After a stellar performance for most of 2024, Indian equities have sharply underperformed their emerging market peers. However, with Goods and Services Tax (GST) rationalisation, a ratings upgrade, and bets on rising consumption, can Dalal Street stage a turnaround?

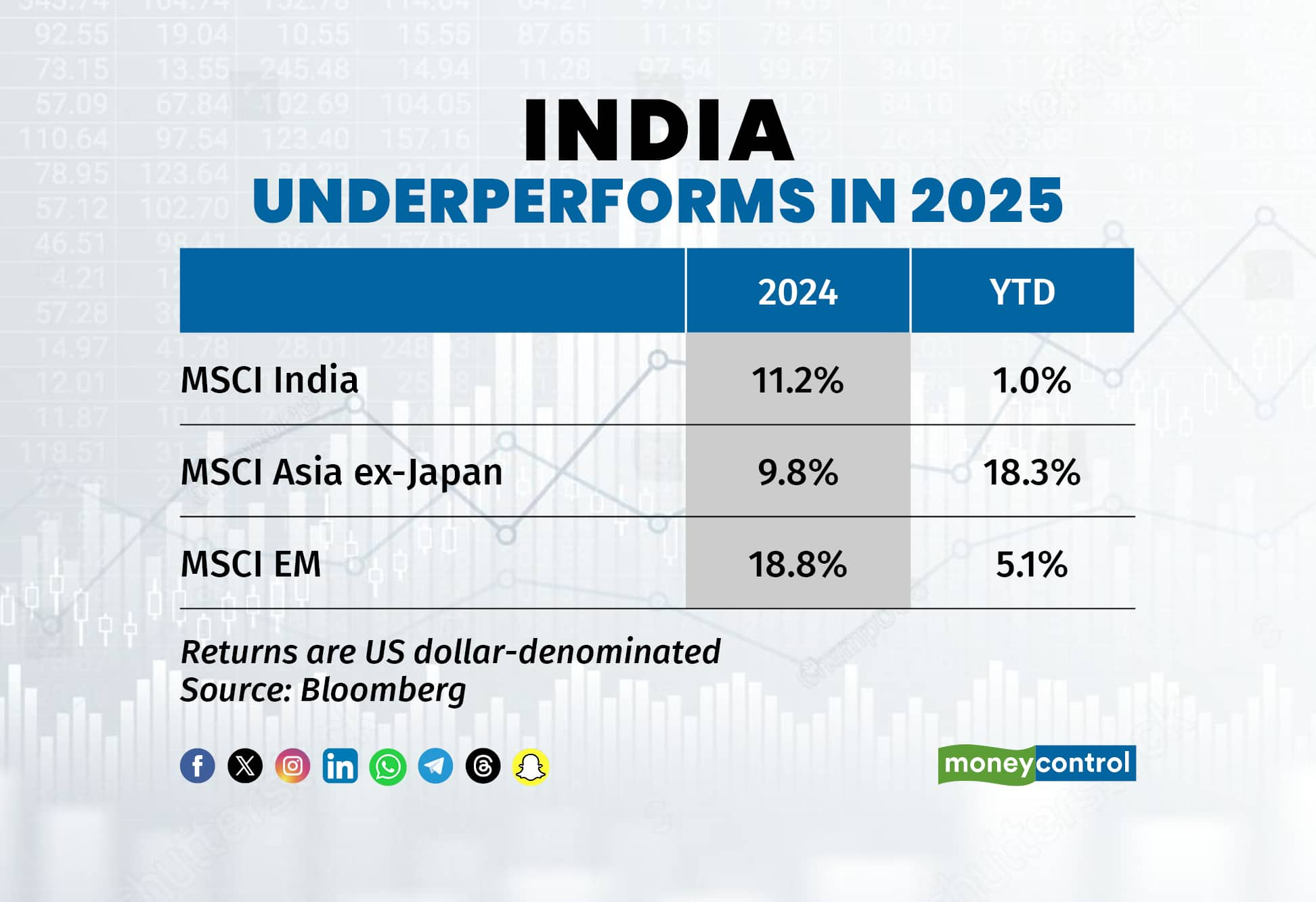

India’s underperformance against emerging markets and Asian peers has lasted 12 months, noted international brokerage Jefferies. “India has just suffered its biggest period of underperformance over the past 12 months in a global emerging market context in the past 15 years.”

