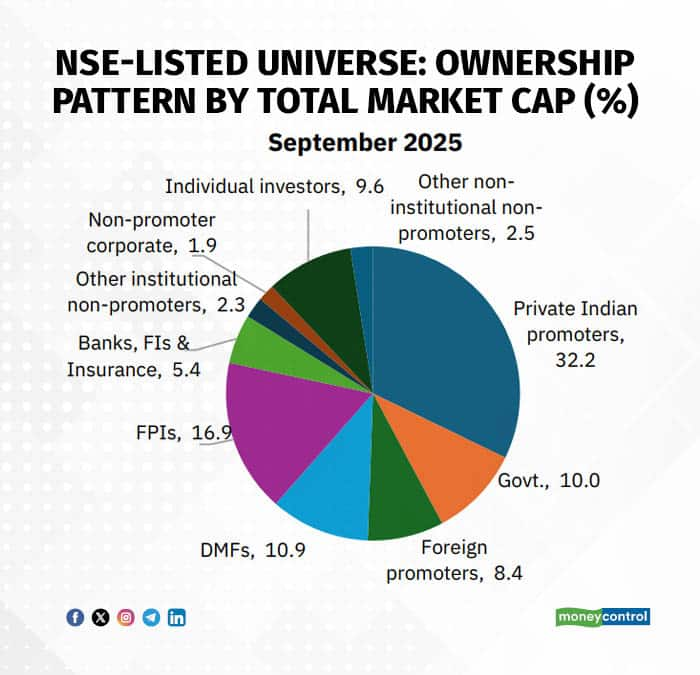

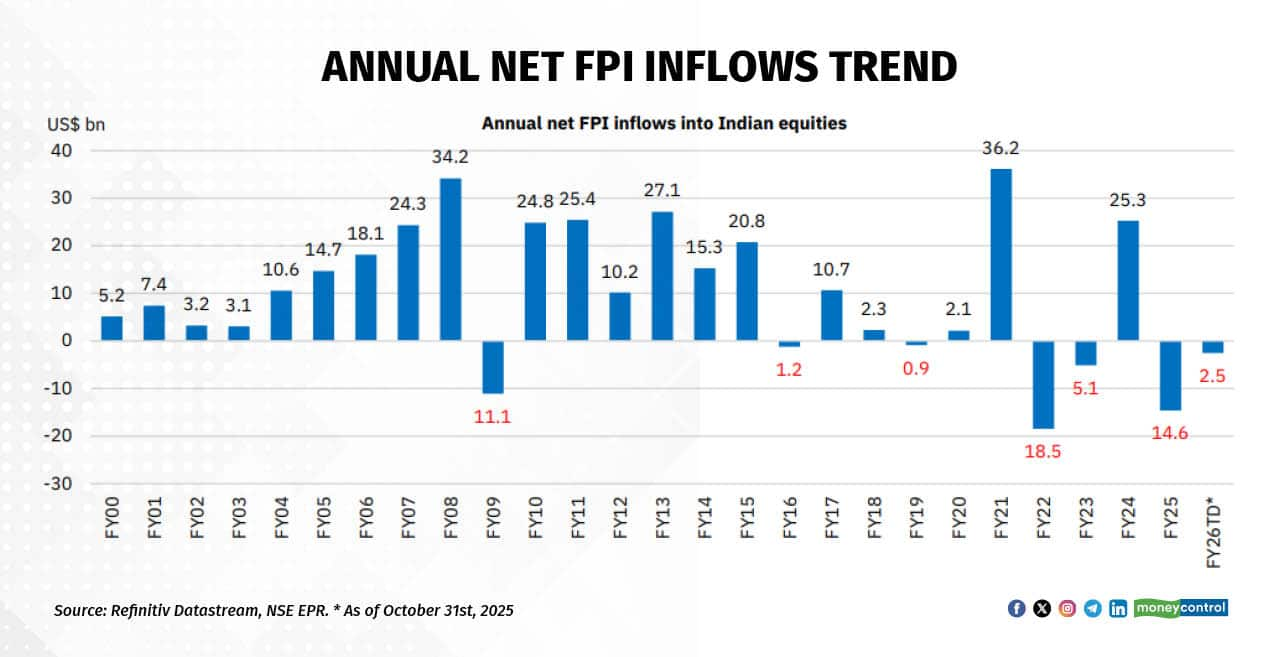

Over the past year, lacklustre returns from domestic equities have made India less attractive to foreign institutional investors, who have relentlessly trimmed their exposure. As a result, FPI ownership in NSE-listed companies declined to 16.9 percent in the September quarter, marking the lowest level in over 15 years amid continued outflows.

