Q) I am sure you know this is something like music to your investors and that is something which I see on your Twitter feed as well, a lot of investors are acknowledging the fact that you have outperformed the broader markets or the markets in general?

A) I will give you a quick one-line thing we got a message from an investor that we have in our - India and globally - portfolio. The gentleman is a senior executive at a major auto company in Germany.

He sent us a mail saying that my whole life – and obviously a very senior person – whole life, the investing journey has changed ever since.

I have started investing with First Global because the way you approach things is so different and now I understand the meaning of diversification, and now I understand the meaning of risk management, what it means by position sizing, which I was never told – these were his words.

The letter further added that initially he use to buy 5 stocks that are likely do well, four would tank 80% and net-net, he would still lose money.

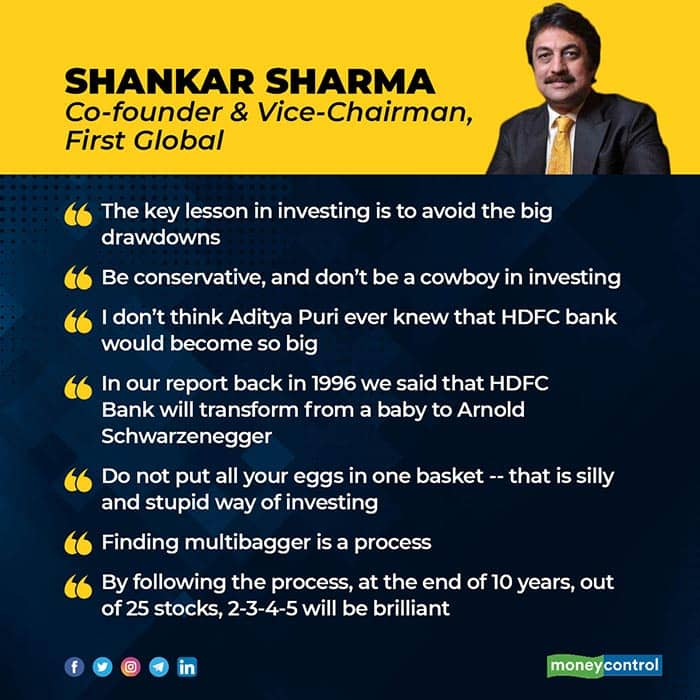

So the point is that you can do it by following strict process scientifically and like I said avoid the big dangers, big drawdowns you will come I had in investing.

Q) I was going through your Twitter feed and interestingly you bought HDFC Bank back in 1996. It has been a mega wealth creators for investors. What does the journey hold for the private sector lender amid a change in management?

A) Yeah, so I mean, first and foremost, I mean nobody knew nobody. I don’t think Aditya Puri ever knew that this bank would become so big.

In hindsight, we can all say I saw this coming and all that, buy nobody saw this coming. Our bet was that it was going to do very well and we put out our piece of research in ’96 which said exactly that putting a baby and Arnold Schwarzenegger together side by side.

We wanted to say that this baby is going to become Arnold Schwarzenegger, and it did become Arnold Schwarzenegger, but hey, to say that we actually saw all that, I mean that is being very, very immodest.

In reality, it was always a good bet, back then great management team, but that would become so big, nobody knew, 25,000 percent return.

Aditya Puri is not an entrepreneur by definition, right, he was a career banker. Here too, he was an employee, a founder employee but still an employee.

I don’t think in the history of business at least in India and frankly, even globally you have seen an example of an employee creating an organization of this size, scale, and excellence. I don’t think it is matched across the world, forget about India.

Therefore, if you see this achievement, and expect that the next guy will be as good as Aditya Puri, I mean, fingers are crossed, it’s a great, great company, it’s a huge machine, and as long as you don’t fiddle around too much, it can still keep running, but these are going to be big shoes to fill and let’s hope and pray that a great organization institution like HDFC Bank continues doing.Remember HDFC as a group has been founded only by employees becoming entrepreneurs okay, that’s been the nature of the HDFC group, and they have got that DNA. Hopefully, the same DNA will continue even in the future.

