Last week, the geopolitical tensions between US and Iran dented sentiment initially.

However, its recovery in the later part of the week due to easing Middle East worries, likely US-China trade deal by mid-January and pre-Budget 2020 rally, helped the market recover most of those losses.

The market turned from fear to greed very quickly and closed with marginal loss for week ended January 10.

The recovery in the later part of the week was so strong that the Nifty50 touched fresh record highs of 12,311.20 on January 10, but failed to hold onto the same towards the end of the trading week. The index closed 0.16 percent lower at 12,226.65, and the BSE Sensex was down 0.27 percent at 41,464.61.

But, the real momentum was seen in broader space as the BSE Midcap index gained 1.24 percent, and smallcap climbed 3.26 percent during the week, largely on account of pre-Budget rally and optimism ahead of Q3 earnings.

Experts feel the volatility is likely to increase with positive sentiment in coming days, as we approach the Budget day (scheduled for February 1) and amid October-December quarter earnings.

On January 13, the market will first react to Infosys earnings and November industrial output data that were announced on the evening of January 10.

"Markets are heading for testing times given that the result season has set in and budget parlays too will have to be digested in weeks to come. Volatility is expected to increase, although prices are not expected to move much till Budget. However, sector specific rallies are likely to continue," Jimeet Modi, Founder and CEO, SAMCO Securities & StockNote told Moneycontrol.

He said in general, the market was heading higher, and therefore investors should accumulate quality stocks through the bottom-up approach with a higher focus on midcap stocks.

Auto and banks stocks fell during the week, whereas healthcare, IT, metals and power gained strength.

"In the short-term, the market will be careful given the limited room to grow due to premium valuation and miniscule improvement in business, while the Budget and Q3 results will give clear cut direction for the market. The global risk has reduced in 2020 with likely trade deal between US-China, Brexit and in anticipation of improvement in the world economy," said Vinod Nair, Head of Research at Geojit Financial Services.

Here are 10 key factors that will keep traders busy this week:

US-China trade deal

Globally, the key factors to watch out for would be the signing of phase one of the trade deal between the world's largest economies, US and China, in the coming week. US President Donald Trump has been saying that the phase one deal would be signed soon, and reports suggested that talks for the phase two trade deal may begin immediately.

Both countries are expected to sign a partial trade deal on January 15. China's Vice Premier Liu He, head of the country's negotiation team in the US-China trade talks, is visiting the US on January 13-15 to sign a 'phase one' trade deal.

Experts feel it would be major relief for global equity markets and the economy, which have been facing trade concerns for more than 16 months now.

Earnings

The third quarter (October-December) earnings season kicked with the announcement of Infosys' results on a positive note, and one of reasons for current rally in the market was optimism ahead of Q3 as most of experts said the second half of FY20 would be recovery time for earnings and would set the path for strong numbers going ahead.

As per the data available on exchanges, 75 companies will declare their December quarter earnings in the coming week which include Reliance Industries, TCS, Wipro, HCL Technologies, Mindtree, HDFC Bank, IndusInd Bank, Delta Corp, Bhandhan Bank, L&T Infotech, L&T Finance, L&T Technology, ICICI Lombard etc.

For all earnings related news, click here

The coming week is very important in terms of earnings as after mixed bag performance from Infosys, three other major technology companies, TCS (January 17), Wipro (January 13) and HCL Tech (January 17) will declare their earnings amid a seasonally weak quarter.

Most brokerages expect TCS to report nearly a percent growth in constant currency revenue and the same in dollar terms could be around 1.5 percent for quarter that ended on December 2019, which may impact the BFSI and retail segments. EBIT margin may see expansion of around 50bps due to rupee weakness and cross currency tailwind. Key things to watch out for would be deal wins, client budgets outlook for 2020 and commentary on BFSI and retail segments.

Wipro may register 1.8-1.9 percent sequential growth in constant currency IT services revenue (within its guidance of 0.8-2.8 percent) and dollar revenue growth could be over 2 percent during the quarter, driven by ITI acquisition and a ramp-up in the ICICI deal. EBIT margin growth could be flat to marginally positive QoQ. Most brokerages expect the IT company to forecast constant currency revenue growth of 0-2.5 percent over Q3.

HCL Technologies is likely to report constant currency growth in the range of 1-1.5 percent QoQ and dollar revenue growth of 1.5-2 percent QoQ in October-December quarter, supported by IBM contribution. However, EBIT margin is expected to decline sequentially due to an increase in wages. IBM products integration and outlook for IMS & ER&D will be key to watch out for.

Index heavyweight Reliance Industries (RIL), the country's largest listed entity by market capitalisation, will declare its December quarter earnings on January 17 and the impact on its stock will be seen on January 20.