The National Stock Exchange’s report highlighted that barring two quarters, FPIs have steadily been paring ownership in NSE-listed companies since March 2023. For the September quarter, holdings declined by 63 basis points.

The selling has been widespread. In value-terms, FPIs pulled out $8.7 billion or roughly Rs 77,000 crore, with a holding of Rs 75.2 lakh crore as of September 30, 2025.

Not just the total listed markets, but the Nifty 50 and Nifty 500 have also seen a sell-off from foreign investors. FPI ownership in the Nifty 50 hit 24.1 percent, lower by 43 basis points on a sequential basis. Foreign holdings sank to 13-year lows for the Nifty 500 at 18 percent, lower by 46 basis points on a quarterly basis, according to NSE’s latest India Ownership Tracker report.

On the flipside, domestic mutual funds (DMFs) extended their record run to the ninth consecutive quarter, as a result of relentless inflows and SIPs. As a result, the ownership of domestic mutual funds rose to 13.5 percent in the Nifty 50 index, 11.4 percent in the Nifty 500, and 10.9 percent across all NSE-listed companies.

As a result of the strong bullishness from DMFs, domestic institutional investors or DIIs, which comprise DMFs, Banks, Financial Institutions & insurance and other institutional non-promoters, saw their ownership in all NSE-listed firms rise to 18.7 percent, surpassing FPIs for the fourth consecutive quarter after a 21-year gap, with the DII-FPI gap widening further.