As a result, the MSCI India (in USD) has underperformed the MSCI Emerging Markets by 18 percentage points since mid-April and by 24 percentage points over the past 12 months.

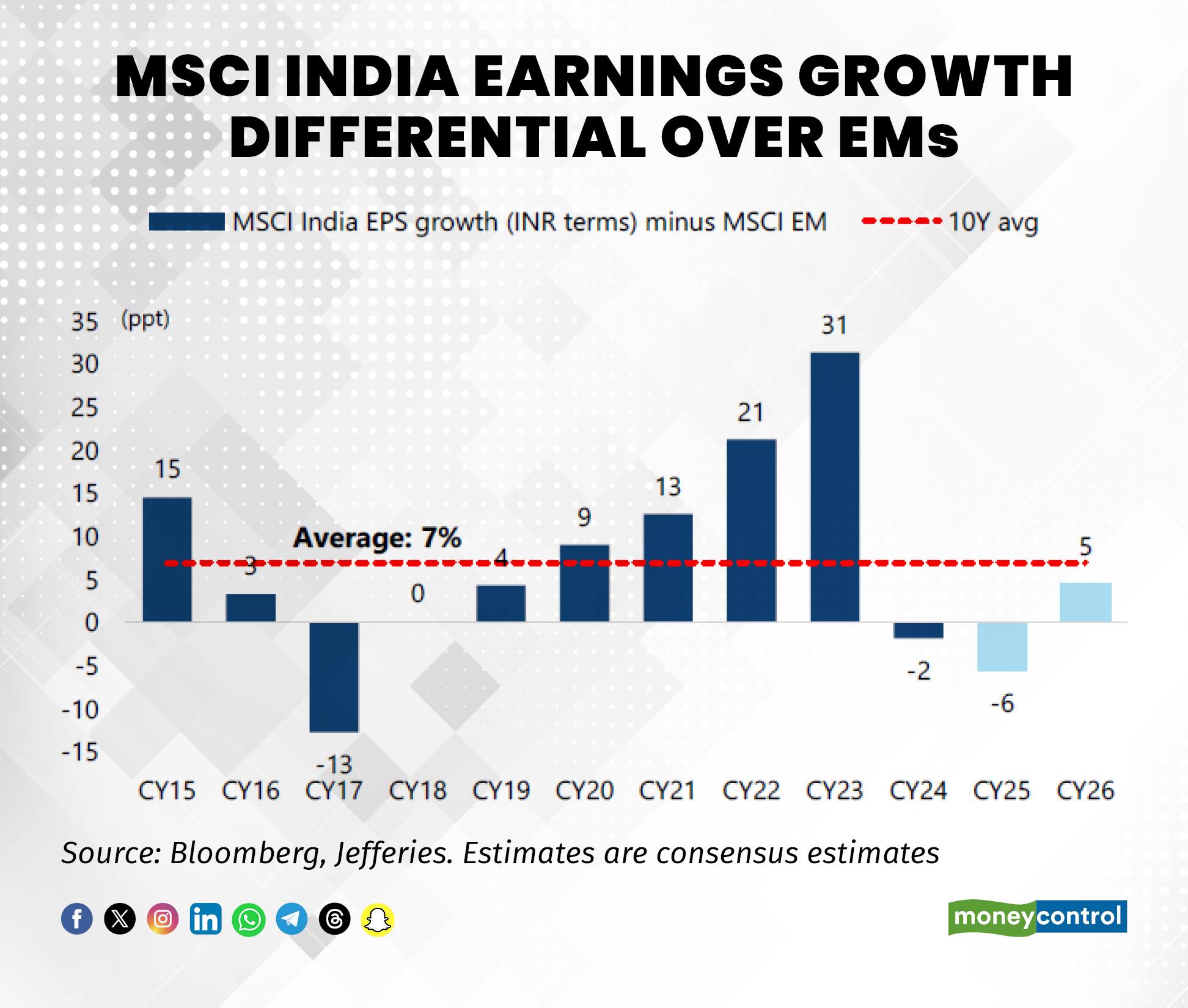

India’s underperformance has also coincided with slowing economic growth reflecting weaker corporate earnings. India's corporate relative (to MSCI EM) earnings growth expectations, however, is a tad lower than historical averages, noted Jefferies.

Nevertheless, analysts are optimistic on turnaround hopes. With the GST rationalisation efforts, brokerages expect the lacklustre earnings trajectory to improve as consumption picks up.

The policy initiatives from the Government on the GST front with indications of next generation reforms have improved market sentiments significantly. In the previous session, the benchmark indices Nifty 50 and Sensex staged a fiery rally, surging over one percent each.

However, VK Vijayakumar, Chief Investment Strategist, Geojit Investments noted that the fundamentals (earnings growth) will take time to respond. “A sustained rally in the market will happen only when we have indications of earnings revival.”

Not just the GST rationalisation, but a slew of triggers are present for the markets to stage a turnaround. “Given a favorable base effect, markets are likely to respond positively, especially as multiple government measures are expected to improve overall growth dynamics and sentiments in 2HFY26,” suggested Motilal Oswal.