Most brokerages expect healthy gross refining margin at around $10.5 a barrel for the quarter, which along with crude throughput, may support its standalone EBITDA.

Majorly, all eyes will be on consumer businesses telecom (Reliance Jio) and retail that are likely to continue to support company's consolidated earnings/EBITDA numbers. The consistent increase subscriber base and higher average revenue per user (ARPU) may support Jio in Q3 FY20.

Macro data

On the macro data front, CPI inflation for December will be announced on Monday, January 13, which is likely to increase further (from more than three-year high of 5.54 percent in November, 2019) on an increase in food prices.

"Consensus shows that inflation will spike further to 6.7 percent in December due to oil prices and vegetable prices," said Vinod Nair of Geojit.

Among others, WPI inflation for December will also be announced on January 14, and the balance of trade data for December will be released on January 15, while deposit and bank loan growth for the week that ended on January 3 and foreign exchange reserves the week that ended on January 10 will be declared on January 17.

Oil prices, Rupee and FII flow

The cooling off of oil prices from $70 a barrel levels to around $65 a barrel after easing US-Iran tensions could continue to support the country like India, which imports more than 85 percent of oil requirement.

As a result, the Indian rupee also strengthened during the week to close at 70.94 against the US dollar, appreciating 100 paise from 71.94 on January 6. Analysts expect the rupee to gain further amid the signing of US-China trade deal this week.

"Market will remain optimistic regarding US-China signing the Phase-One deal on Wednesday, this could appreciate rupee towards 70.50, however, RBI may cap gains by intervening and adding dollars to its kitty. Therefore, we expect USD/INR to trade within 70.50-71.30 range," Rahul Gupta, Head of Research - Currency at Emkay Global Financial Services, said.

Foreign institutional investors were net sellers for the week gone by to the tune of Rs 1,155 crore, but they are still net buyers for the fourth consecutive month, and their flow is expected to be more important especially going into the Budget 2020.

"FII flows and rupee movement have remained quite volatile in the recent period amid the geo-political risks. As we are moving into Budget, FIIs perspective towards markets would be more important to see," Amit Gupta of ICICI Direct said.

Technical view

The Nifty50 failed to sustain 12,300 mark and closed off with the day's high on January 10, forming a Doji king of pattern on daily charts which indicates indecisiveness among bulls and bears, whereas for the week, it witnessed a bullish candle formation with big lower shadow on weekly scale. The index respected to its key support of 11,900-11,935 levels along with the 50 DEMA on daily scale.

Experts expect the index to consolidate, before moving towards 12,400-12,500 levels, in coming days as the momentum is expected to remain positive at least till Budget 2020. The 12,000 level could continue to be crucial support for the index.

"Nifty50 is expected to move in the range of 300-400 points between 12,000-12,400 levels at least till Budget. Market in general is not overbought and therefore has the potential to move higher. Wider participation of across the board stocks are expected to bring in a feel good factor in the market," Jimeet Modi of SAMCO Securities & StockNote said.

He advised buying on dips will be a good strategy for traders before the Budget with weekly lows as stops.

F&O cues

Option data indicated that the Nifty could trade in a range of 12,000 to 12,400 levels in coming trading sessions.

Maximum Put open interest was seen at 12,000 followed by 11,500 strike, while maximum Call open interest was seen at 12,500 followed by 12,400 strike. Call writing was seen at 12,600 followed by 12,500 strike while Put writing was seen at 12,300 then 12,200 strike.

"12,000 Put base in Nifty didn't see any closure despite the index coming below these levels during the week. On pullback we have seen additions in 12,200 Put strike which may act as immediate support for the index," Amit Gupta of ICICI Direct said.

According to him, the pullback can extend towards 12,500, which has remained the highest Call base since the start of the series.

India VIX moved up by 10.87 percent from 12.70 to 14.08 levels on weekly basis.

"Cool of in VIX from higher levels from 16.39 mark, has provided some comfort to the bulls but overall comparatively higher VIX could keep the volatile swings in the market in near term," Chandan Taparia of Motilal Oswal Financial Services said.

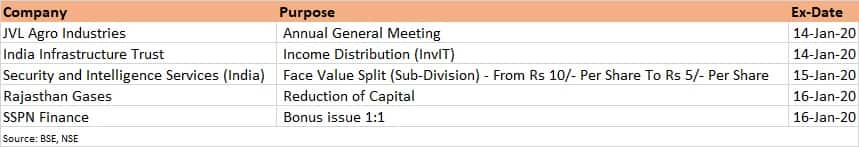

Corporate action

Here are key corporate actions taking place in the coming week:

Global cues

Here are key global data points to watch out for in coming week:

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.