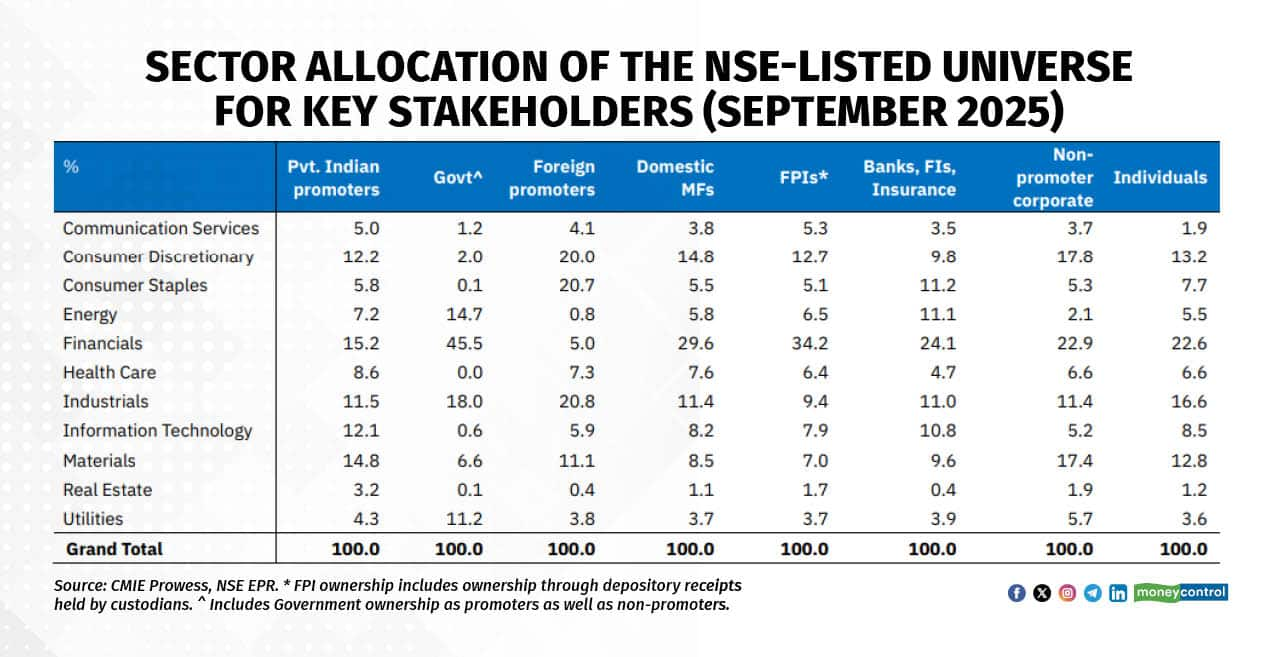

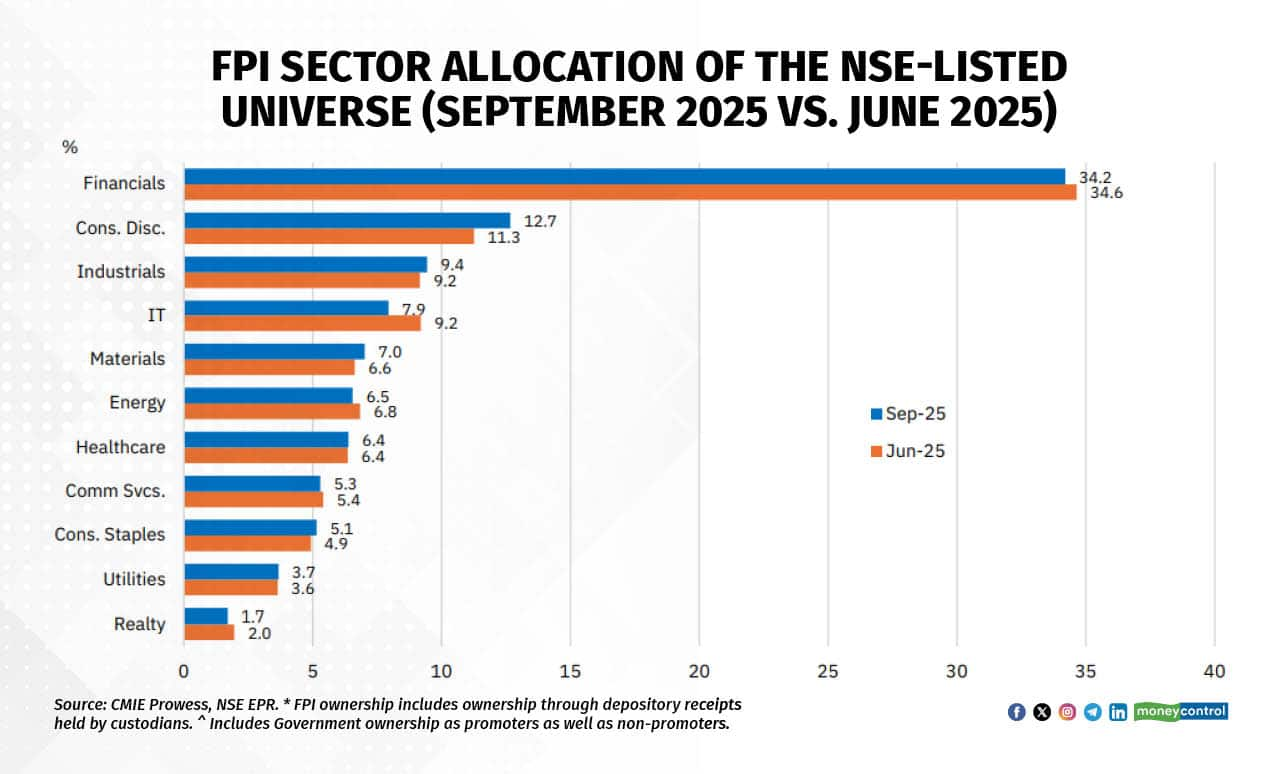

Despite the consistent selling, FPIs maintained their strong overweight position on Financials. However, “FPI exposure to Financials eased by 44 bps QoQ to 34.2 percent after three successive quarters of increases,” the report noted, “Though investors continue to hold a pronounced overweight in the sector relative to the broader market.”

Marginal reductions in FPI holdings were also observed in allocations to Energy and Real Estate. These shifts were offset by a notable 1.4 percentage point rise in Consumer Discretionary holdings to a record 12.7 percent, underscoring a strengthening conviction in India’s domestic consumption story.

Meanwhile, FPIs sharply reduced their allocation to the Information Technology sector, which fell 1.25 percentage points QoQ to a record low of 7.9 percent in the September 2025 quarter, which is the third consecutive quarterly decline and a cumulative drop of 6.6 percentage points over the past 15 quarters.

“Once among the two most preferred sectors for FPIs, with a peak allocation of 31.5 percent in December 2002, IT has now slipped to fourth position with roughly a quarter of that share,” added the NSE.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.