S&P Global Ratings recently upgraded its rating on India from ‘BBB-’ to ‘BBB’, with a stable outlook. According to Franklin Templeton, for equity markets, a ratings upgrade is an added tailwind, which could prove beneficial for improving sentiment.

“While India’s growth story is gaining appreciation, the ratings upgrade could help companies gain access to cheaper capital to further spur growth. India’s cost of debt as reflected by the 10-year yield has been compressing. The upgrade indicates that S&P believes that this can be more structural,” added the firm.

Further, the ratings upgrade could hike foreign interest, as global funds with mandates to invest only in investment-grade economies can now allocate funds more readily to India. “In the longer run, the upgrade may accelerate inflows from foreign investors and catalyze capital formation, particularly in high-growth sectors,” noted the AMC.

India has been caught in the crossfires between U.S. and Russia tensions, with U.S. President Donald Trump imposing an additional 25 percent tariff penalty, along with the imposition of a 25 percent tariff on Indian goods.

However, brokerages noted that diplomatic discussions between the U.S. and Russia during the weekend have evoked a somewhat favourable outcome, with the potential of Trump temporarily deferring the levy of punitive tariffs on countries importing Russian oil.

“Although the final outcome on the tariff issue is still uncertain, and the endgame could be very different, the frayed market sentiments will be assuaged for the time being, as markets will likely perceive the interim deferment positively,” stated Motilal Oswal.