Q) You have got the Midas touch when it comes to picking winners. So any stock idea for our listeners that could turn in to Gold?

A) No, first and foremost, I don’t have any Midas touch, let me be absolutely clear, okay. The whole point in investing as I said earlier as well that do not put all your eggs in one basket -- that is silly and stupid way of investing.

One could buy 25 stocks with some good research. Out of the 25 at the end of 5 or 10 years, 5 will become multibaggers, in another 5 you might end up losing maybe 25-30-40% which have exited, and the balance will be along with the market whichever way the market has gone.

So your five are going to come out buying 25, your five are not going to come out buying only those five because nobody can predict.

Finding multibagger is a process and we follow a process and that is how these things will come about. A pharma stock we bought in March which is up 5x came out of the process, and it didn’t come out of a brainwave.

By following the process, at the end of 10 years, out of 25 stocks, 2/3/4/5 will be brilliant and that’s how you will create the money.

Now as we speak right, I mean, India has been a very strange market wherein one part of the market has done terribly but there are other parts which like you said one of the stock I have mentioned right now without taking names, a 5X in four months is huge.

In India, right now the interesting spaces remain telecom as well as pharmaceuticals. And also focus on sectors that have not been hurt by this pandemic. Sectors that are hurt by this pandemic, we all know which sectors they are.

While they are going to have a rally and they will basically go up from the lows we still think there are risk there. Like I said, in investing as long as you avoid the riskiest areas of the market you will make money.

Investors should also remember one more thing -- one should not as an investor try to make all the money that is supposed to be made in the market because many stocks will go up.

Many stocks will go up in the market, and you don’t have to buy all of them. You should buy and get the ones which give you the best risk and reward tradeoff, as simple as that.

And we find that there is plenty of them are available, it’s not that they are not available. We have chosen to stay out of banks and NBFCs and we are quite thankful or that.

In the month of June, we actually underperformed because of that a lot of the NBFC rallied. We all know which one, right? But, I prepared to sit out those part because there are still dangers ahead.

Q) Do you think the outcome of the US elections will have an important bearing on the equity markets across the globe?

A) I don’t think, I think a lot of this is all nonsense when people keep trying to figure out what happens to the presidential election and therefore which will happen to the stock market.

In the US, the government and the president they don’t really control much in the economy unlike India, right? Policies are drafted and driven by who which party is in power and who was leading and all that -- US is more like a machine, it doesn’t really matter, whether Trump or Biden who really cares as long as the central bank remains accommodative.

As long as the central bank remains accommodative – equity markets will be fine there and if they are fine there in general other markets will also be fine that’s and of course as long as corporate numbers are good and companies do well.

I don’t think one individual matters so much in the context of the US, it matters a lot in India, but it definitely doesn’t matter in a large machine like the US economy.

Q) What is your take on the commodity prices all seems to be heading in one direction and that is up be it crude oil, Gold, Silver, etc. Nasdaq has already touched a record high, do you think tracking the momentum India could follow the trend?

A) Yeah, so we picked all these commodities in April. We have written about it also in our investors' updates which are monthly. We have done very well because of having commodities and commodities-centric markets.

We had Russia, we had Brazil which is up 50% in the last couple of months. So, obviously there is a reasonable bit of expectation that commodities will do well.

In that context, if you see India then a number of the commodity stocks have done very well. So, if you look at steel or you see the aluminum, those stocks have done pretty decently in India in the last couple of months.

I can’t take names. So, you can play some of these themes even in India and we have these names in our portfolio and that is another reason why we have done well. Few stocks have done phenomenally well in the last couple of months that are up 30-40%.

We have been able to capture the global commodity upswing, that in our India theme, apart from playing it globally. In India you can’t play a number of them directly, you can play them indirectly through the stocks which we have.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.