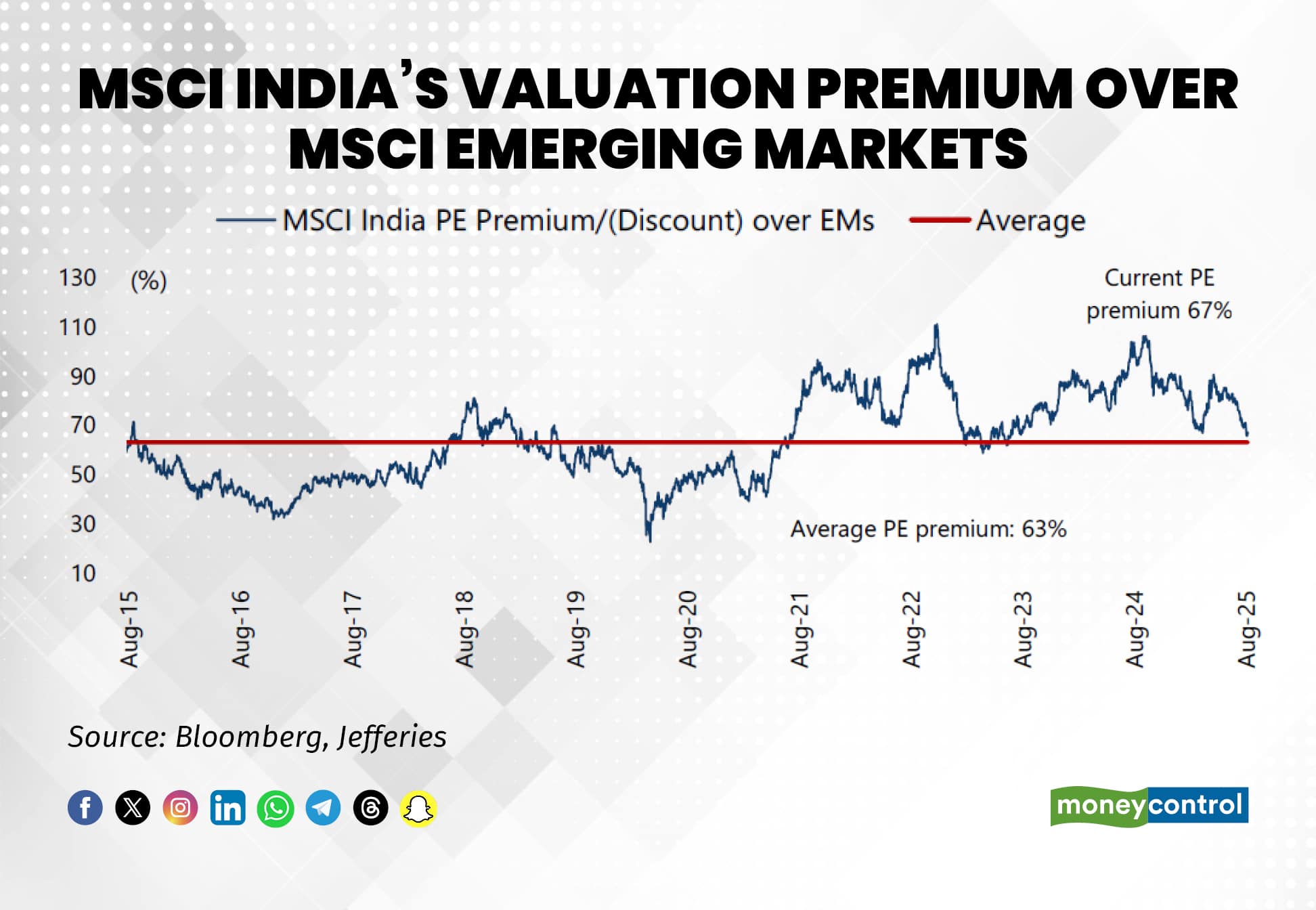

The MSCI India Index usually trades at a premium to other emerging markets, with an average PE premium of 63 percent over the past 10 years. During March to April 2025, the outperformance of India pushed this premium to 90 percent, noted Jeffieries. However, as the outperformance faded, the premium quickly returned to average levels.

Currently, India’s corporate earnings growth outlook compared to MSCI EM is slightly below historical trends. The MSCI India 12-month forward PE stands at 21.7x, which clocks in around 10 percent above its 10-year average. However, based on the bond yield-earnings yield gap, Jefferies noted that valuations are broadly in line with historical norms.

According to Emkay Global, the confluence of factors, especially the GST rationalisation, provide long-term benefits to the economy. The brokerage hiked its target on Nifty 50 for September 2026 to 28,000, which implies a 13 percent upside from current levels.

“The GST rationalization offsets near-term worries on weak growth and tepid earnings. The six-week downtrend should now reverse, as the outlook for earnings improves considerably, and valuations will factor in the broader positives of this big-ticket reform measure,” noted the broking house.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.